Can’t stop now: It’s time for women to get real about their retirement goals

Too many women say they don’t feel ready to retire, either financially or mentally. One thing that might help? Let’s start talking openly about money.

DR. NASREEN KHATRI

CLINICAL PSYCHOLOGIST AND NEUROSCIENTIST

Here is a sobering statistic: Only 18% of women with children say they are “very satisfied” with their retirement readiness, according to a 2018 TD Wealth report.1 In fact, almost half of the women surveyed say they have no plan for retirement whatsoever.

We’re living in a time when women have a growing financial influence. In the decade ahead, it’s projected that Canadian women could control as much as $3.8 trillion of personal wealth in the span of a decade.2 By 2030, it’s expected that women may inherit as much as 70% of all intergenerational wealth.3

As a clinical psychologist with 20 years of experience specializing in women’s health, I have witnessed firsthand how financial stress can take a toll on the mental health of women of all ages.

A combination of financial and psychological factors is putting more pressure than ever on women to level up their financial confidence or get left behind. This includes a fast-changing economic landscape in which women are increasingly becoming primary breadwinners.

And while it’s no secret these challenges disproportionately impact women leading up to and during retirement, we can pause to appreciate the opportunities they present as well. Here are some of the very real reasons women may need to save more for retirement than men:

Financial disadvantage: Systemic inequities in pay, levels of employment and opportunities to secure jobs with pensions means many women may accumulate less wealth throughout their working lives than men.4

Social inequities: Women tend to experience interruptions that hinder or halt their career development and financial growth throughout their lives. These interruptions can include divorce, the birth of a child, and unpaid leave to care for children or aging parents. The COVID-19 pandemic in particular impacted women disproportionately in terms of layoffs, furloughs and the need for many women to step away from work altogether to care for family.

Brain health, depression and dementia: Women are significantly more likely than men to be diagnosed with depression5 or dementia.6 Both of these ailments can significantly impact mental cognition. When cognitive deficits arise, financial decision-making is one of the first skills to decline. Moreover, the span of that decline can last longer for women because, on average, women tend to outlive men.

Now what? Ways to get on track with retirement planning

For so many women, the time to start planning for retirement is now. The good news is getting on track can be easier than you think. Here are some of the things I believe more women should be doing:

- Talk: Break the taboo around money

My professional experience has taught me that in order to solve a problem, we first need to be able to name it, describe and discuss it. Nonetheless, many of us grow up believing money is somewhat of a taboo topic. We aren’t encouraged to talk about finances, let alone taught how to manage them. And yet, money touches every aspect of our lives. Given its importance, how can we change our beliefs about money and become more confident, proactive and effective with it in our daily lives?

One solution? Talk it out.

Instead of experiencing finances as a stressor, talking openly about money can help us view our finances as a lifelong relationship, one in which we have agency and choice. Moreover, learning to see financial wellness as a part of our overall health can help us engage with it in a more helpful way.

Your conversation can be with a partner, friend, sibling, parent or anyone you feel comfortable enough with to broach the topic of money. Some say that “talk is cheap.” But when it comes to your financial future, silence is unaffordable.

- Accept that financial planning is a skill, not a talent

Being good with money is not something you’re born with. It's a skill you can learn. The good news is that anyone can start working toward their goals by taking it one step at a time. Start with something you can control. For example, your own dreams for retirement. Do you want to travel? Start a new hobby? Spend more time with family? Remember, your retirement goals don’t have to be based on numbers. They can be personal to you.

Write them down. Even the simple exercise of writing it down can bring emotional relief and help get you one step closer to solving an issue and improving outcomes.

- Build your confidence

Once you begin to create a picture of what you want, you can introduce small, sustainable steps to help you realize your retirement goals. Whether you start a money jar, watch a webinar on retirement planning or talk with a friend about how you feel about your financial situation, it all adds up. The key is gaining knowledge and confidence through learning. Once you feel comfortable, you can start to make a more detailed plan.

