Ask MoneyTalk: My mom is recently widowed. Why is she having such trouble getting a handle on her finances?

Many women are thrown into learning about money for the first time when they experience the loss of a partner. And age-related cognitive changes can make managing finances in later life especially tricky. Here’s how adult children can collaborate with parents to optimize financial health.

DR. NASREEN KHATRI

Clinical Psychologist and Neuroscientist

It’s no secret that women have historically deferred to their partners when it came to financial decision-making. It’s only recently that women have gone mainstream with their financial independence, in many cases out-earning their partners.1 According to TD Wealth, 31 % of women are now the primary earners in their household. Still, some women in their later years may be tackling financial independence for the first time.

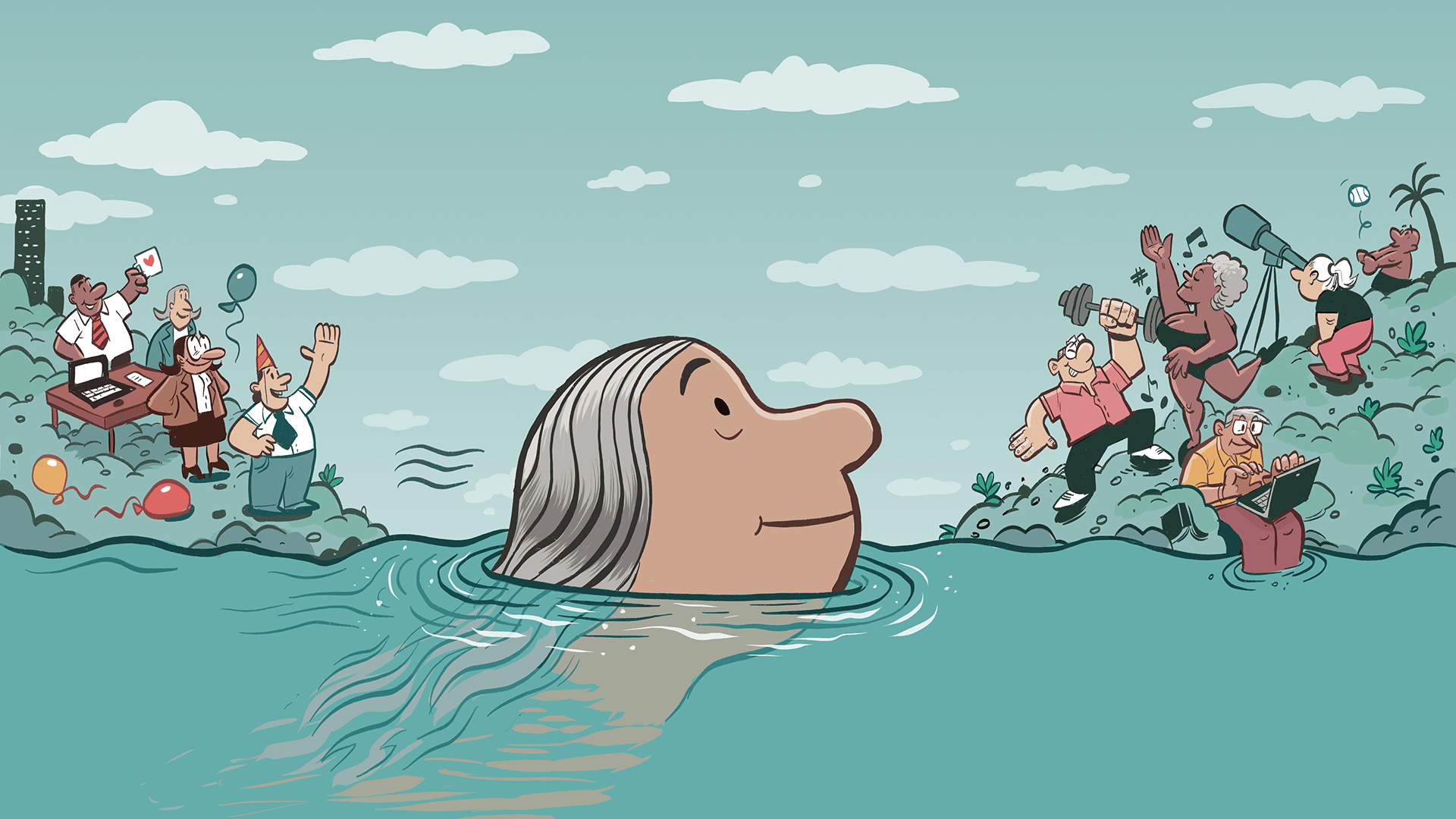

Let’s look at why your mom might need some help with her finances right now. The death of a spouse can be world-changing. Mourning is as individual as it is complex. This emotional sea change might mean your mom’s finances are currently taking a back seat. Maybe life is overwhelming right now, and her bills are piling up. And for a short period of time, that’s probably OK.

But after a few months, if her mood doesn’t brighten (even a little), or you start to notice changes in her personality, memory and thinking, and the bills are still going unpaid, it may be time to open the lines of communication. You may want to encourage her to speak with a mental health professional who can complete a “check-up from the neck up,” and assess your mom for signs of depression, cognitive issues or both.

Financial decision-making is complicated and the first thing to fail when age-related cognitive changes emerge. This can be a good time to establish or strengthen open, respectful communication with your mom about her mood, memory and finances. Here are some thoughts that might help.

Ask for permission to help

First, ask permission to discuss sensitive topics. Ask your mom if there is a good time to talk. This signals collaboration and respect and allows your mom to maintain some control over when and how the conversations take place.

When you do sit down to talk, try to remain fact-based, neutral and specific about what you have observed. (For example, “Yesterday, I noticed that we had the same conversation about your mortgage bills that we had the day before. And that you teared up when I asked you about it. Can we talk about how thinking about your bills makes you feel? I’d like to help make this easier for you.”)

