The debate over uranium’s role in society has carried on ever since its radioactive properties were initially discovered in 1866. Uranium is the primary fuel for nuclear reactors and its potential to generate substantial amounts of carbon-free energy is hard to ignore, which is why many countries see it as key to society’s green energy transition. But there are risks surrounding its use. For some, the Chernobyl nuclear meltdown in 1986 casts a long shadow.

Today, as some countries begin to shut their nuclear plants down, others that had previously scaled back their use of nuclear power are restarting plants. Developing nations in particular are looking to build nuclear reactors to power their economies. Amidst all this, global stockpiles of uranium fuel have been declining over the past decade.1 But if more countries see nuclear as a way to lower carbon emissions, it could drive the price of uranium higher.

So, could uranium add some power to your portfolio or should you steer clear of the radioactive commodity entirely? Before you can answer that question, it can help to understand what’s driving the demand for uranium, as well as where the potential — and potential risks — may lie. Here, we answer some of the questions you may have about this commodity.

Clean energy is the future, but how is uranium different from other elements?

Uranium is a metallic element usually found in low concentrations throughout the Earth’s crust. It’s one of the heaviest elements with an atomic weight of 238.03 — considerably heavier than lithium for example, which has an atomic weight of 7.0. Most importantly, it’s radioactive, which means it emits alpha particles as it decays, making it sufficiently energy-dense for nuclear power generation and extremely toxic.

Just how powerful is uranium?

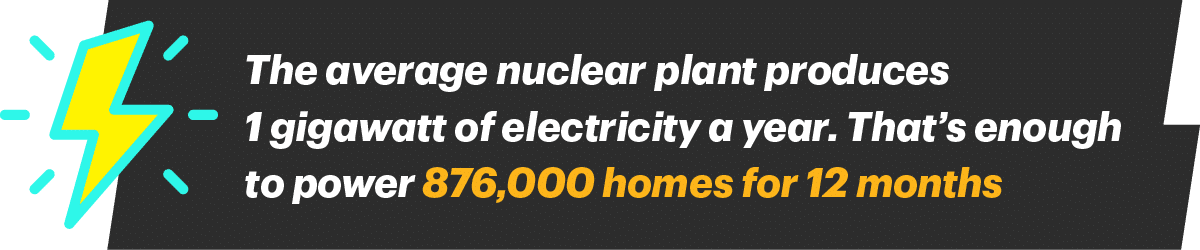

While small quantities of uranium are used in medicine and the creation of nuclear weapons, it’s more commonly utilized to produce electricity in nuclear power plants. Globally, some 440 nuclear reactors produce about 10% of the world’s electricity. 2 And although these facilities are incredibly expensive to build, Craig Hutchison, a Mining Equity Research Analyst at TD Securities, says they can be productive and provide a source of low-cost power for decades. In the U.S., the average nuclear plant produces one gigawatt of electricity a year. 3 That’s enough to power 876,000 homes for 12 months or to charge 1,000 electric vehicles simultaneously at fast charging stations at a rate of 1,000 kW per hour. 4 5 To put that in context, fast EV chargers currently range in power between 15 kW and 350 kW per hour.6

U.S. utilities are the biggest consumers of uranium, followed by China and France. While China, India and the Middle East are among those most actively increasing their use of nuclear power, Canada and the U.S. are in the process of developing a new generation of small modular reactors (SMRs) to be deployed in places ill-suited for large, conventional plants. These SMRs are better suited for remote communities, such as those in the far north, which lack sufficient transmission lines and grid capacity.

How hard is it to get the stuff out of the ground?

Uranium is extracted in three main ways:

-

- In Situ Recovery (ISR) — This low-cost method of extraction is only possible where the uranium is embedded in sandstone. It involves drilling wells into the ground, injecting a complexing agent (typically sulphuric acid), and in some cases an oxidant, into the wells and pumping out a solution from which uranium can be extracted. This method, which accounts for more than half of global production, also produces no tailings, the problematic by-product often associated with other mining processes.

- Open-pit mining — Deposits within 300 metres of the surface can be dug up with open-pit mining. The overburden is removed, then the ore is mined in layers. Explosives are used to break up the rock before the ore is removed for processing.

- Underground mining — High-grade deposits lying deeper than 300 metres can be mined using underground methods. Because exposure to radioactive uranium is harmful to miners, the drilling, blasting and hauling at the ore face is largely automated. The two biggest operating mines in Canada are both underground.

Mining companies continue to experiment with new and hybrid methods of extraction, which can be more appropriate for particular geological conditions. These methods include raised boring and underground ISR using a “freeze wall” to limit runoff or contamination of the site.

The product of ISR and mining methods is typically a form of uranium known as “yellowcake”, which requires further enrichment to become reactor ready. Russia is the world’s leading processor of yellowcake, turning it into enriched uranium hexafluoride gas and uranium dioxide fuel pellets. The CANDU reactors developed and used in Canada do not require enrichment.

Where does most uranium come from?

Kazakhstan is by far the world leader, with 43% of global production in 2022. It is followed by Canada (15%), Namibia (11%) and Australia (8%). Australia has the greatest share of proven reserves of uranium.

Everyone seems interested in clean energy. Has this affected the price of uranium?

The spot price of uranium spot price reached a high of US$136 per pound in 2007, as global demand was spiking and new reactors were being built, with most construction happening in China. Around the same time, Cigar Lake, a major uranium mine in Saskatchewan, was shut down because of flooding. in 2011, a global pullback in nuclear power use was triggered by the Fukushima disaster, when an earthquake and tsunami caused a series of three meltdowns at a Japanese power plant. In response to the disaster, Japan shut down 12 additional plants immediately and Germany decided to phase out its nuclear network entirely. Prices fell to around US$20 a pound for several years as a result of these events. More recently, as some countries (including Canada) have opted to restart their nuclear plants, the uranium price has crept up above US$50. 7

While it has rebounded from historical lows, the price of uranium still needs to climb higher before mining companies expand production, says Hutchison. The uranium price that would make it economic bring on a mine in the U.S. is somewhere between US$60 and US$70 a pound, he explains. Still, even with Germany and Japan backing away from nuclear power, Hutchison believes the prices could continue to rise, given global stockpiles are currently at their lowest level in 15 years.

“After a decade or more where inventories have been drawn down, to the point that there’s very little fungible inventory left to purchase, any incrementally new demand is going to drive the price higher,” he says.

Global demand for uranium sits at about 86,000 metric tons. Worldwide production capacity is currently only 49,000 metric tons. The difference is made up of stockpiles held by utilities and commodity traders, and the recycling of spent fuel.

While the uranium price is volatile, it does little to affect demand from utilities. Nuclear power facilities are hugely capital intensive, meaning their fuel cost represents less than 10% of their lifetime cost structure. Most uranium is sold under long-term contracts.

“I’ve been covering uranium for well over 10 years,” says Hutchison. “I’d say it’s in the best position since I started coverage, because Fukushima is far enough in the rear-view mirror.”

What are the geopolitical issues around the uranium market?

Historically, the biggest factor behind demand fluctuations has been the incidence of nuclear accidents and the corresponding backlash by citizens and governments to reduce or eliminate nuclear power. Currently, there are functioning nuclear facilities in the war zone in Ukraine at an elevated risk of an accident that could have far reaching consequences.

Conversely, the case for nuclear power has been supported over the years by the disadvantages of other energy sources, especially fossil fuels. The American nuclear industry expanded quickly in the 1970s in response to the Arab oil embargo and soaring oil prices. Today, governments see nuclear as a tool in the fight against climate change.

More than half of global uranium output comes from state-controlled companies in developing countries, which may prioritize security of supply over market considerations. Russia is the largest processor of uranium, which has led some Western customers to seek new supply chains.

How environmentally friendly is it really?

Nuclear is not a renewable energy source, but it is low-carbon. As such, there’s an argument for its use in the transition to a net-zero-carbon world. While hugely expensive to build, nuclear power stations can provide reliable base load power for many decades. Nuclear power stations complement more intermittent renewable sources without emitting greenhouse gases in their operations.

While most of the global primary uranium supply comes from state-controlled companies, producers and physical uranium trusts based in the West generally measure and report their environmental, social and governance (ESG) performance. “ESG is a huge factor in mining and has been for 20 years,” says Hutchison. “Mining companies have been very early on ESG — much earlier than most companies out there — because without a social licence, you just don’t get your mine licence.” As an example, he points out that mining companies operating in Canada have made concerted efforts to sign impact and benefit agreements with First Nations in the typically remote areas where the resource is located.

While there remains the problem of safely storing nuclear waste, storage methods have improved over the years, and more of the spent fuel is being reprocessed.

So, how can I buy the stuff?

There are multiple ways to get exposure to uranium. You can invest in:

- The stocks of producers. The hard part can be finding pure plays not invested in other minerals or energy technologies, too.

- Uranium exploration stocks. These are often riskier than producers, because they could have no revenue and their properties may never get developed. However, they can have upside potential.

- Stocks of nuclear technology developers.

- Uranium Exchange-traded funds (ETFs). These funds invest in uranium miners, exploration companies or nuclear-themed businesses more generally, spreading the risk with the aim of tracking the industry’s fortunes.

- Buy it (indirectly). There are restrictions on how much uranium you can own directly, but you can invest in physical uranium by buying it through a trust or a futures contact.

The takeaway

If you believe in the future of nuclear power, you could consider devoting part of your investment portfolio to this sub-sector in one or more of the ways identified above. Investing in uranium stocks comes with a number of industry-specific risks. Like with any investment, you will need to consider if it is appropriate for your portfolio.

- World Nuclear Association, https://world-nuclear.org/information-library/nuclear-fuel-cycle/mining-of-uranium/world-uranium-mining-production.aspx , Accessed on August 25, 2023 ↩

- World Nuclear Association, “Nuclear power in the world today” https://world-nuclear.org/information-library/current-and-future-generation/nuclear-power-in-the-world-today.aspx#:~:text=Nuclear%20energy%20now%20provides%20about,in%20about%20220%20research%20reactors. Accessed on August 2, 2023 ↩

- Office of Nuclear Energy, “Infographic: How much power does a nuclear reactor produce?” https://www.energy.gov/ne/articles/infographic-how-much-power-does-nuclear-reactor-produce#:~:text=Nuclear%20energy%20has%20been%20powering,power%20per%20plant%20on%20average. Accessed on August 2, 2023 ↩

- Office of Nuclear Energy, “How much power is 1 gigawatt?” https://www.energy.gov/eere/articles/how-much-power-1-gigawatt#:~:text=To%20help%20put%20this%20number,Need%20a%20stronger%20visual%3F. Accessed on August 2, 2023 ↩

- Zach Stein, Carbon Collective https://www.carboncollective.co/sustainable-investing/gigawatt-gw#:~:text=Electric%20Vehicle%20Charging%3A%20Electric%20vehicles,of%201%2C000%20kWh%20per%20hour Accessed on August 2, 2023 ↩

- Electric Vehicle Energy Storage Company, https://www.power-sonic.com/blog/the-ultimate-guide-to-dc-fast-charging/#:~:text=HOW%20MANY%20KW%20IS%20A,15%20kW%20to%20350%20kW., accessed on August 25, 2023 ↩

- World Nuclear News, Refurbished Candus make headway towards restart https://world-nuclear-news.org/Articles/Refurbished-Candus-make-headway-towards-restart , Accessed August 3, 2023 ↩