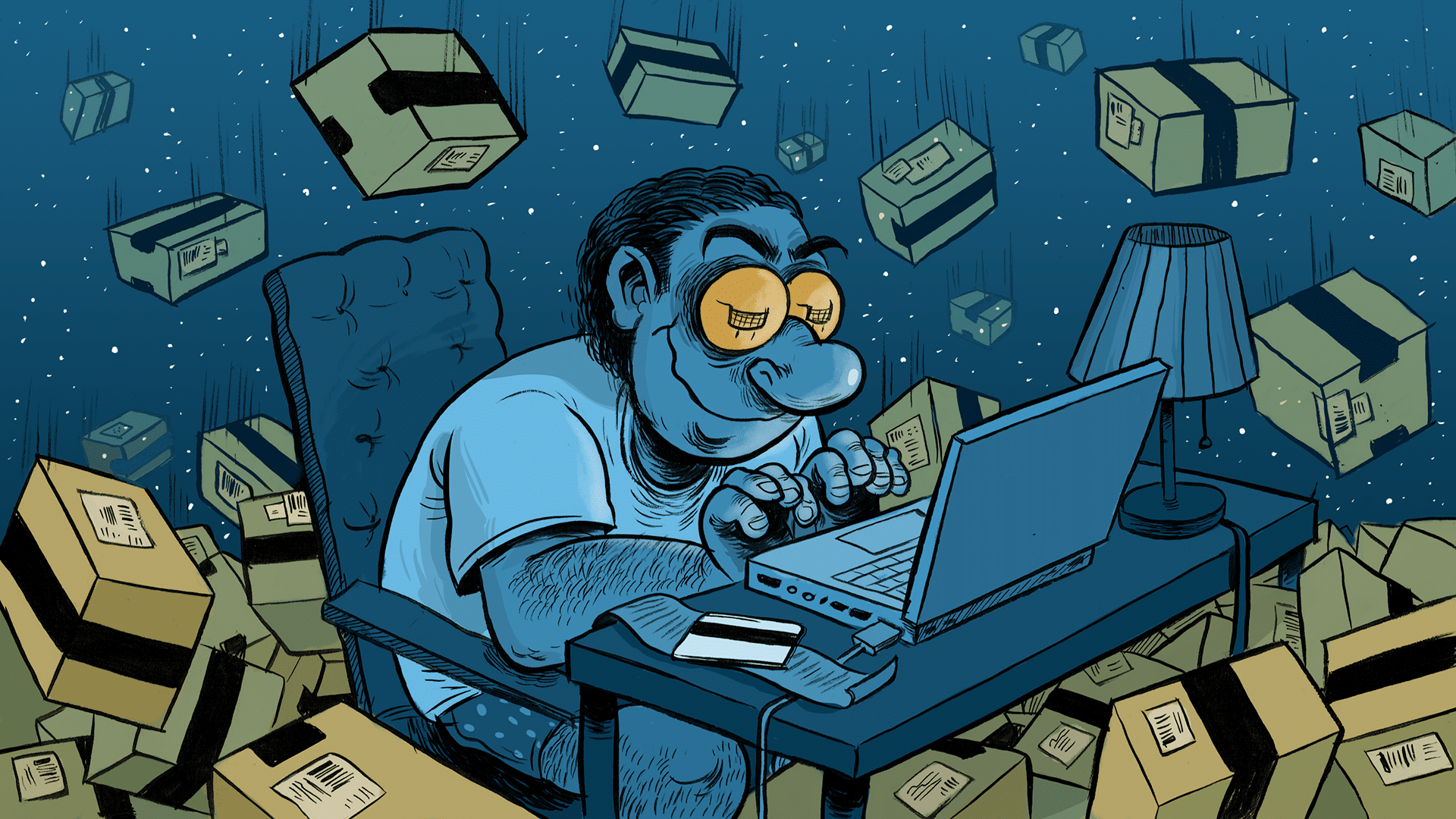

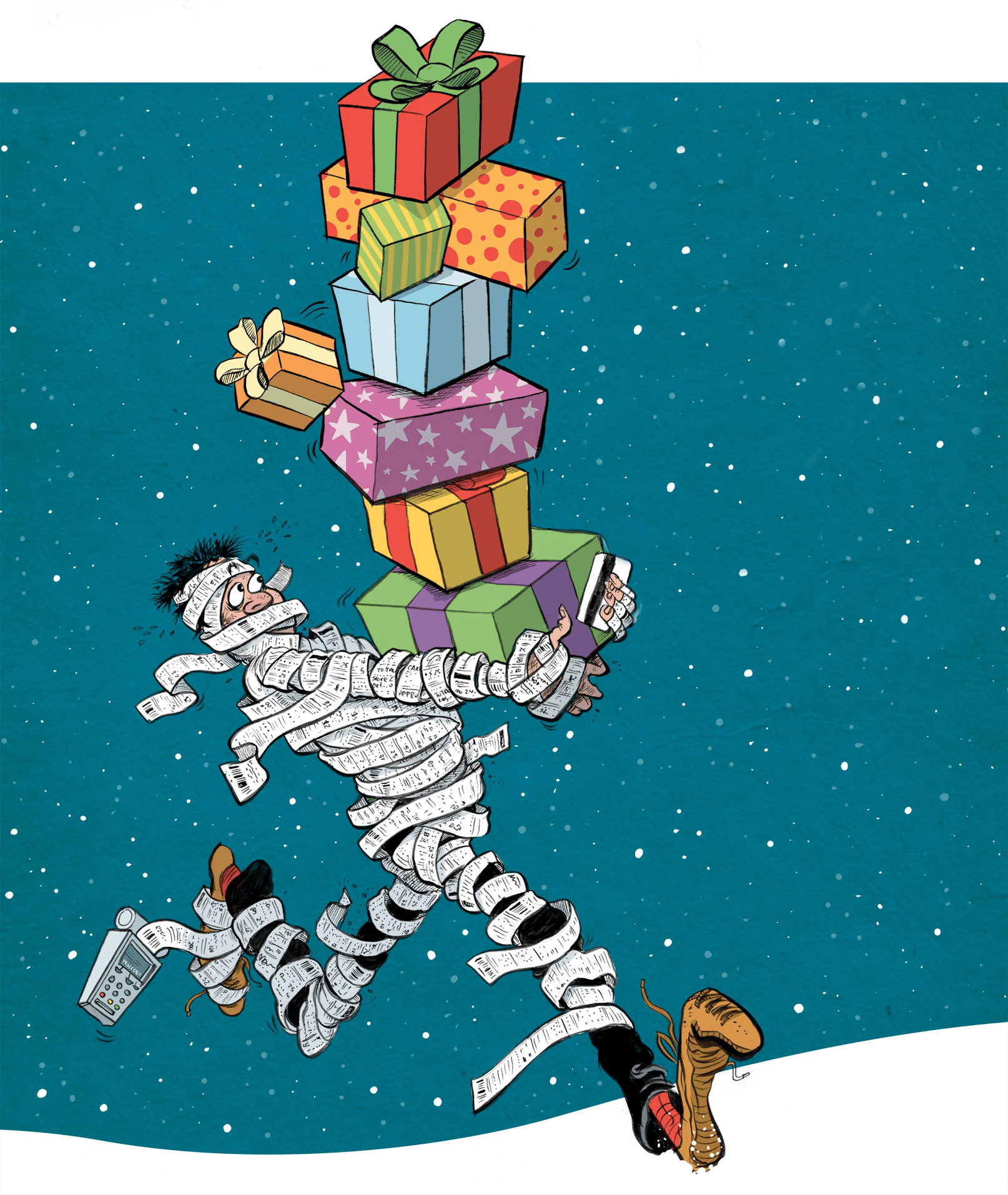

Return of the overspender

The holidays are a time for family and joy, but they’re also a time when many Canadians tend to rack up credit card bills. This year, high inflation and a possible recession threaten to squeeze our wallets. Here are some tips to help you enjoy the holidays without blowing the budget.

Louise* has a philosophy when it comes to buying gifts for her family. She likes to overwhelm loved ones with gifts, food and excitement. Her holiday gift strategy is always the same: a book, some clothes and something special. It was like that when she was a kid, and she’s tried to keep the tradition alive over the years with her own family. Unfortunately, she always gets carried away when she hits the shops and spends more than she budgeted for.

With high inflation and talk of an impending recession dominating news headlines, Louise is worried she may no longer be able to maintain her usual giving ways. Things seem to be getting more expensive each year and this year, Louise wonders if her dollars might be better off in a rainy-day fund.

Many Canadians may relate to Louise. Come the holidays, we often feel compelled to overspend regardless of how expensive gifts have become or how the economy could affect our finances in the new year.

