What the RRIF!? 10 common questions you may have

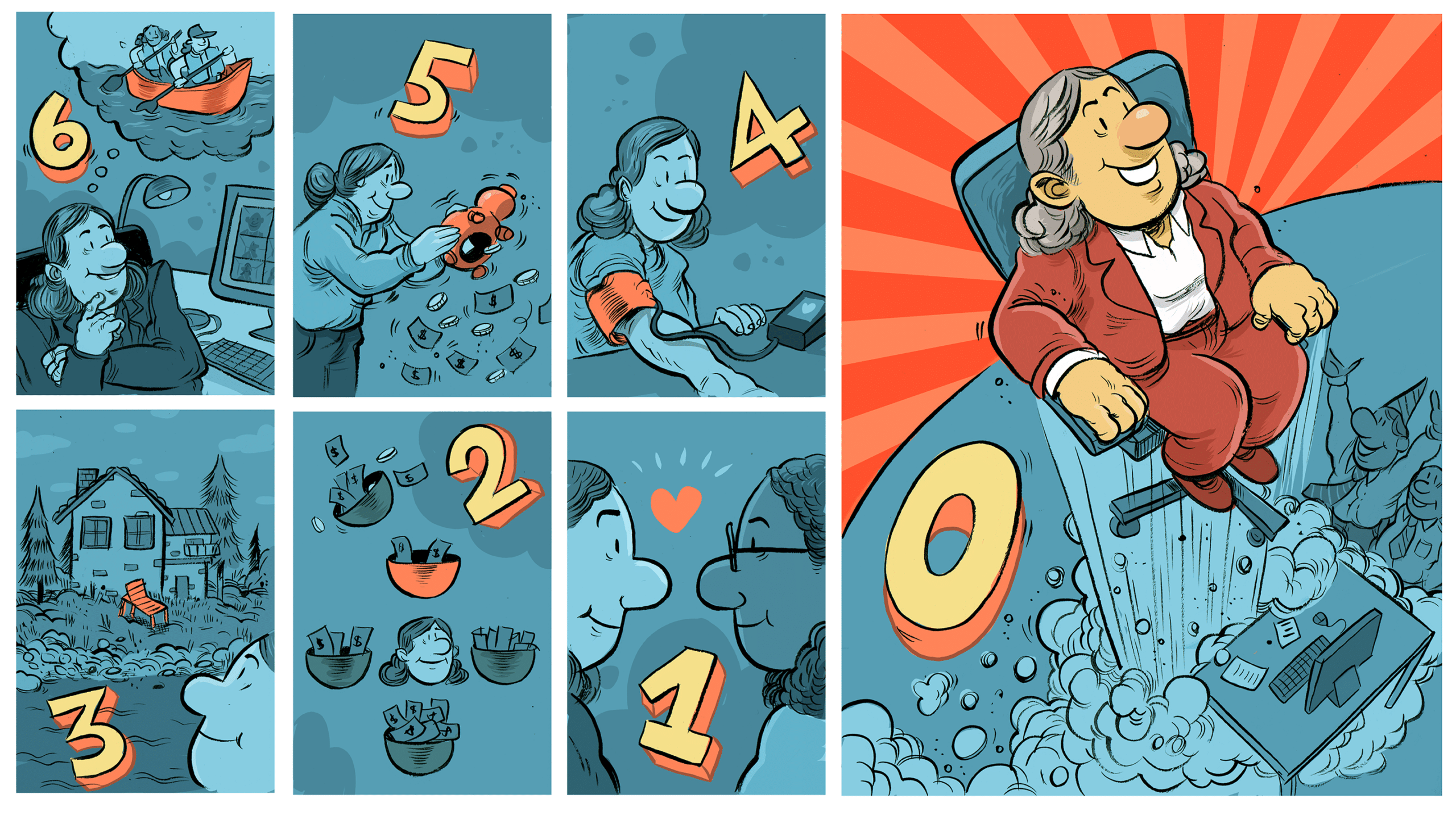

Many people know at least a little about RRSPs. But what about RRIFs? If you’re in or nearing retirement, are you ready to begin the big conversion? Here’s a quick guide to the world of RRIFs.

