What’s your Brain Wealth? Retiring from work without retiring from life

For many women, the idea of retiring just hits different. To help ensure your retirement is everything you want it to be, it may be time to consider your “Brain Wealth.”

DR. NASREEN KHATRI

CLINICAL PSYCHOLOGIST AND NEUROSCIENTIST

For many women, the dream of retirement is the prospect of spending more time with family and friends, travelling the world or focusing on personal passions and hobbies. For too many women, however, retirement can also be a time of loss.

Compared to men, retired women are more likely to experience the death of a partner, bouts of poverty, diminished cognitive functioning and an overall decline in their sense of well-being.

The key to retiring from work — but not from life — may be maintaining our “Brain Wealth,” something I define as the combination of emotional, cognitive and financial health. It can help us stay present, connected, happy and secure in our lives, despite the challenges we may face.

Not your father’s retirement

Let’s be honest, retirement was never designed with the contours of today’s working woman in mind. When the traditional retirement age was set at 65, the workforce was mostly male and a typical career consisted of an unbroken working stretch that lasted about 40 years. The average life expectancy of men at that time was also 66 years.1 In other words, the workforce consisted mostly of men who worked continuously for their whole adult lives, retired and died shortly thereafter.

Cut to today. Women make up almost half of the workforce. However, unlike their male peers, working women are likely to experience numerous career disruptions related to childbearing and childrearing, caregiving for elders and attendant periods of part-time work and unemployment.2 Women are also more likely to experience challenges related to income inequality and sexism in securing and maintaining high-level paid work or pension security.

Demographics have shifted over the past three decades as well. There are more unmarried than married adults for the first time in history, single-person dwellings are now the most popular domestic arrangement, fewer women are having children and chronology no longer dictates life stage.3 For example, a 51-year-old woman may be a retirement-ready grandmother, or the mother of a young child, still in the prime of her career.

Enter the COVID-19 pandemic. Approximately 3.5 million North American women left the workforce to care for children during the long months of online schooling to care for vulnerable, aging parents and in-laws or all of the above.4 The timing of this pandemic workplace exodus meant that, for millions of women, retirement planning was upended and compromised. That’s because the average elder caregiver is a 49-year-old working woman with children still at home.

Some women may never retire, retire repeatedly or even begin new careers or interests. Moreover, retirement can mean many things — it’s basically a “one size fits one” world when it comes to our relationship with work.

With all the challenges and opportunities women face during their working years, it can be important to tailor retirement to your personal lived experiences, wants and needs. However, the common denominator in being able to help plan and live the retirement you want and deserve will be something deeper. It will likely depend on the level of your Brain Wealth.

What is Brain Wealth?

Brain Wealth is a combination of brain and financial health. Brain health refers to your sense of emotional well-being and cognitive functioning, including thinking, memory and decision-making. Financial health means having the knowledge, skills and behaviours necessary to help keep yourself financially stable. Put emotional well-being, cognitive functioning and financial stability together and you get Brain Wealth.

Why is Brain Wealth so important for women in retirement?

Emotional well-being is a part of brain health that is often compromised across the female lifespan. For example, women are twice as likely to be diagnosed with depression as men. This may be due to biological changes like pregnancy and menopause and to stressors that women are more likely to experience, such as poverty and domestic violence.5

And, when it comes to cognitive health, women are twice as likely to be diagnosed with dementia as men.6 Moreover, individuals with a history of untreated depression are twice as likely to develop dementia later in life, compared to people who do not.7

Finally, women also tend to live longer. That means an increasing risk of mental health issues and cognitive impairment, plus a need to stretch their financial resources over a longer time horizon than men.

How to optimize Brain Wealth in retirement

The good news is that despite the challenges that many women face during their working years, they don’t preclude having a healthy, prosperous and enriched retirement life.

Simply knowing what Brain Wealth is and how it can be optimized is a great start. The next step is to begin practicing good Brain Wealth habits, like the ones listed below.