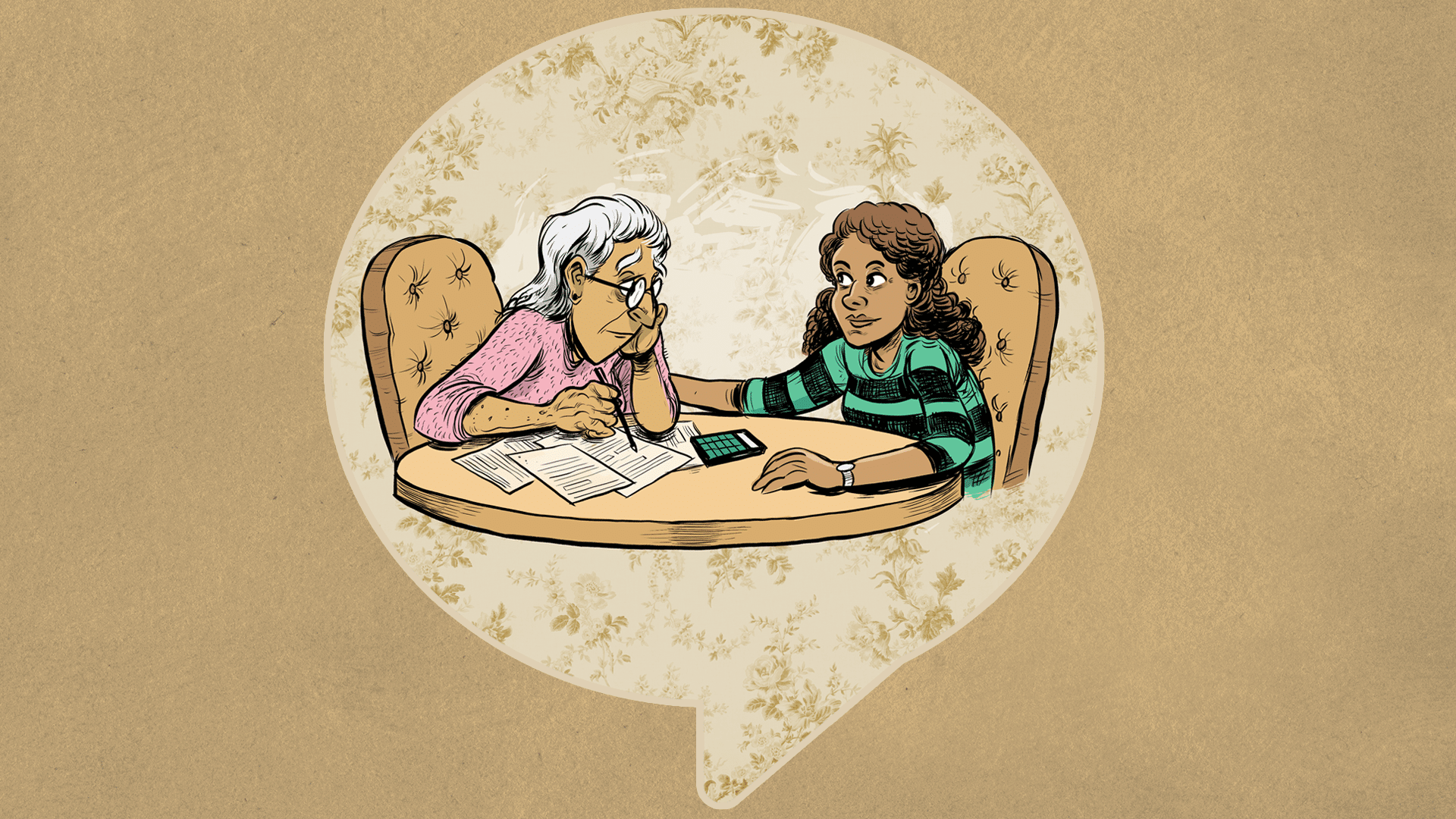

Offer to collaborate

Next, you can help create a plan together to tackle her finances. Depending on the situation, it may be appropriate to accompany her to the bank, and ask to be included in conversation with her advisor.

Her advisor may be able to collaborate with you both. If your mother has an advisor she is comfortable with, they can help her to understand how she can most easily tackle the tasks that are most urgent, while helping keep an eye on her future financial needs. Her advisor can encourage your mom to ask questions about anything, from paying bills to investments and debt. It’s interesting to note that many women may not have a relationship with an advisor, or the advisor has primarily had a relationship with her partner over the years. This can be a time to ask your mom how she feels about her advisor, and if she needs help to find one that she can be comfortable and open with.

Be patient and don’t push

If you hit a roadblock and you sense your mom is shutting down, don’t push. Unless it is an emergency, you’re better off returning to this conversation another time. People can experience money differently depending on their age, generation, gender and culture. These differences can be obstacles to creating a healthy financial relationship. Seek to listen and understand without judgement. Try to model open, healthy communication about health in general (physical, emotional, cognitive, and financial). Over time, this will nurture a more open, healthy communication style that can lead to financial health for your family.

You can visit the TD Wealth for Women website to find more about how women can meet their financial goals, now and in the years ahead.

Dr. Nasreen Khatri is an award-winning registered clinical psychologist, gerontologist and neuroscientist with over 15 years of professional experience. She specializes in the assessment, treatment and research of mood and anxiety disorders in women and aging at The Rotman Research Institute in Toronto. She is also a Scientific Officer of the Centre for Aging and Brain Health Innovation at the Baycrest Centre.

- TD. TD Wealth for Women. https://www.td.com/ca/en/investing/td-wealth-advice-for-women/ Accessed October 25, 2021 ↩