Budget basics: 4 ways to painlessly hack your spending

Household costs are rising, but many people equate budgets with having to compromise their lifestyle. Does it have to be that way? Turns out, there are several ways to save money without necessarily feeling the pinch.

Even if you have been able to make ends meet in the past, many Canadians are now feeling the pinch of rising inflation as we see higher prices for gas, groceries and other everyday items. In February’s inflation statistics had shown that prices rose 5.7% annually, the highest increase since 1991.1 A recent Ipsos poll found that 74% of us are concerned about inflation and 82% expect that our finances will be negatively impacted.2

To help manage higher bills, and the stress those bills inevitably bring, it may be time to set a budget. Zeljka Walker, Senior Investment Advisor at TD Wealth, Private Investment Advice, says budgeting can make you more aware of how you use your money and what alternatives you may have: That knowledge can influence your spending and saving.

“You might be surprised to learn that your daily coffees add up to a trip to the Bahamas every year,” she says. “Wouldn’t it be nice to make the choice of one or the other? Maybe your coffees are important to you, but maybe you would happily trade that coffee in for something you would enjoy more.”

She says today’s tech makes it easy to categorize and tally your expenditures. Budgeting apps like TD MySpend can even import spending transactions — and do it almost automatically. Once you have a handle on how much is going out, you may find simple ways to adjust your spending. Walker suggests these easy budgeting hacks if you’re looking to save money.

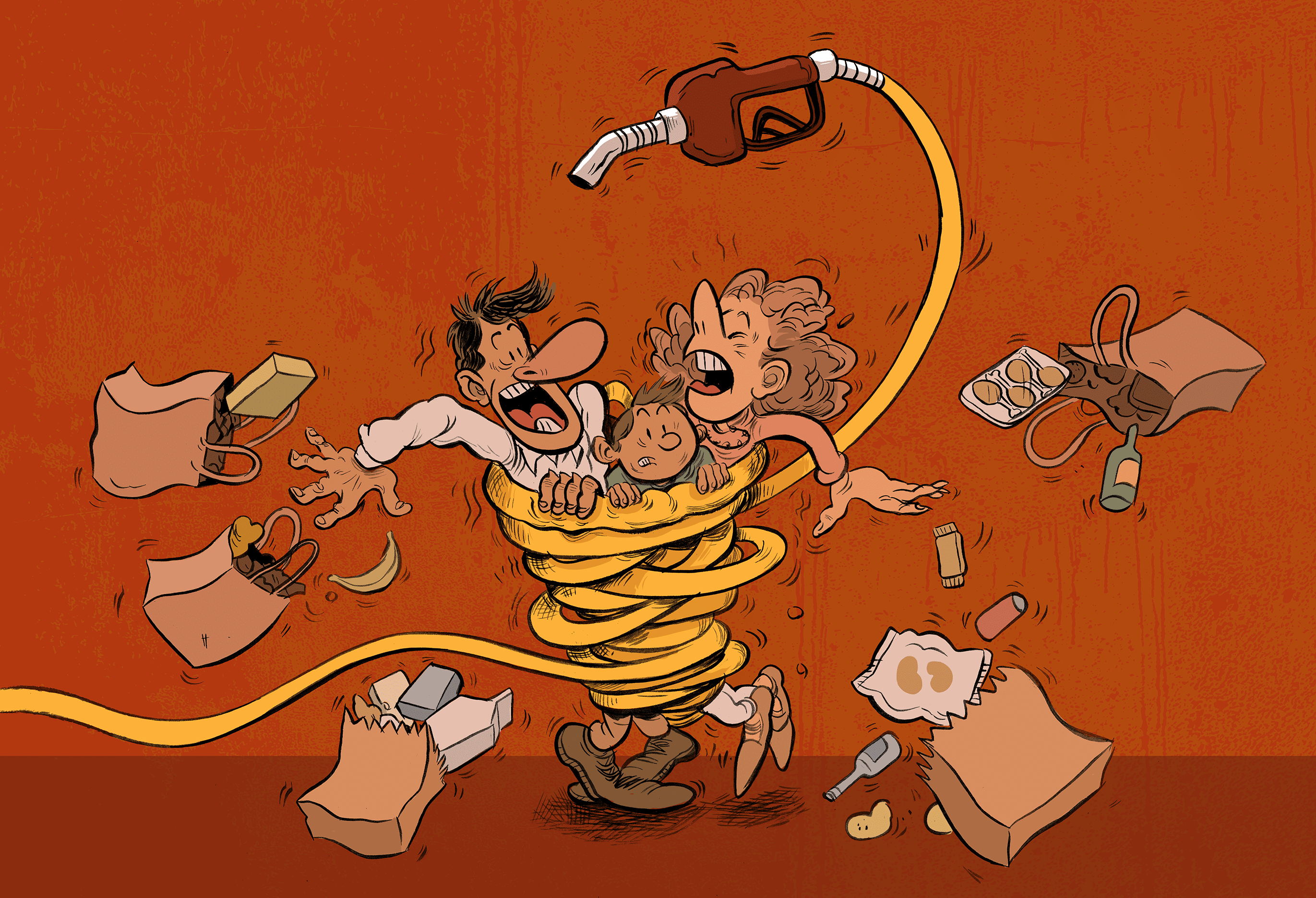

Revisit your transportation costs

With the rising price of new and used vehicles, and the increase in gas prices across the country, vehicles are eating up an increasingly big share of people’s budget. The Canadian Automobile Association estimates that owning a car, including repaying loans, insurance, gas, maintenance and depreciation can cost upwards of $1,000 a month.3 Many Canadians are now working remotely at least some of the time, and many families might be able to reconsider having a second car, or going without a car at all. “Now is a good time to see if public transportation, taxis or ride-sharing could actually save you money,” says Walker. “Renting or car-sharing is widely available now when you do need a car for a day or a weekend.”

Manage debt and investments

No one wants to carry around a lot of debt, so it might be tempting to just put all your extra cash towards paying it down. While that seems prudent and responsible, it may not be the best course of action for your finances: Debts must be addressed, but you should also be directing funds towards investments.

Walker suggests distinguishing between what is good and bad debt. Good debt is money you borrow that can help improve your financial circumstances, such as a mortgage. Other kinds of debt, like high-interest credit card debt is considered to be a drain on your budget. Walker says ignoring credit card debt on an expensive pair of shoes, for example, is likely not beneficial for your financial situation. When left unpaid, that debt will rack up interest: As your shoes wear out, they have no real financial value but you may end up paying more for them than what was on the price tag.

She says budgeting also means having a holistic view of your finances and ensuring you are saving enough to make regular investments. Investing may seem like an unnecessary expense to some in times of belt tightening, says Walker. But growing savings through investments can help you reach future goals including retirement, buying a home or financing a child’s education.

“Looking at ways to cut back doesn’t have to be hard,” she says, “Just $50 a month put into an investment with a return of 4% could yield over $8,000 over the next 10 years.”4

Divvy up that tax refund

When we get that cheque in the spring, it can feel like a windfall. Guess what? A tax refund is just your own hard-earned money, money that the government was holding onto temporarily. Walker offers up one tip for your tax refund: Think ahead about how much you will spend, save, and use to pay down debt.

“If you want to treat yourself, go for it,” she says, “but don’t let fun eat up your whole tax refund. Think ahead and figure out how much you will put towards debt if you have any, how much you could invest and get it working for you, and lastly, what you can spend on living life.”

Learn when to fix it or replace it

Sometimes saving money means forgoing something new if the old item can be fixed. Other times, it’s the opposite. Buying something new can save more money over time. It can be tough deciding whether it’s better to pay to fix something like a car or appliance, or to just buy a new one.

“Always fixing something may not be the budget-saver you think it is,” says Walker. She suggests this rule of thumb: If you are less than halfway through its expected life, and repair costs are less than half of the replacement cost, it may be worth it to fix it. Conversely, if it’s more than halfway through its life and costs more than half of the replacement value, it’s time to replace it.

Walker says everyone’s situation is unique and so too are everyone’s goals in life. Budgeting is a personal quest to get finances in order so that money is not lost to unnecessary expenses you may regret. Instead, budgeting is a time to direct funds towards things that are meaningful to you and your family.

“Just committing to reviewing regularly what brings value to your life may help you find places to trim,” she says, “and that can help you find money to put away for a day when you really need it.”

DENISE O'CONNELL

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN

- TD Economics, Canadian Consumer Price Index (February, 2022). Mar. 16, 2022. https://economics.td.com/ca-cpi, accessed March 16, 2022. ↩

- GlobalNewswire, New Ipsos Poll Reveals 26% of Canadians May Soon Need Charitable Services to Meet Basic Needs, Up from 11% Due to Pandemic and Inflation. February 23, 2022, accessed Mar. 7, 2022. https://www.globenewswire.com/news-release/2022/02/23/2390144/0/en/New-Ipsos-Poll-Reveals-26-of-Canadians-May-Soon-Need-Charitable-Services-to-Meet-Basic-Needs-Up-from-11-Due-to-Pandemic-and-Inflation.html ↩

- Canadian Automobile Association, Canadians unclear about the true cost of owning a vehicle. May 24, 2018, accessed March 7, 2022, https://www.caa.ca/news/canadians-unclear-about-the-true-cost-of-owning-a-vehicle/#:~:text=%E2%80%9CCAA’s%20Driving%20Costs%20Calculator%20helps,gas%2Dpowered%20car%20is%20%243%2C300 ↩

- TD Bank, Compound interest calculator, accessed Mar. 11, 2022, https://www.td.com/ca/en/personal-banking/personal-investing/compound-interest-calculator/ ↩