- Get a "check up from the neck up"

If you’re experiencing negative changes in mood, sleep, appetite, energy, thinking, concentration or decision-making, and it’s disrupting your daily functioning, it may be time to seek help from a mental health professional. A clinician can provide an assessment and, if indicated, prescribe treatment. Fortunately, many common mental health concerns like depression are eminently treatable, with many evidence-based options available.

- Schedule that long overdue physical

The pandemic has put many of us behind our regular check-up schedule. Time to play catch-up and resume regular check-ups with your doctor and dentist.

- Sort out your finances

If you’re struggling with debt or any financial stress, you can seek professional help. Financial advisors can help you overcome many issues you may be facing, as well as create a plan for the future based on your own goals, needs and wants. Advisors are trained to meet you where you are today on your retirement preparedness journey to help optimize your potential.

- Move your body and get enough sleep

One of the best things you can do for your brain, body and overall well-being is to exercise regularly. Even taking a 15-minute walk can help us to feel more energetic, alert and positive throughout the day.

Sleep is also key. Most of us are walking around sleep-deprived on any given day. Lack of restful sleep impairs cognition and negatively impacts mood. Poor sleep is not a normal part of aging, regardless of what you've heard. If you do not wake up rested after a night of sleep on an ongoing basis, see your doctor.

- Prioritize relationships

Relationships provide meaning, social support and give us the energy and motivation we need to be the best versions of ourselves every day. Even short conversations and face-to-face time with friends and family can be beneficial to our sense of well-being and energy levels.

