Holiday spending: How (not) to blow the budget

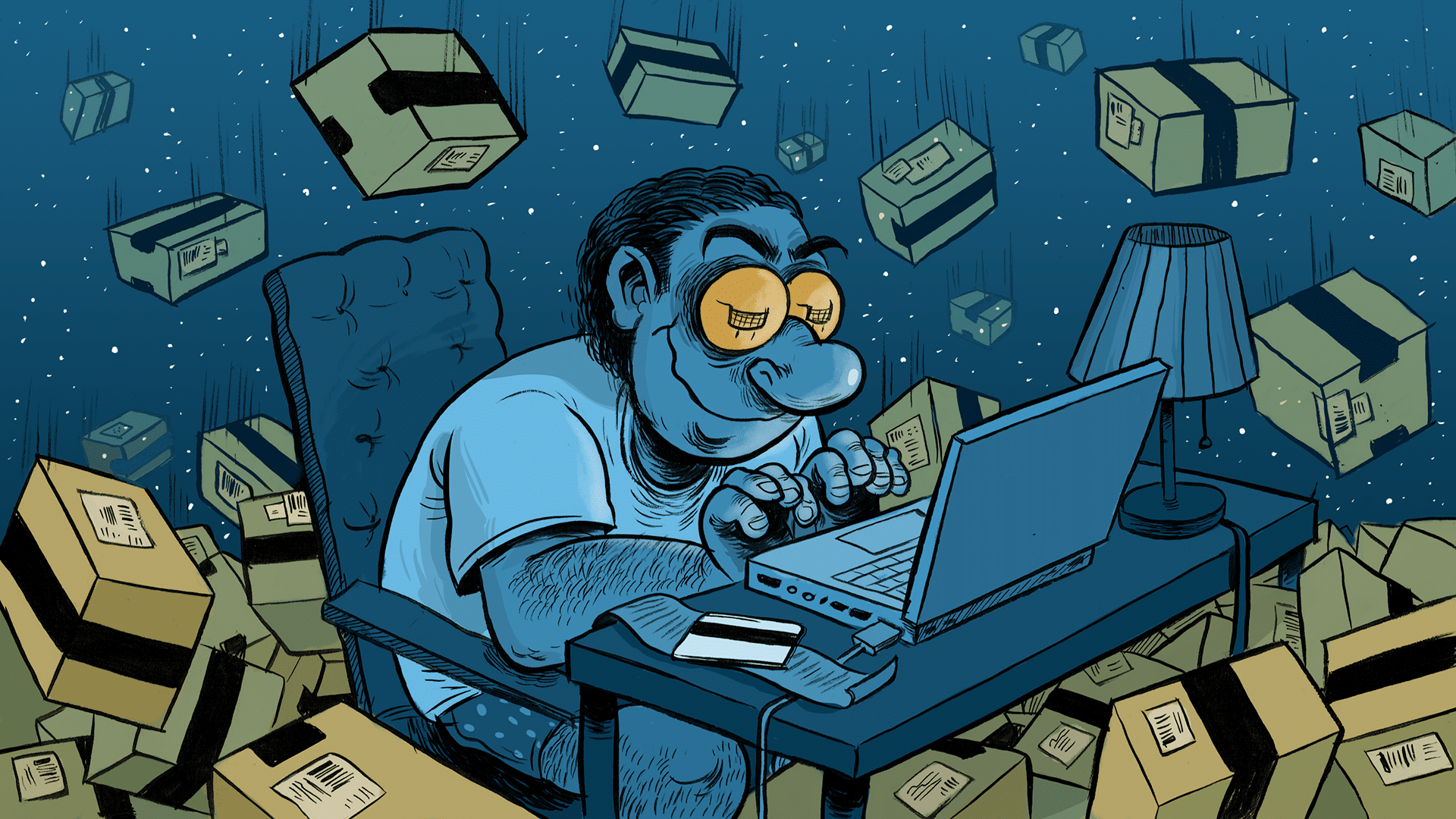

Every year it gets said: Let’s stick to a budget this holiday season. And every year the budget gets blown. Here are some ways to make this year feel special without overspending.

We all have holiday traditions we come to love: family get-togethers around a huge meal, lighting the menorah, reminiscing about times past, and watching the kids tear open presents. Unfortunately, there’s also a bunch of traditions many of us would rather not have: desperately buying questionable items at the last minute, a huge credit card bill in January and the thought of our unused gifts hiding in our relatives’ closets.

We love the holidays, exchanging presents and celebrating together. But sometimes our exuberance to make the holidays special can overwhelm our financial good sense. At the worst, undisciplined buying habits can push us into debt. But even if they don’t, spending with no regard to the consequences may distract us from reaching our financial goals. No one wants to be Scrooge — but neither should we have to scale back vacation plans just because we gave away gift cards to everyone we know.