Sharon,* a high school history teacher now nearing retirement, has spent the better part of her career regularly contributing to her Registered Retirement Savings Plan (RRSP). She likes the tax deduction she receives each year and she’s comforted by the idea that she’ll have something beyond her pension to rely upon come retirement. As the date draws closer, however, Sharon is starting to have questions about the next step: the Registered Retirement Income Fund (RRIF). For example, she wonders how far in advance she needs to start planning out her RRSP conversion.

If you’re in or nearing retirement, you’ve likely heard of RRIFs before. You may even be aware that you must take out the full amount of your funds as a lump sum or convert your RRSPs to either a RRIF or an annuity by December 31 of the year you turn 71, with many of us choosing a RRIF. But what else should you and Canadians like Sharon know? We sat down with Nicole Ewing, Director Tax and Estate Planning, TD Wealth, to answer some of the most common questions people have about RRIFs.

Here’s our quick guide on everything RRIFs.

The Basics

What is a RRIF anyway?

As part of your financial plan, you may view a RRIF as a continuation of your RRSP and its purpose as paying a retirement income. Typically, once you’ve retired and are no longer earning a regular income, you’ll need to begin withdrawing the savings you have been accumulating all these years. Whether it is at age 71 or earlier, you may convert your RRSPs into RRIFs. Your annual withdrawal from your RRIF will provide a stream of income in retirement. Both RRSPs and RRIFs are tax-sheltered accounts (meaning you’ll only pay tax upon withdrawal), but a RRIF is an investment vehicle used to withdraw a portion of your funds annually while allowing the remainder to accumulate on a tax-deferred basis. Like an RRSP, your RRIF may hold both investments (e.g., stocks, bonds, GICs) and cash.

When do I need to convert my RRSP?

You can convert an RRSP to a RRIF at any time, but you must have converted all of your RRSPs into either cash, a RRIF or an annuity on or before December 31 in the year you turn 71. At the stroke of midnight on January 1, you will no longer be able to hold RRSPs or contribute funds, though you will be able to build contribution room. If you fail to convert your RRSPs in time, the Canada Revenue Agency (CRA) will treat your entire RRSP holdings as income for that year. That means that, depending on the amount of money you have in your RRSPs, you could be facing a large tax bill.

There’s a small caveat here: If your spouse is not yet 71 and you’re still generating income, you may contribute to your spouse’s RRSPs — assuming you still have contribution room available. Not only can this lower the tax you’ll pay as a couple, but you’ll also benefit from the initial tax deduction. To learn more about RRSPs, read RRSPs: Searching beyond the basics to help save money.

What are the withdrawal limits?

Each year, the government mandates that you withdraw a minimum amount from your RRIF as retirement income. This must begin the year after you set up your RRIF. If you’re 65, the minimum withdrawal is 4% of the account’s value on December 31 of the year prior. At 71, your withdrawal rate is 5.28%. From there, the percentage grows every year to a maximum of 20% for anyone 95 years and older.

There is no annual maximum withdrawal amount, but an additional withholding tax will be levied if you exceed the minimum. Essentially, the financial institution holding your RRIF levies a withholding tax to submit to the CRA on your behalf. “The withholding tax isn’t a penalty,” says Ewing. “You’re not actually paying more. It’s just there to ensure you have enough money set aside to pay for the extra funds withdrawn come tax time.”

If you withdraw just the minimum, no withholding tax will be levied, however, you will still be responsible for paying regular tax on this “retirement income” come tax season.

RRIFs during retirement

How does a RRIF impact my taxes?

Like RRSP withdrawals, the amount you withdraw from your RRIF will be subject to income tax and you’ll need to report it when you file your taxes. To help with this, you will receive a T4RIF tax form once a year from each RRIF plan holder.

Ewing notes that, in addition to contributing to your income, RRIF withdrawals may also impact specific government benefits you may receive. For example, if your income in retirement qualifies you for the Federal GST/HST credit, you’ll want to consider the impact of a larger RRIF withdrawal on your eligibility. “There’s a certain income limit for these types of programs, and once you exceed it, you may be denied the benefit,” she says. While the GST/HST income limit changes every year, it’s approximately $50,000 – $70,000, depending on your marital status and how many eligible dependents you have.