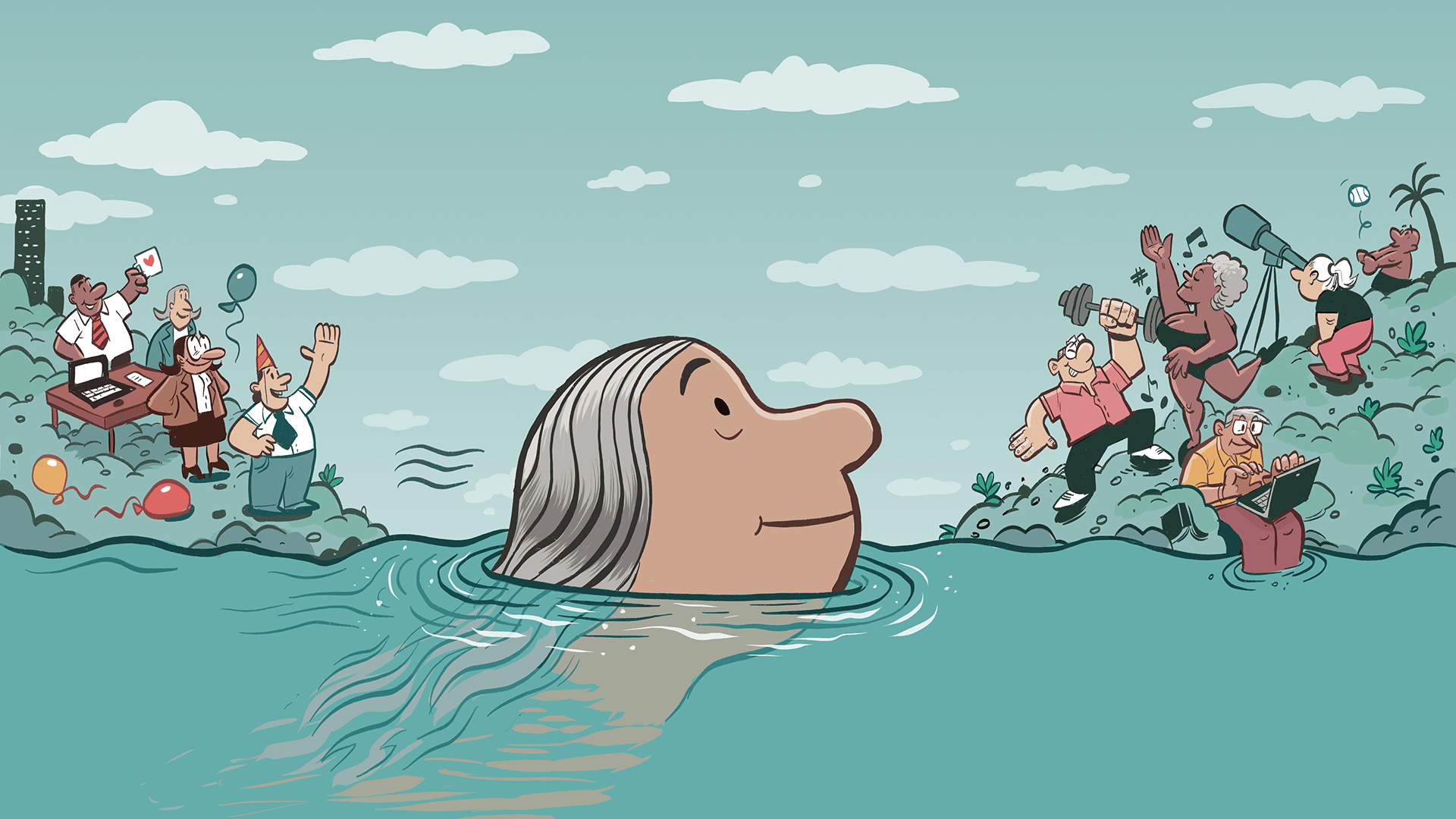

- Try something new

The end of a career doesn't mean the end of dynamic and meaningful experiences. You may still have decades of life ahead of you — what do you want to do with them? You can continue to grow by trying something new, whether it’s a new relationship, hobby, sport, travel, volunteer opportunity or other pursuit.

Retire from work, not from life

Many women dream of a healthy, secure and fulfilling retirement. However, the challenges women face related to mental, cognitive and financial health may impede a smooth journey forward.

By becoming aware of your Brain Wealth, as well as taking steps to help optimize it, you can leverage opportunities to tailor your post-work life to your own dreams. It’s time to take the reins and prepare for the retirement you want and deserve.

Your retirement. Your way.

Dr. Nasreen Khatri is an award-winning registered clinical psychologist, gerontologist and neuroscientist with 20 years of professional experience. She specializes in the assessment, treatment and research of mood and anxiety disorders in women and aging at the Rotman Research Institute in Toronto. She is also a Scientific Officer of the Centre for Aging and Brain Health Innovation at the Baycrest Centre.

- “Mortality Projections for Social Security Programs in Canada,” Office of the Superintendent of Financial Institutions, last modified May 15, 2014, https://www.osfi-bsif.gc.ca/Eng/oca-bac/as-ea/Pages/mpsspc.aspx#TOC-IIIb3. ↩

- Kim Parker, “Women more than men adjust their careers for family life,” Pew Research Center, October 1, 2015, https://www.pewresearch.org/fact-tank/2015/10/01/women-more-than-men-adjust-their-careers-for-family-life/. ↩

- “State of the union: Canada leads the G7 with nearly one quarter of couples living common law, driven by Quebec,” Statistics Canada, July 13, 2022, https://www150.statcan.gc.ca/n1/daily-quotidien/220713/dq220713b-eng.htm. ↩

- Bobby Caina Calvan and Christopher Rugaber, “Many women have left the workforce. When will they return?” AP News, November 4, 2021, https://apnews.com/article/coronavirus-pandemic-business-lifestyle-health-careers-075d3b0ab89baffc5e2b9a80e11dcf34. ↩

- “Depression in women: Understanding the gender gap,” Mayo Clinic, January 29, 2019, https://www.mayoclinic.org/diseases-conditions/depression/in-depth/depression/art-20047725. ↩

- “Differences between women and men in incidence rates of Dementia and Alzheimer’s Disease,” National Institutes of Medicine, January 1, 2019, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6226313/. ↩

- “Depression and risk of developing dementia,” National Institutes of Health, May 3, 2011, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3327554/. ↩