It’s true that the holiday season can also be a busy, stressful time when many Canadians become wrapped up in life and their jobs, says Natasha Kovacs, a Financial Planner with TD Wealth. “The holidays can create a time where we try to overcompensate by splurging,” she says.

If you find yourself regularly spending more than you intend to this time of year, you’re likely not alone. But there may also be ways to rein in your holiday shopping. We talked with financial and behavioural professionals to gain some insights into why opening your wallet is so easy this time of year and what we can do to regain control.

What goes on in your head when you shop

Gift giving is an interesting part of wealth psychology and can highlight behaviours we all have around money.

“As with any sort of altruistic activity, there is also a private benefit. On the one hand gift-giving is an act of generosity — you do an act for someone else — but it’s also something you do for yourself, to make you feel less guilty or make you feel good,” says Nico Lacetera, a professor at the University of Toronto’s Behavioural Economics in Action at Rotman (BEAR) institute. He studies, among other things, the psychology behind our financial decision making.

He says scholars call this altruistic feeling the “warm glow.” Unfortunately, making yourself feel good through shopping can become an end in itself.

Lacetera says there are other established behaviours at work as we’re purchasing goods, such as something called Loss Aversion. Going into a clothing store, touching a beautiful scarf and considering how much your friend would adore it creates an emotional bond with the item, he says. Walking away without it would make you feel just terrible — so you go to the cashier.

There is also the peer effect. When you enter a bustling shopping centre and see crowds with overflowing shopping bags — decorations are twinkling, music is blaring and people are in costume — the whole spectacle draws you into doing the same action everyone else is doing because of a need to conform and be part of the community.

“You may be confident when you leave the house that you are not susceptible to these influences, but you end up like many other people: You feel the social norm is to buy stuff,” Lacetera says.

Kovacs finds that during the holiday season, many people may also want to “keep up with the current trends often advertised through social media.” If you are seeing posts of someone getting a new car or the newest gaming console, you might feel inadequate and want your family to have nice things too. And why not, you’re worth it, right?

Why overspending habits are hard to break

Lacetera says anyone who has tried to lose weight or take up exercise may be familiar with the Intention-Action Gap. We make plans to make a behaviour change but following through is difficult. This can happen during the spending process too: We may have the best intentions to buy a single item at a certain price online but the pressure of sales and one-day-only deals can disrupt our best intentions.

Breaking any kind of long-term habit isn’t easy but it helps to be mindful of your underlying motivations instead of blaming yourself for lack of discipline or character.

Lacetera says we all are prone to unconscious behaviours and being aware of our blind spots can be the first step toward managing our actions. This allows you to proactively make plans so that you are not at the mercy of the holiday’s emotional roller coaster.

“Knowing [your biases] helps. You can then set in place your own rules to curb overspending,” he says. These can be hard commitments like cutting up your credit card (effective perhaps, but impractical) or softer strategies like just leaving it at home. But there may be even simpler tactics that may work for you.

Lacetera suggests if you step back and realistically consider each gift, who it’s for, how much it costs, how it will be used and appreciated, the analytic process can go a long way toward making smarter money decisions.

Start with an organized plan

Kovacs says she’s had her holiday shopping well under way since September so it’s no surprise that she wants everyone to be as organized as she is. Shopping early automatically takes away the need-to-buy stress that can accompany last-minute scrambles, she says, and makes the purchases she does make far more considered. Early-bird shopping also allows her to track specific sales in the months leading up to the holidays, so she can get the best deals.

But one thing Kovacs stresses is that getting organized means making a realistic budget and a list of gifts before heading to the malls or shopping online. Sticking to your budget may be easier when you have a frame of reference of what is an appropriate amount to spend on each sibling, aunt or cousin.

Make this holiday season about experiences

Despite trying to be a smart shopper, Kovacs says people can take a cue from the experience of celebrating through the COVID-19 pandemic and consider what is truly meaningful to them at holiday time: spending time with our loved ones. The result, she says, could be an effort to devote more energy into being together and bringing your family closer.

“It’s the memories that matter. It’s not all of the material things that we have. So how can we proactively encourage bonding and connecting and creating memories that outweigh what money can buy?” says Kovacs. Practically, that could mean more active events together — skating and hot chocolate, delivering donations to a charity — rather than the ritual of opening presents.

Kovacs says by now, many people may have significant savings because the pandemic has limited their discretionary spending for almost two years. But this holiday season may also bring an opportunity for families to celebrate together for the first time since becoming vaccinated. That combination, she says, may give an extra impetus to overspend.

“Changing a lifetime of habits is difficult,” Kovacs says. “If you need help, talking to a financial advisor like me can help organize your funds, set a budget and give you a financial framework so that you’ll be able to reach next year’s financial goals easier.”

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN