What will you do with your tax refund?

Doing something super-smart with your tax refund may be a great indicator of your future financial planning success.

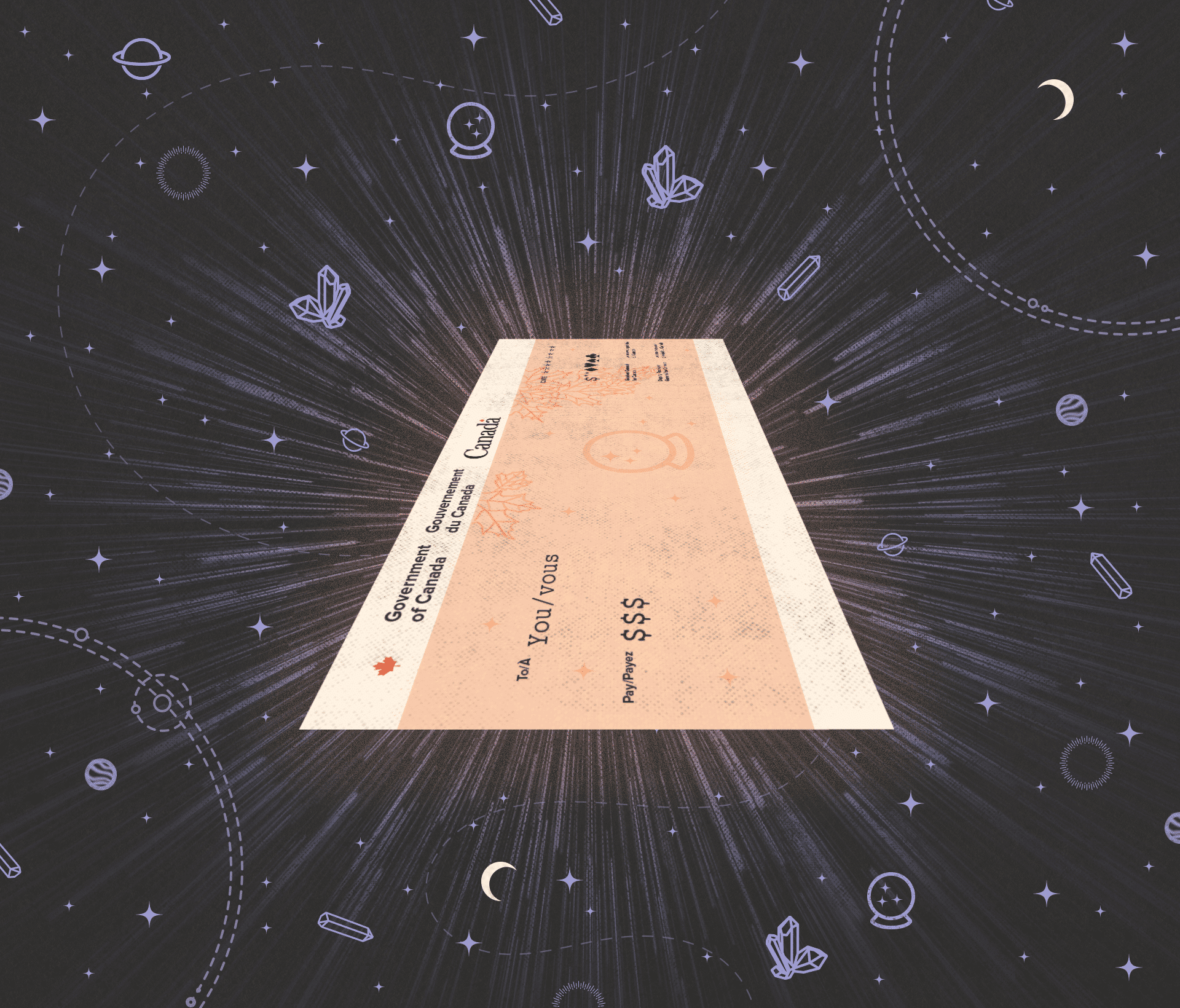

For centuries, humans have looked to the stars to predict their fate. But what might the future hold for your tax refund? Do you have solid plans for the money or is its fate as mysterious as what tarot card you flip over? It's always a pleasant surprise when a cheque arrives in the mail, or a few extra digits pop up in your bank account, but imagine what you'd do if you have a plan to make the most of the opportunity.

