As a newbie investor, I hear terms like “fundamentals” and “technicals” but never really know what to look for when researching a stock. Whenever I look at a broker’s stock overview page, I see a wall of words and numbers that seem important but also confusing. I know I should do my homework to ensure the companies I’m picking will be a good addition to my portfolio, but what numbers should I be looking at? How do I know what’s important?

I took these questions to my more experienced and knowledgeable colleagues. As a starting point, they identified the key difference between fundamental and technical analysis. Fundamental analysis looks at a company’s financial statements to examine how the operations are doing: What are the revenue, expenses, and net profits? Technical analysis, on the other hand, monitors stock price movements to identify patterns and trends that could help me make a prediction of where the price is going. Technical analysis does not consider how a company’s operations contribute to the price of a stock. With that in mind, my colleagues highlighted three basic metrics of fundamental analysis that I can analyze when researching a stock:

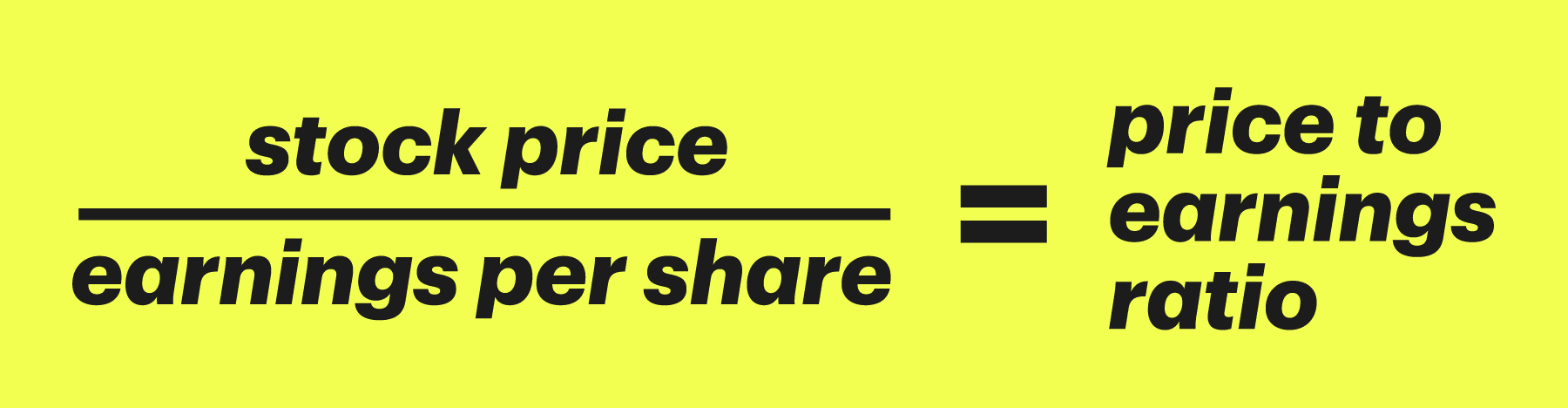

Price-to-earnings (P/E) ratio

Price-to-earnings (P/E) ratio is a tool investors use to help identify whether a stock is over- or undervalued. A higher P/E ratio would mean the stock is expensive compared to its earnings. To make sense of P/E ratios, it’s important to put them into context, by either comparing similar companies or past performance. For example, if I’m looking to invest in a technology company, I might want to compare its P/E ratio to a competitor. Paying more for a stock, in the form of a higher P/E ratio, isn’t necessarily a bad thing. In fact, it could be telling me to dig a little deeper. If we’re comparing two tech companies and Company A is coming out with an innovative product that increases demand for its brand, the P/E ratio may be higher because markets see growth potential. Similarly, the P/E ratio of Company B could be lower because markets see less growth potential. Essentially, P/E ratios provide insight into the market’s sentiment about a stock.

Do the math: You can often find the P/E ratio of a company on your broker’s stock overview page. But you can calculate it yourself by dividing the company’s stock price by its earnings-per-share (EPS). For example, if a company’s stock price is $50, and its EPS is $2, the P/E ratio would be 25 (50/2 = 25). In other words, you’d be paying 25 times its EPS.

Debt-to-equity (D/E) ratio

Debt-to-equity (D/E) ratio is another metric to consider. This ratio helps you understand how much debt a company owes compared to its shareholder equity. In comparison to other companies, a high D/E ratio means money is going toward paying debt rather than building shareholder equity. Moreover, if interest rates rise, this ratio could worsen since debt payments could rise. A high D/E ratio can flag concerns about risk. But like P/E ratios, D/E ratios can’t be looked at in isolation because different industries have different capital needs. For example, it might be common for telecommunication companies to have higher D/E ratios but not so common for say, tech companies. That’s why D/E ratios should also be compared to companies within the same industry.

Do the math: D/E ratios can be found on most brokerage stock overview pages. But you can calculate it manually by dividing a company’s total liabilities by its total shareholder equity. For example, if the total liabilities of a company are $300,000, and the total shareholder equity is $200,000, then the D/E ratio would be 1.5 (300,000/200,000 = 1.5). This tells you the company has $1.50 of debt for every dollar of equity.

Return on equity (ROE) ratio

This is the metric most commonly associated with the famed value investor (and surprising ukulele enthusiast) Warren Buffett. The return on equity (ROE) ratio is a percentage that shows how efficiently a company earns a profit from your investments. A higher ROE means that a company may be more efficient at generating profit. Buffett specifically looks at this metric to gauge whether a company has consistently performed well compared to others within the same industry. For example, because utility companies tend to have different ROE ratios than consumer product companies, it would be unfair to compare companies from those sectors against each other. How companies generate profit varies across industries.

Do the math: An ROE ratio can be calculated by dividing a company’s total net income by its total shareholder equity. For example, if a company’s net income is $30,000, and its shareholder equity is $100,000, the ROE would be 30% (30,000/100,000 = 0.30). In other words, the company generates 30% profit from its net assets (that’s another term for shareholder equity — the difference between what a company owns, and what it owes). Net income can be found on a company’s income statement, and shareholder equity can be found on a company’s balance sheet.

Price-to-earnings, debt-to-equity and return on equity ratios help us assess the factors that contribute to the price of a public company. Next time I’m considering a new investment, I’ll be sure to look at these three metrics as a starting point to ensure I have a better understanding of the risks to consider when building my portfolio.