Can building a deck help me understand the economy?

As consumers, we occasionally get a first-hand look at how the laws of economics actually work. We see it at the gas pump but also, increasingly, at the local hardware store. Throughout 2021, the lumber market experienced violent swings due to supply and demand. It seemed everybody wanted to build something, taxing supplies in the middle of a pandemic. By May 2021, the cost of 1,000 board feet (BF) of lumber had soared to US$1,686. By September, it had dropped to less than US$600. At the time of writing, the price has bounced below US$700. If you’re looking to build a deck, this might be promising news. But if you’re thinking like an investor, the outlook may not be as clear.

I’ve never seen 1,000 board feet. What exactly does that look like?

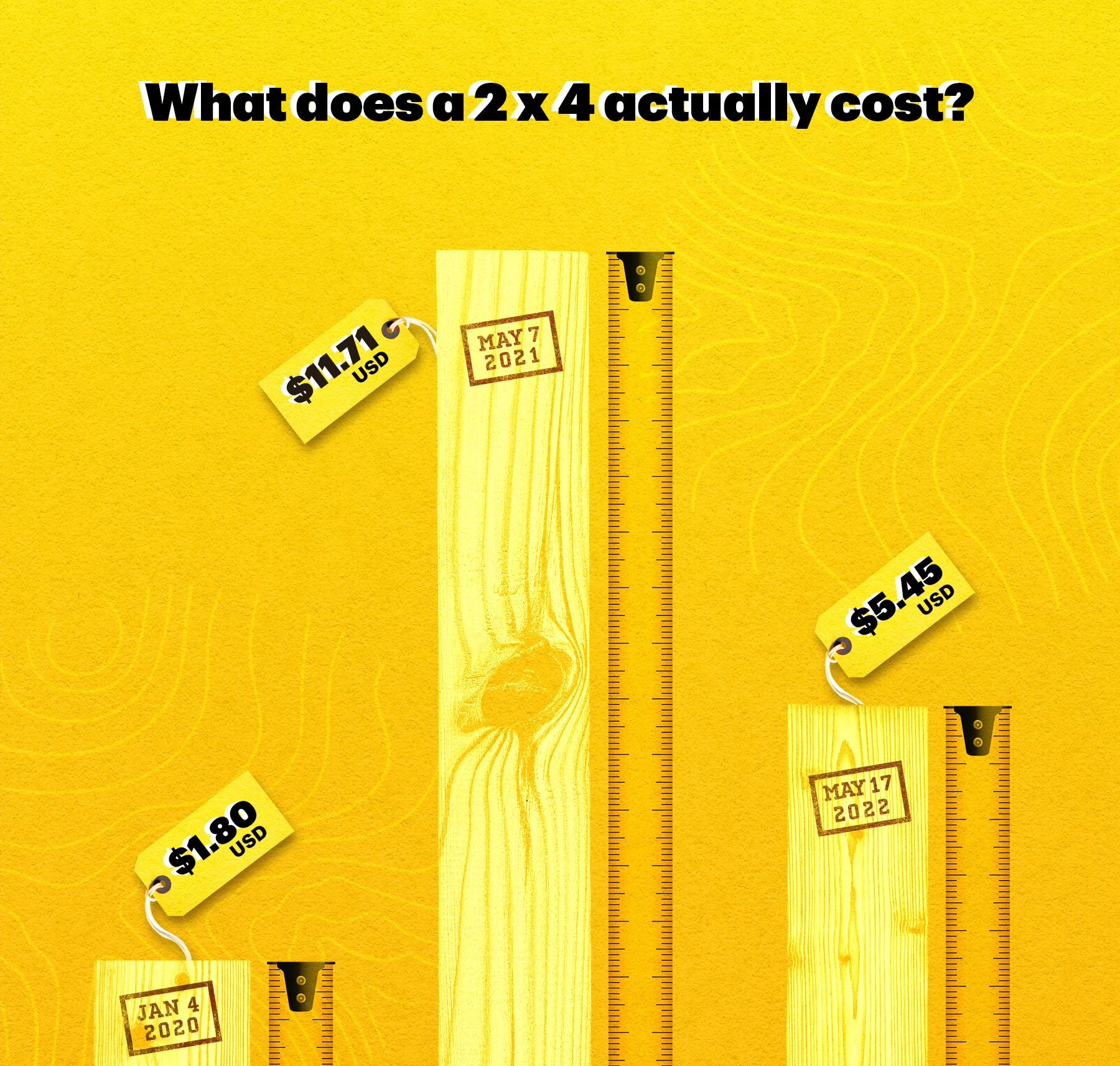

The clever mathematicians at the University of Regina have a formula for figuring out a relatable way to think about the cost of 1,000 board feet of lumber. According to their math, one 16-foot two-by-four equals about seven board feet. The chart below shows what the price for that classic cut of lumber might look like from a wholesale perspective (that is, before any retail markup gets added).

So when we say lumber trades at US$1,686 per 1,000 board feet, it means the wholesale cost of materials for a 200-square-foot deck is around US$2,300. If lumber drops back down to US$500 per 1,000 board feet, the wholesale material price for the same deck would fall to about US$1,600.

OK, so there’s clearly lots of demand for lumber. We’re not short on supply, are we?

No, there are still lots of trees. (Or timber, as the uncut and unmilled logs are known in the trade.) However, the main factor over the past year hasn’t actually been a lack of supply, but rather a bottleneck in timber processing. The problem goes all the way back to March 2020, when Canadian Forest Industries reported that sawmills and lumber producers were dealing with customers who wanted to cancel existing orders. Given what they were experiencing, sawmill operators guessed the pandemic would mean little or no construction taking place (decks or otherwise), and decided to scale back production. But after a couple of very uncertain months in residential construction, home building was declared an essential service. Suddenly many projects were back on track and demand resurged, marking the start of a supply/demand tug-of-war.

While the timber production bottleneck is a significant event, it’s just one of several factors affecting the volatility in lumber prices. Even after sawmills ramped up production, it was still difficult to get the wood to customers across North America when so many borders were closed to traffic. This created an imbalance between supply and demand and it upset every stage of the process from milling to delivery.

But it’s not just the cost of a deck that went up. How much did the price of lumber add to the cost of building new homes?

The simple answer? A lot. According to research conducted by the Canadian Home Builders Association, higher lumber prices may have added somewhere between $10,000 and $30,000 to the cost of each new home. (Fun fact alert: The average home needs about 16,000 board feet of lumber). Their report surveyed developers, who told them that construction costs directly attributable to lumber rose an average of $19,254 per home. Nearly half of the respondents also said they chose to delay both pre-sales and development due to price volatility in many construction supplies — a move that, in turn, could have a significant impact on future housing supply. You can see where this is going: While higher lumber may already have you rethinking your home improvement project, those rising costs can also have a big impact on the economy.

Will demand for lumber continue to remain strong?

The closest thing you will find to a crystal ball — at least in the world of economics — is a leading indicator. That is, a point of measurable data that appears to correspond with a future event or trend in business. One leading indicator favoured by investment analysts is the total value of building permits. Changes in the collective value of building permits issued each month can offer a peek into future demand for building supplies like lumber. You don’t need a degree in economics to understand these monthly reports. Building permits show an intention to build, and therefore an intention to spend on all the materials required to make that happen. Building permit values rising? Contractors will need to buy more lumber. Building permit values falling? Demand may be headed for a decline.

Besides the supply chain, what other things affect the forestry sector?

Concerns about competition and fair pricing can have an impact on trade agreements — and that affects pricing. For example, Canada and the U.S. have fought over lumber for years. U.S. lumber producers argue that because Canadian lumber production is subsidized by the government, Canadian lumber mills sell wood to Americans for below market value. That’s because in Canada, the government owns most of the forests (known as Crown lands), and companies only purchase the right to cut timber on this land. American forestry companies argue that renting timberland is much less expensive than owning it, which they say amounts to an unfair advantage. As with any dispute, the issues are not always clear cut. From the perspective of Canadian lumber producers, because the Canadian government (and by extension you and me) owns the Crown land, it can impose regulations to ensure environmental and sustainability concerns are addressed. For example, the government can (and does) impose cutting and replanting protocols. Canadian lumber producers argue that the cost of implementing these types of regulations also has an impact on profitability.

One more factor? Support in the U.S. for tariffs is not universal. The U.S. National Association of Home Builders has argued consistently against lumber tariffs because rising construction costs hurt housing affordability.

Speaking of sustainability: Trees are good for the environment, right?

They are, and that’s one of the reasons Canada adopted the United Nations’ 2030 Agenda for Sustainable Development Goals (SDGs) back in 2015. Canadian governments at the federal, provincial and territorial level, as well as industry members, support the United Nations’ Global Forest Goals because forests are integral to sustainable wellbeing. They purify air and water, provide renewable energy, timber and jobs, as well as recreational and cultural benefits (green bathing anyone?).

Sustainable forest management (SFM) is a way of using and caring for forests to maintain their environmental, social, and economic value over time. The United Nations considers Canada a world leader in SFM because the methodology is applied to all of Canada’s publicly owned forest land — which accounts for about 91% of our forests. The UN notes that the annual timber harvest affects less than 0.5% of the total forest area and contributes about $25 billion to the Canadian economy.

Not all countries with timber resources have adopted the UN Global Forest Goals, and that may be a factor if you are considering investing in this sector.

Right. So, if investors want to get exposure to this sector, what kinds of things can they do?

Typically, with any sector, investors can decide whether they want to hold specific companies in their portfolio or a basket of similar stocks in the form of an ETF or mutual fund. Beyond asset class, there are several ways to look at the types of companies that might benefit from a stable outlook for lumber. Investors can consider researching individual forestry companies or they might look at companies on the periphery of the sector. For example, while buying shares in a lumber company may not suit your overall portfolio objectives, perhaps purchasing stock in a company with a track record in home improvement or construction may suit your investment goals. Keep in mind, these types of companies may actually benefit from a weakening lumber price. Alternately, you might look at Real Estate Income Trusts (REITs) which can benefit from a robust construction environment.

Bottom line? What does this mean for forestry companies?

Robust demand and strong lumber prices are certainly helping the forestry sector after several years of low prices and slim profit margins. As the pandemic recedes, and the path from sawmill to end-customer becomes smoother, the supply side of the equation could become more stable. Investors considering forestry companies for their portfolio should keep a close eye on factors that will help (or hurt) sustained demand. That means watching data like housing supply and interest rate changes. Whether you are considering some home improvements or looking to diversify your portfolio, understanding lumber pricing can offer valuable insights into this industry and the health of our economy — and that can help support good investment decisions all around.