Full disclosure: We want you to think about what you will do with your tax refund. Already in 2023, Canadians have received an average refund of $2,172.1 Many of us will see the money they receive as an unexpected windfall. Studies suggest that because we regard tax refunds as free money, we tend to spend these windfalls less wisely than we do with our regular paycheques.2 And yet the financial environment we are in this year, with higher inflation, interest rates and general uncertainty, can't help but be contributing factors on how we will plan around the refund.Save, splurge or invest, we’re deliberately nudging you toward thinking about your options now. That's because evidence shows putting great ideas in front of people can often be enough for them to act on those initiatives.3 So, read ahead and peer into the future to see what you could have done with your tax refund. And give it some thought. You never know — a better financial decision may be in the cards.

Next move

Big plans for retirement? Book time with a financial planner to actually calculate if you're on track to get where you want to go.

FLIP TO REVEAL NEXT STEPS

What you did

Rolled your tax refund into your RRSP or started an emergency fund.

What it may say about you

You are dynamic, responsible and thoughtful. Setting aside funds for retirement is the first step to helping those plans become a reality. Plus, in the past few years we've all learned that the unforeseen can knock any financial plan sideways. Having an emergency fund of cash on hand is one way to help meet financial needs if things get tough.

Next move

While it feels great to treat yourself, now could be the time to check in and see what shape your finances are in.

FLIP TO REVEAL NEXT STEPS

What you did

Splurged on something you've had your eye on.

What it may say about you

You treated yourself — and that's OK. If you finally replaced your old TV or put the first payment on a new car, or just bought yourself something nice — congrats. Life has been filled with uncertainty for a while now and it's normal to reward ourselves and our families every now and again.

Next move

If you're missing your credit card obligations regularly, you may want to think about talking to a financial planner about get your spending and bills under control.

FLIP TO REVEAL NEXT STEPS

What you did

Used your tax refund to pay down debt

What it may say about you

You are reliable and pragmatic because you realize that saving and investing can be hard if you have outstanding debts pulling you down. Paying down high interest debt including a line of credit, car loan or a credit card bill is one of the most sensible things to do with your tax refund — particularly when interest rates have risen so dramatically.

Next move

You can make a plan for your money before you receive it. You may be surprised how far some forward thinking can take you.

FLIP TO REVEAL NEXT STEPS

What you did

Well, the tax refund went into your bank account and faded slowly away…

What it may say about you

"Life happens," but you could get better organized. You did have vague plans for that money. And then one thing led to another and you forgot about it. And then, when you really needed it, it had vanished. And the same thing happened exactly the same way last year.

Next Move

Think about what other financially savvy moves you could be making: Is your TFSA maximized? Your kids' RESPs? Have all the options covered for your family's security?

FLIP TO REVEAL NEXT STEPS

What you did

Used your tax refund to make an extra payment on your mortgage

What it may say about you

Take a bow because you are astute, forward-thinking and smart. You know making an extra mortgage payment can have a big impact and doing it every year can shave years off your mortgage and the interest you’ll pay.

Next Move

If you haven't already, update your Will, Powers of Attorney and talk to your advisor about your estate plan. It's never too early to plan ahead for your family should something unforeseen happen.

FLIP TO REVEAL NEXT STEPS

What you did

Asked your employer to reduce the amount of tax you pay

What it may say about you

You’re logical. You realized that your tax refund is based on the amount of tax your employer takes off your paycheque — the surplus comes back to you annually as a tax refund. It’s your own money! Asking your employer to take smaller deductions from your pay means you get to choose what to do with the funds earlier. And you already have a plan for an automatic withdrawal of those extra funds to a TFSA so they don’t just fade away.

Getting a tax refund may seem like an automatic process, but doing something smart with it can sometimes be hard. If you’re wondering what great money moves you can make with your tax refund, talk with a financial advisor or planner soon. You might get a glimpse of your future financial health.✯

DON SUTTON

MONEYTALK LIFE

- "Individual income tax return statistics for the 2023 tax-filing season," Canada Revenue Agency, last modified February 8, 2023, www.canada.ca/en/revenue-agency/corporate/about-canada-revenue-agency-cra/individual-income-tax-return-statistics.html?_ga=2.192170986.1162801900.1677008388-1586431994.1675348439.↩

- Richard Thaler, “Mental Accounting and Consumer Choice,” Marketing Science, Vol. 4, No. 3 (Summer, 1985), pp. 199-214, accessed February 21, 2023.↩

- Kim Ly, et al, “A Practitioner’s Guide to Nudging,” Research Report Series Behavioural Economics in Action Rotman School of Management, University of Toronto, p. 7, March 15, 2013, accessed February 21, 2023.↩