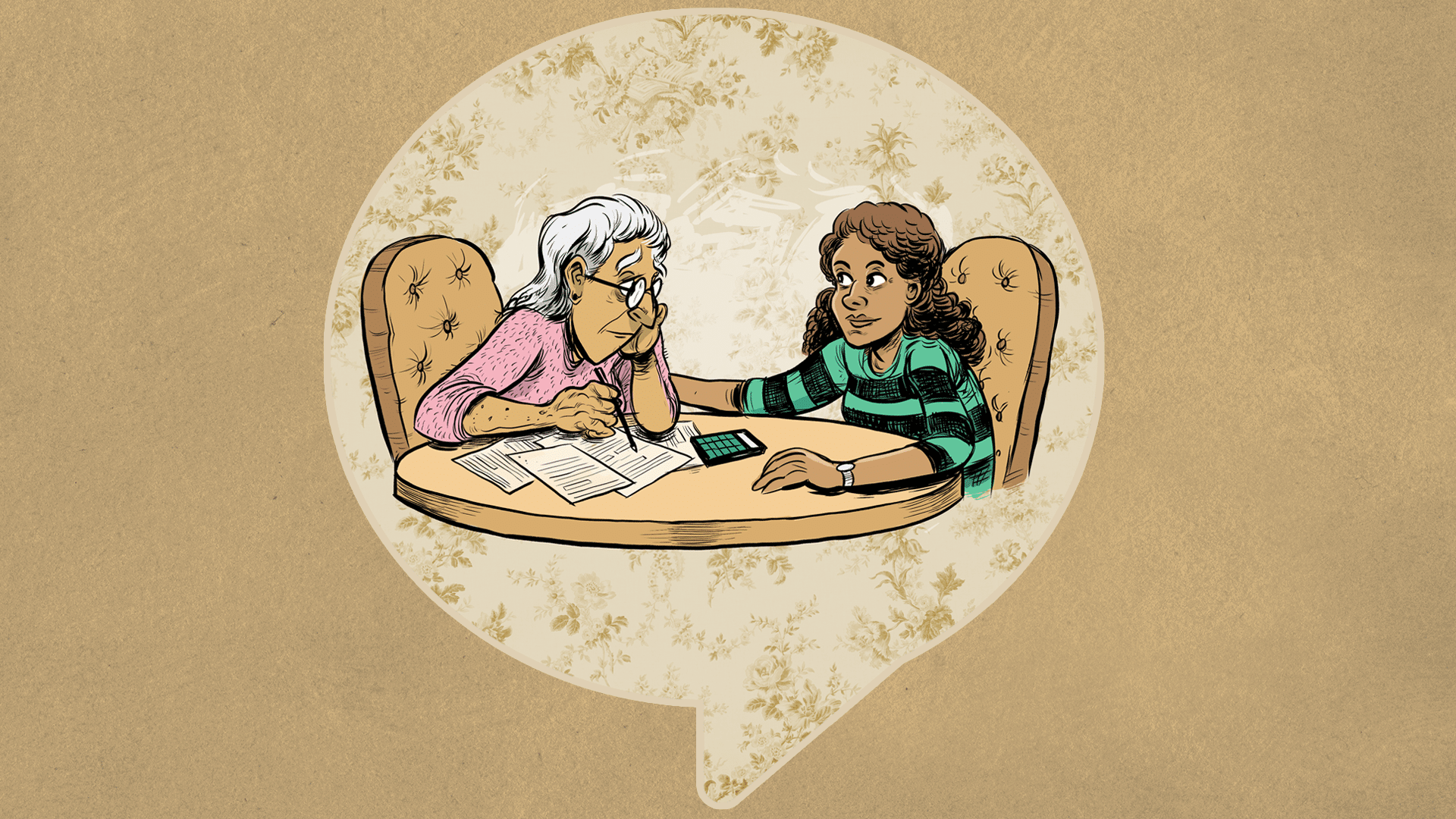

- Get the support you need

Just as you wouldn’t try to fix a broken leg on your own, you can seek professional help if you are struggling with debt or any other financial stress. Wealth advisors are trained to help educate their clients on financial literacy and help with their financial health — depending on their goals, needs and wants. If you have any questions about your own retirement, or how to begin planning for it, speak to a financial advisor.

Embrace this golden opportunity

Ultimately, women experience unique challenges with retirement planning due to a variety of systemic inequities and cultural norms. We can begin to improve our relationship with money by talking about it with those we trust and seeking professional financial advice.

Learning to view money management as a skill that can be learned can further help us engage with it in a positive, productive way. But it all starts with an open and honest conversation.

After all, money talks. And so can we.

If you’d like to speak to a financial advisor to help you create a plan to reach your retirement goals, you can reach out at TDWealthforWomen@TD.com.

Dr. Nasreen Khatri is an award-winning registered clinical psychologist, gerontologist and neuroscientist with 20 years of professional experience. She specializes in the assessment, treatment and research of mood and anxiety disorders in women and aging at the Rotman Research Institute in Toronto. She is also a Scientific Officer of the Centre for Aging and Brain Health Innovation at the Baycrest Centre.

- Source: TD Wealth Behavioural Finance Industry Report, 2018. www.td.com/content/dam/wealth/document/pdf/wealth/behavioural-finance-industry-report-en.pdf. Accessed November 8, 2022 ↩

- Benjamin Tal and Katherine Judge, “The changing landscape of women’s wealth,” March 2019. https://www.cibc.com/content/dam/personal_banking/advice_centre/pdfs/in-focus-en.pdf Accessed November 8, 2022 ↩

- Investor Economics Household Balance Sheet 2021 ↩

- TD Stories, “This is a pivotal moment in history for women but the industry needs to step up,” Jan. 25, 2021. Stories.td.com/ca/en/article/ingrid-macintosh-this-is-a-pivotal-financial-moment-in-history-for-women-but-the-industry-needs-to-step-up. Accessed Nov 21, 2022 ↩

- World Health Organization, Depression Fact Sheet. Sept. 2021. www.who.int/news-room/fact-sheets/detail/depression. Accessed on Nov. 15, 2022 ↩

- Alzheimer’s Association. 2019 Alzheimer’s Disease Facts and Figures. www.alz.org/media/Documents/alzheimers-facts-and-figures-2019-r.pdf. Accessed on Nov. 15, 2022 ↩

![Bounce Back From The Retirement Blues- TD MoneyTalk Life Stories [Feat]](https://www.moneytalkgo.com/wp-content/uploads/2016/06/Bounce-Back-From-The-Retirement-Blues-TD-MoneyTalk-Life-Stories-Feat.jpg)