How does a RRIF impact my OAS/CPP?

Because your RRIF withdrawals affect your total income for tax purposes, your Old Age Security (OAS) benefit may also be impacted. If, for example, your annual RRIF withdrawal boosts your income to such a degree that you exceed the maximum income amount set for OAS, you may not receive the full OAS amount — termed a claw back. For that reason, Ewing says, “You may want to consider the timing of your RRIF withdrawals within this context. You’ll want to do the math.”

Your Canadian Pension Plan (CPP) or Quebec Pension Plan (QPP), on the other hand, is not affected by RRIF withdrawals. Nonetheless, it may be beneficial for those who are able to afford delaying CPP/QPP to do so until they turn 70. Canadians who begin receiving their CPP/QPP benefits at a later age can receive more money than those who start at 65, although there are many ideas to consider. To learn more about CPP/QPP and OAS benefits, read: The new rules of retirement: How our longevity is changing the game.

What happens to my RRIF when I die?

If you name a qualifying survivor as beneficiary before you pass away, your RRIF will not be included as part of your estate and may not be subject to probate fees. Eligible beneficiaries include a spouse or common law partner, a financially dependent child or grandchild under the age of 18 and a financially dependent disabled child or grandchild.

If your qualifying survivor is your spouse or common law partner, you can alternatively choose to name them a “successor annuitant.”

“A successor annuitant means that your spouse can essentially step into your role and take over your RRIF account,” Ewing says. “This is pretty common and often the way to go.”

If you have not named an eligible beneficiary, your RRIF will be treated like any other asset. It’ll become part of your larger estate and taxed as income on your final tax return. It’s important to note here that the beneficiaries you’ve set for your RRSPs will not automatically transfer to your RRIF.

Beyond the basics

Can I coordinate with my spouse?

If your spouse is younger than you, your age gap may come in handy when it comes time to withdraw from your RRIF. That’s because Canada’s tax regulations allow for a lower withdrawal rate based on your spouse’s age instead of your own.

If one partner has a lower income, Ewing says that pension splitting may be another way to coordinate with your spouse. “Pension splitting allows the higher-income spouse to reduce the income taxed in their hands and instead have it taxed in their partner’s hands at his or her lower marginal tax rate,” she says.

Can I invest my RRIF withdrawals?

You are required to take the mandatory minimum withdrawal amount, but if you don’t need the money to pay for current expenses, consider reinvesting the amounts rather than staying in cash. “An ideal option may be to transfer your mandatory withdrawal to your Tax-Free Savings Account (TFSA) where investments can enjoy tax-sheltered growth,” Ewing says. “You can transfer assets from your RRIF to your TFSA “in kind” and simply include the withdrawn amount as income on your tax filings.”

What if I don’t need the funds when I withdraw?

There are several options if you don’t need the funds. As mentioned, you may want to keep your RRIF investments in their invested form after withdrawal. However, Ewing suggests Canadians also consider their legacy: “Gifting to the next generation as part of your overall wealth transfer strategy is one option. Or you may want to consider using the funds for a charitable donation.” If you’re taking out more than you need, donating funds to charity can help offset the tax you otherwise would have owed on the initial RRIF withdrawal.

How should I manage my funds before I withdraw them?

There are many options for funds kept within a RRIF, just like there are many options for funds kept within an RRSP. First and foremost, however, Ewing suggests Canadians remember that RRIF accounts are retirement accounts and that may mean adjusting your risk tolerance. “Capital preservation is very important for retirement savings,” she says.

Ultimately, Ewing says that the earlier people start thinking about their RRIF strategy, the better: “Canadians should really start thinking about RRIFs well before retirement. Usually around the same time they start thinking about OAS and CPP,” she says.

If you have questions about how to manage your own RRIF strategy, it can help to speak to a wealth advisor or financial planner.

*Sharon is a fictionalized character.

TAMARA YOUNG

MONEYTALK

ILLUSTRATION

DANESH MOHIUDDIN