Move aside oil, gold and copper, there’s another commodity grabbing investor attention: lithium. The silvery metal’s price soared by more than 1,500% between November 2020 and November 2022 — but before you get too excited, know that it’s also plunged by nearly half in the last six months. 1 What gives? And could there be a good investment opportunity here?

In this installment of The Conversation, we look at some of the questions you may have about this highly-charged corner of the mining sector.

Those are some outsized returns. What makes lithium so different from other metals?

Lithium is a soft, yet highly reactive lightweight alkali metal that’s seldom found in a pure state. The only way to extract it is from a compound — a material composed of two or more elements. In commodity markets, it’s usually traded in the form of either lithium carbonate or lithium hydroxide.

So, it’s hard to mine, but what is lithium good for?

Until the 1990s, there was little need for lithium beyond its use as an additive in ceramics, glass, lubricants and medications. That changed with the introduction of rechargeable batteries for a variety of devices. Because of its energy density and ability to be recharged, lithium-ion has gradually become the most widely used battery chemistry, first for portable electronics, including most smartphones and now in electric vehicles (EVs).

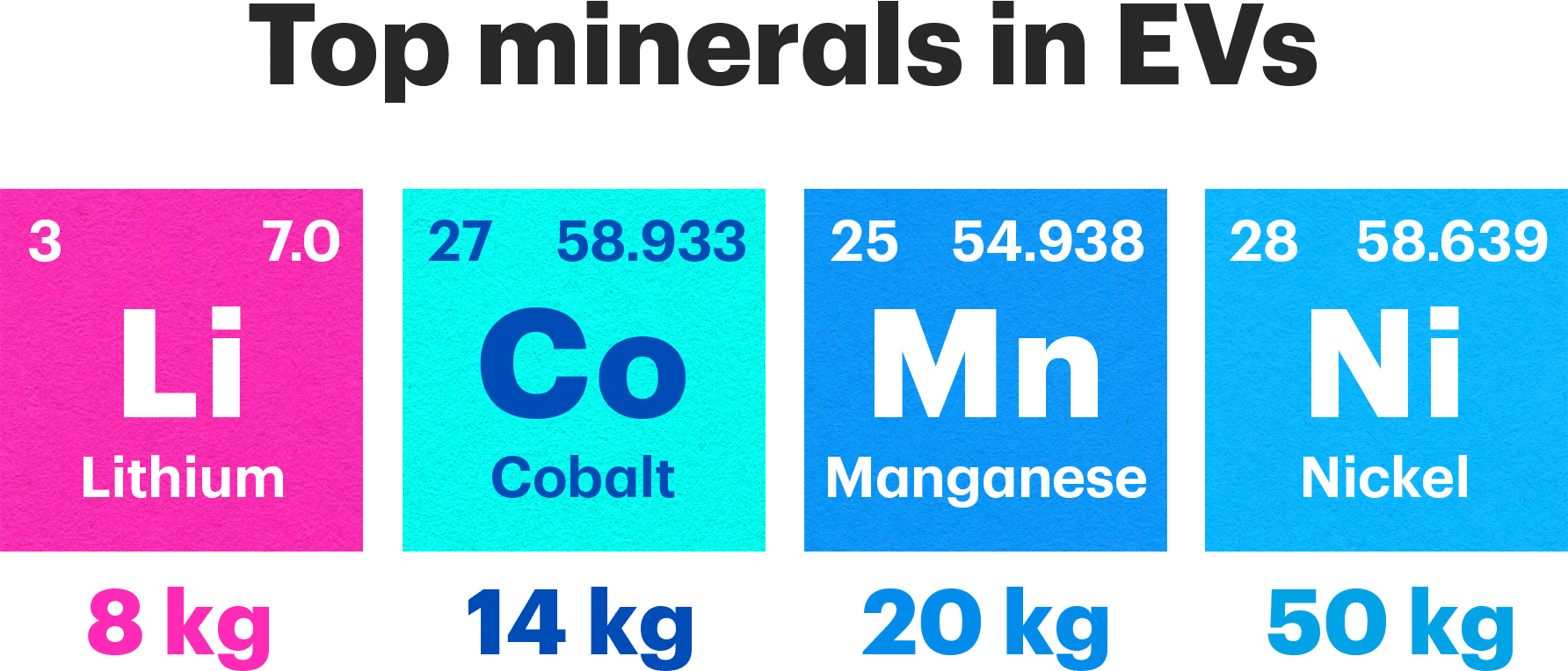

This explains why lithium is going from a niche commodity to one in huge demand. Global EV sales more than doubled in 2021 from a year earlier to 6.6 million. 2 They jumped another 55% in 2022, to 10.5 million. And each electric car battery contains an average of 8 kg of lithium compounds, along with other critical minerals like nickel, manganese and cobalt for its electrodes. By some estimates, lithium demand will jump more than five-fold by 2030. 3

That sounds like a lot of metal. How will the industry meet the demand?

Meeting demand is going to be a challenge. Because lithium has never been produced in huge quantities before, there are a limited number of big producers. And though new sources may help meet demand in the short term, the ramp-up of the industry’s output will be lumpy — hence the recent price gyrations.

As with any mineral, bringing a resource to market takes years, if not decades. Each major new production facility can suddenly increase global supply by 5% or more. As a result, supply and demand will often be out of balance.

The recent price volatility has been particularly acute in China, where EV sales slowed after government subsidies were withdrawn and automakers cut prices on conventional gasoline-powered cars to clear out inventory in advance of new emissions standards that are coming into force this summer. 4

Despite the recent price slump, future demand for the metal seems strong. So long as lithium is a key input in batteries, it’s expected to play a critical role as governments look to electrify global transportation as one approach to address climate change.

Source: World Economic Forum

Where is it going to come from?

We get lithium in one of two ways. It can be mined, crushed and extracted chemically from ore like other metals or it can be extracted from brine — salty groundwater that is pumped to the surface, then left to evaporate. Lithium is then refined from the crusty deposits left behind in the evaporation ponds.

Mines are located all over the world. China and Australia have large operating mines and brine operations are found in Chile, Argentina and Bolivia. In cooler climates, where natural evaporation is impossible, engineers are developing methods for direct extraction of lithium carbonate from brine.

Thanks to Canada’s long history of and expertise in mineral exploration and finance, Canadian-based companies are at the forefront of lithium resource development in places like Argentina and Brazil. You’ll find a few listed on the Toronto Stock Exchange, of which some are expected to begin commercial production this year.

Apart from the Canadian-based companies operating mines abroad, new lithium projects are starting up in Ontario and Quebec, including a new open pit mine near James Bay in Quebec. The James Bay project is expected to be Canada’s first large source of the metal.

As it stands, having a domestic lithium supplier will benefit Canadian EV and battery producers only in the sense that it contributes to the supply of the material in the marketplace. The prospect of a global lithium shortage, however, could place stress on international trade relations.

China has about 60% of the world’s lithium-ion battery refining capacity, and Chinese companies have been aggressively financing and securing future sources of supply both inside and outside the country. Other nations are also looking at their strategic interests. Canada, for example, has a Critical Minerals Strategy, whereby the environmental assessment process on new mines may be expedited to help secure a domestic supply.

Source: International Energy Agency

Is it environmentally friendly?

While lithium may be a big part of the solution to greenhouse gas emissions, extraction and processing of lithium isn’t typically environmentally friendly. Lithium mines, brine and refining operations have, in the past, caused surface and groundwater contamination, as well as damage to natural habitats and respiratory problems in humans. They also use a lot of water, which can be problematic in lithium-rich (but parched) countries like Chile, Argentina and Australia.

Canada’s James Bay Lithium Mine Project is being undertaken in partnership with the Eastmain Cree Community, a local First Nation.

So, can I actually buy the stuff?

Like most metals, you can own it directly in the form of lithium bars, but it is very unusual for individuals to hold the actual commodity — especially because lithium is corrosive and can be toxic. Investors tend to add the metal to their portfolio in other ways.

One of the more common ways to access the lithium market is to invest in the companies that are mining it, with several publicly listed companies in Canada and abroad to choose from. Just remember, before you invest in a company, take the time to do your due diligence to ensure you understand the risk involved.

Of course, if you’re not sure which company to buy, you also have the option to own a basket of them in the form of an Exchange-Traded Fund (ETF). You’ll find several lithium-focused ETFs trading on markets in Canada and the U.S., although some of those funds may also include companies involved in the lithium production cycle or in battery manufacturing.

What are the risks around investing in lithium stocks?

-

- Fundamental volatility: The price of the commodity will remain volatile for the foreseeable future due to fast-rising demand and a much less consistent ramp-up in supply.

- Geopolitics: Lithium’s supply is currently concentrated in Australia and South America in jurisdictions with a low to middling geopolitical risk to investors. But the situation is complicated by competition between China and western countries for control of the strategic resource. At the same time, car manufacturers are competing with each other to secure supply. GM struck a deal with Lithium Americas to finance the latter’s Thacker Pass mine in Nevada, and Tesla was recently reported to be interested in acquiring Sigma Lithium. Vertical consolidation of this kind could impede the growth of a global lithium market that functions smoothly for independent producers and customers.

- Technology: Lithium-ion is the best rechargeable battery chemistry we have right now, but it has drawbacks, not the least being the availability of its component materials. Another problem is its chemical instability, which has led to laptop computers and cars catching fire or even exploding. For this reason, scientists are continuing to research new, better battery chemistries. Should a viable, cost-effective alternative emerge that doesn’t require lithium, demand for the substance would decrease, mines and reserves would be worth a fraction of what they are today and many producers could go out of business.

The takeaway

All commodity prices are volatile. Ones whose markets are in their infancy, like lithium, are even more so. Even if you believe passionately in contributing to the energy transition, it may be appropriate for investors to think of investing in lithium as a high-risk, high-return allocation within their larger portfolios, suitable for money they can afford to lose.

- Lithium, Trading Economics, Accessed May 2, 2023, https://tradingeconomics.com/commodity/lithium ↩

- Ian Shine, “The world needs 2 billion electric vehicles to get to net zero. But is there enough lithium to make all the batteries?”, World Economic Forum, July 20, 2022, https://www.weforum.org/agenda/2022/07/electric-vehicles-world-enough-lithium-resources/ ↩

- IEA, Lithium production, 2021, and projected demand in climate-driven scenarios, 2030, IEA, Paris https://www.iea.org/data-and-statistics/charts/lithium-production-2021-and-projected-demand-in-climate-driven-scenarios-2030, IEA. Licence: CC BY 4.0 ↩

- Siyi Liu and Dominique Patton, “Chinese lithium price dives in heated auto price war”, Reuters, March 23, 2023https://www.reuters.com/markets/commodities/chinese-lithium-price-dives-heated-auto-price-war-2023-03-23/ ↩