“We often lose sight of the bigger picture when gift-giving season is upon us,” says Anthony Damtsis, Manager, Behavioural Finance with TD Wealth. “So it’s easy to lose track of how much we’re actually spending relative to our overall financial situation.”

If you’re hoping to avoid overspending this holiday season, does that mean you have to make like Scrooge and pack up the holiday decorations? Not quite. Damtsis says if we understand the reasons behind our overspending a little better, we may be able to cut back and save our wallets in the process. We spoke with Damtsis about some of the ways we can become more enlightened spenders this holiday season. Here’s what he shared.

Where does the compulsion to overspend come from?

Getting to the bottom of a problem is often the first step to recovery. Why do we feel the need to overspend? For some, busy lifestyles may make us feel guilty about our perceived shortcomings as parents, children or friends. To make up for those shortcomings, we overspend on gifts at the end of the year. For others, gift-giving can be a means to manage conflict within a romantic relationship. We reason with ourselves: Isn’t an extravagant gift the perfect apology?

For many more, however, neither of these reasons rings true. Instead, we simply fall victim to what Damtsis calls our “mental accounting bias” during the holiday season. That’s our inability to grasp just how much we’re spending until it’s too late. “We may only want to spend $100 on each of our close family members and friends, for example,” says Damtsis, “but if you have 20 people to shop for, suddenly you’re spending $2,000 on gifts. Practically speaking, that $2,000 could equal one month’s mortgage payment, but we lose the bigger picture because of how we feel about these purchases.”

Can we learn to cut back?

While many would be quick to dismiss our tendency to overspend as a lack of self-control, Damtsis says it may not be that simple: “I don’t think it’s really fair to call it a lack of self-discipline. Rather, competing demands often make it difficult for us to focus on what our long-term goals are.” Assuming the desire to give a great gift is one of these competing demands, he says it can help to find innovative ways to combat our mental accounting bias and buy presents without overspending.

When it comes to saving, that might mean using your imagination to come up with gifts that don’t come with such a hefty price tag. For example, instead of buying your partner an expensive piece of jewelry, you could plan a special night at home where you prepare a three-course meal. Alternatively, if you have young grandchildren, you could offer to give your overwhelmed adult children a night away from the kids. Couples who are saving up for a vacation or a long-term goal like retirement may even decide to forego gifts entirely this year. Ultimately, it’s important to remember that the holidays are about showing the people in your life how much they mean to you, and that doesn’t have to cost a lot of money.

When it comes to spending — because, realistically, most of us are going to spend at least a little money — there are other ways to set yourself up for success. “Some people, for example, may choose to use cash to purchase gifts instead of a credit card,” says Damtsis. “There’s research that shows using cash to pay for things activates the areas of the brain associated with physical pain. Of course, this “pain” doesn’t prevent us from paying for things entirely, but it may create enough “friction” to make an impact on our tendency to overspend.”1 Another option is to put aside regular savings, or something like rewards points in an account throughout the year to allot for the holidays. That way the above average expense incurred later in the year won’t cut into your monthly budget.

Speaking of budgets…

To avoid the unpleasant arrival of a massive credit card bill, one of the most effective ways to curb spending is to build a budget. Not only can a budget help you get more organized financially, but it can also help you understand how much you can reasonably afford this holiday season. A budget should be part of a wider financial strategy that tracks how much money is coming in, how much is allotted to regular bills, what goes to savings and what can be directed towards holiday gifts. Don’t forget to cover all of your holiday costs, including decorations, entertaining, last-minute gift exchanges, impromptu holiday dinners and any charitable donations you’d like to make.

Financially, things may be a little harder this year than they have in the past. The markets are volatile, interest rates are still rising, and inflation has proven stubbornly high. In response to these troubling economic events, it may be normal for families to feel a little overwhelmed at the prospect of yet another lavish holiday season. To get into the spirit of cutting back, remember the many reasons why we celebrate this time of year, the importance of the holiday season and appreciate the time we have with loved ones. It doesn’t have to be any more expensive than that.

If you have any questions about your finances and how to manage your spending during the upcoming holiday season, speak to a financial planner or advisor.

*Louise is a fictional blend of different people and attitudes on gift-giving.

TAMARA YOUNG and DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN

- “Study: Paying Cash is Painful, And Makes You Value Your Purchase More,” Forbes, July 28, 2016, accessed Nov. 14, 2022, www.forbes.com/sites/elizabethharris/2016/07/28/study-paying-cash-hurts-and-makes-you-value-your-purchase-more/?sh=75617be68285. ↩