When it comes to money, there may be nothing more dispiriting than seeing your portfolio nosedive over the course of a year. Unfortunately, that’s what many investors are experiencing. In the first six months of 2022, the United States’ S&P 500 Index was down by over 20% and Canada’s S&P/TSX Composite Index declined by nearly 7% during the same time period.

With these numbers, it’s impossible not to feel your insides churn and the sweat pour down your face every time the markets fall further. Sure, we saw a big drop in March 2020, but investors barely had time to realize what was happening before stocks started rebounding. This downturn has been more sustained, but it’s also more consistent with past bear market declines.

It may be natural to feel like selling, but the best strategy, which has been proven time and time again, is to sit tight, stay invested, continue any scheduled contributions and think long term.

To help guide us through the reasons why, we spoke to Sam Stovall, a market historian and author of The Seven Rules of Wall Street. Here are just some of the reasons why people should stay invested when markets head south.

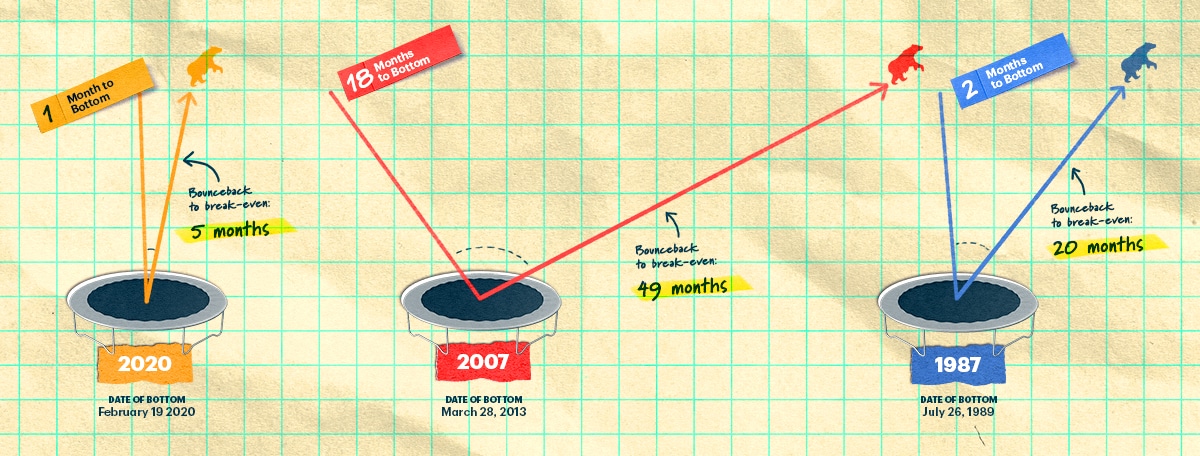

Back from the bottom. How big was the bounce?

Since 1945, the average recovery time from a bear market bottom has been 23 months. Here's how this looked for three notable bounces.

Since 1945, the average recovery time from a bear market bottom has been 23 months. Here's how this looked for three notable bounces.

Source: S&P Bear Markets Since 1929, Sam Stovall, S&P Capital IQ

This too shall pass

It’s easy to forget that downturns are normal — some would even say healthy. Since World War II, the U.S. stock market has experienced: 61 pullbacks of between 5% and 10%; 23 corrections (which is a drop of between 10% and 20%); and 13 bear markets of 20% drops or more. It’s also easy to feel as if the down markets will never rebound, but Stovall has found that the average recovery time in a bear market is 23 months. The 2020 recovery took just five. “The amazing thing is the speed with which markets get back to break-even,” Stovall says. Soon, hopefully, the unease you’re feeling will be a distant memory.

Investing is not gambling

“How many casinos do you know that pay the gambler 80% of the time? Because that is the frequency with which the market has posted positive total returns since World War II,” Stovall points out. If you respond to every market fluctuation with a portfolio change, you’re pushing the exercise in the direction of gambling.

The best days in the market tend to happen near the bottom

No matter what index you’re looking at — the S&P/TSX Composite, S&P 500 or other indices — if you look at the trading days with greatest percentage gains, a disproportionate number fall in years like 1987, 2008 and 2020. Those happen to be years in which the market crashed. Indeed, a lot of these days fall in the same month as the market bottom. “Usually, you see the greatest amount of volatility and price action very early in a new bull market,” Stovall says. You have to be invested on those days to benefit from those bounces.

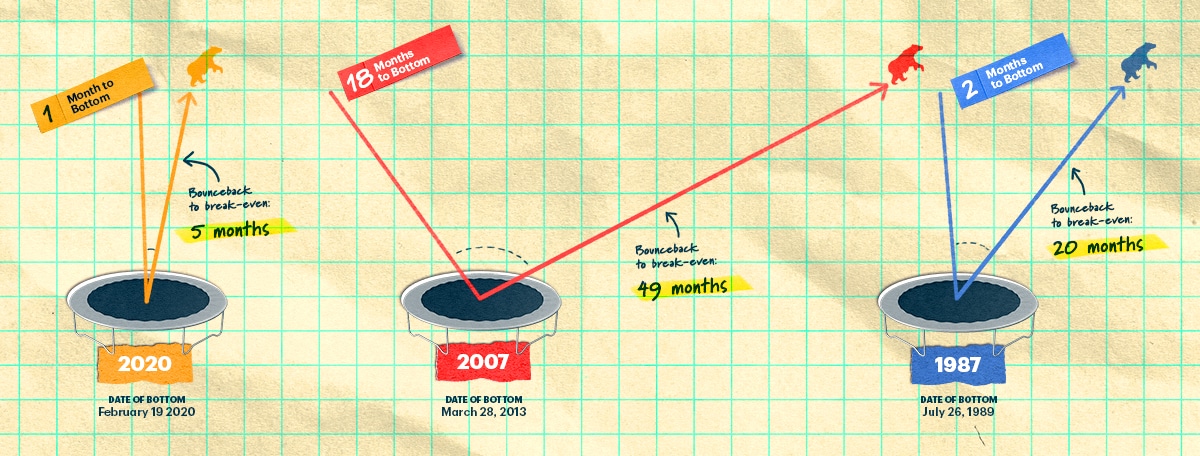

What if you miss the market's best days?

This chart shows what would have happened if you missed only the best 1% of trading days between 1991 and 2021. In fact, if you missed them all, you would have lost money.

This chart shows what would have happened if you missed only the best 1% of trading days between 1991 and 2021. In fact, if you missed them all, you would have lost money.

Source: TD Asset Management

You don’t want to miss the best days

A few years ago, Stovall ran some numbers. For the 30 years prior to December 31, 2017, the S&P 500 Index posted a compound annual growth rate (CAGR) of 8.1%. That would be an investor’s total return if they remained fully invested the entire time. Not bad, right? However, if the same investor missed just the 10 best trading sessions over those 30 years, their return would drop to 5.7%. Subtract the 20 best days and the CAGR falls to 4.1%. The 30 best days? 2.7%. Miss the 40 best days and it’s 1.4%. This year, TD Asset Management conducted a similar exercise for Canada showing that $10,000 invested in the S&P/TSX Composite Index on December 31, 1991 would have grown to $60,423 after 30 years. But if you failed to participate in the best 1% of trading sessions over that period, you’d have lost money. In January, you would only have had $3,747 left. Stovall’s takeaway: “It’s important to stick with the market unless you have a strategy that will work well for you.”

You don’t have a better strategy

“If you do try to time the market, you have to be right twice. You have to know the correct time to get out and the correct time to get back in,” he observes. In all his years in the market, he’s never figured it out and he’s never come across someone who has either. “The movie I got the greatest amount of investment advice from is Magnum Force, where Clint Eastwood, playing the character Dirty Harry, says through gritted teeth, ‘A man’s got to know his limitations,’” Stovall says. “Investors have to acknowledge their limitations.”

An investment portfolio can be like a bar of soap — the more you touch it, the smaller it may get

This happens two ways: First, changes in strategy tend to be counterproductive because investors can be their own worst enemies. Fund flows show retail investors tend to get in and out of the market in greater numbers at the worst times and end up buying high and selling low. That’s why you need to set a plan and stick to it through at least one full market cycle. Second, tinkering is costly because it incurs transactional fees that eat away at your returns. The smaller your portfolio, the more trading and other fees will hurt.

During the past six months you may have discovered you are not sleeping as well and may be less risk-tolerant than you thought you were. Fair enough. Instead of making hasty, ill-considered changes to your portfolio that could end up locking in your losses, take the time to re-evaluate your goals and educate yourself on the options. Then, and only then, come up with a plan to reallocate your assets in a way that’s more appropriate to your temperament as an investor. By that time, the market may well have righted itself.

If that’s not it and you feel you have to do something, make it something you should do regularly anyway. Rebalance your portfolio. Cut loose the stocks that you’ve been holding too long that never delivered. Consider quality companies you’ve had your eye on that are now more affordable.

On that last note, downturns present opportunities. For investors who are interested in dividend paying stocks, stock prices may go up and down, but the dividends paid by high-quality companies tend to remain steady. For U.S. dividend stocks, Stovall suggests consulting the S&P Quality Rank or the IQ Trends newsletter for lists of stocks with a history of paying a consistent and rising dividend stream that also have low payout ratios (meaning they are expected to be well-positioned to maintain their dividends even in case of a recession). In Canada, consider looking at what’s in the S&P/TSX Dividend Aristocrats Index, which includes companies that have consistently increased their dividends every year for at least five years.

But know that even by not doing anything different in the midst of a correction or bear market, you’re doing something. Scheduled contributions will buy more stocks today than they would have last December. So will reinvested dividends. Stay invested. You’ll thank yourself later.