The new rules of retirement: How our longevity is changing the game

More years to live means more ideas on retirement choices, investing and when to take your Canada Pension Plan.

Ideas about health don’t often age well. Weight loss sauna suits seem ridiculous these days and predictions about eating a meal from a single pill are still science fiction.

But what has aged well is, well, us. Thanks to better medicine, improved diets and a variety of other factors, many predictions about better health and longevity have come true. From 1921 to 2011, the average Canadian’s life expectancy has increased from 57.1 years to 81.7, a gain of almost 25 years — that’s an additional third of a lifetime we’ve been given.1

According to Statistics Canada, if you are 50 years old today, you are likely to see the year 2053 — with additional bonus years if you don’t smoke or are female.2 If you are one of the lucky ones who will reach your 90th birthday, statistics say you’ll likely hit 95.3 Moreover, as we age, we will have more energy — perhaps to chase great-grandkids — than previous generations.4

Increasing longevity also means new ideas about how those additional years of life impact your finances. For instance, working past retirement age may no longer seem unusual. Given our new lease on life, is it still correct to keep retirement savings in low-risk investments? Should we take Canada Pension Plan (CPP) earlier…or later? And won’t we run out of money if we’re living longer?

What we have to grapple with is whether our ideas about money and retirement are, like the weight loss suit, outmoded. If we’re going to be around at 93, we hope our money will be there too.

Varun Bhagwat, a Financial Planner with TD Wealth Financial Planning, in Mississauga, says the topic of longevity floats above nearly every conversation he has with clients. In fact, he has recently shifted his life expectancy calculations from a maximum of age 90 to 95 to reflect longevity trends. But the fact of a longer and healthier life has caught many of Bhagwat’s clients off guard. A majority of his clients are immigrants, and, perhaps due to lower life expectancies back home, he says they can’t see themselves living past their 80s. Paying for extra years of retirement is a complicating factor for their financial goals — goals that already seem at odds with each other: How to save for a comfortable retirement while also giving their kids a significant leg up in an increasingly expensive economy?

“I see this as a conflict for people in their 40s and 50s. Should they save more for their future or spend more? They have a strong desire to do both. Let’s be honest, these are conflicting choices. Striking a balance between them may not be that difficult if you have the proper strategies,” Bhagwat says.

Proper strategies can address how greater longevity can impact your finances, says Bhagwat and he mentions three ways living longer has changed the way we think about retirement planning.

Planning doesn’t stop at retirement

It is a knotty conundrum for anyone planning for the future if you don’t want to run out of savings: With a finite amount of savings, living longer diminishes the amount of money you can spend per year.

But Bhagwat says this equation is misleading because it presupposes that we can see far into the future and make a single planning decision based on what might be. The reality is, proper retirement planning entails a series of decisions and adjustments around your goals as life continues and events occur.

He says a good retirement plan will target short-, medium- and long-term goals after you receive your last paycheque. At age 65, your short-term goal could be a long-delayed vacation. A medium-term goal at age 75 may be to downsize your home, help out children and cut back on activities as you slow down. A longer-term goal may be to keep savings growing but also safe when you hit age 85.

Needless to say, if you are hale and hearty and financially secure at 85, you’ll be glad you still have savings for the next decade of your life. Bhagwat says setting goals is one part of the agenda but as life events occur — changes in health or sudden expenses — alterations can be made. Using this type of active planning means individuals, no matter their health or age, can strategize and adjust for what lies ahead.

“Monitoring and assessing your situation is key,” says Bhagwat. “You want to check the progress of the plan you have implemented and that’s something you can do with a Financial Planner like me. It’s essential to assess your plan every six months including when a significant life event occurs and if there’s a shortfall or if you are not on track, your financial planner can help to get you back on track.”

Retirement investing isn’t limited to fixed income

Once retirement nears, the traditional wisdom is to keep your savings safe now and for the future. Even if you have been successful in the stock market, risking money you can’t make back can seriously harm your retirement. Inflation, however, challenges that approach.

If you keep your savings secure in cash or in Guaranteed Investment Certificates (GICs), even an average rate of inflation may diminish your savings substantially over a long period — and the longer you live, the greater that bite will be. Bhagwat says there’s actually a further complication: When interest rates are low (our economy has recently left a long period of historically low rates), income-only investment returns may not be enough to sustain every retirement portfolio.

With these conflicting ideas in mind, anyone on the cusp of retirement may face an investment dilemma: Safe investments or growth investments? Or some kind of combination?

The first part of the solution, says Bhagwat, is to work with professionals on this problem. He offers his clients strategic portfolios that are geared to those in their retirement years. Typically, these portfolios would include stocks and bonds but also other sophisticated investments, which aim to generate moderate returns and long-term growth while reducing portfolio volatility. Bhagwat says that when the economy has sudden shifts, portfolios are adjusted to help optimize returns and minimize risk.

“(The portfolios) are very dynamic. They help clients get growth but also protect on the downside,” he says.

Tying it back to retirement, Bhagwat says that if a client needs a certain cash flow amount until age 95, the investment portfolio has to be built with that in mind.

With this calculation, Bhagwat helps clients understand why a holistic retirement plan is more important than simply focusing on a rate of return.

When to take CPP…depends on you

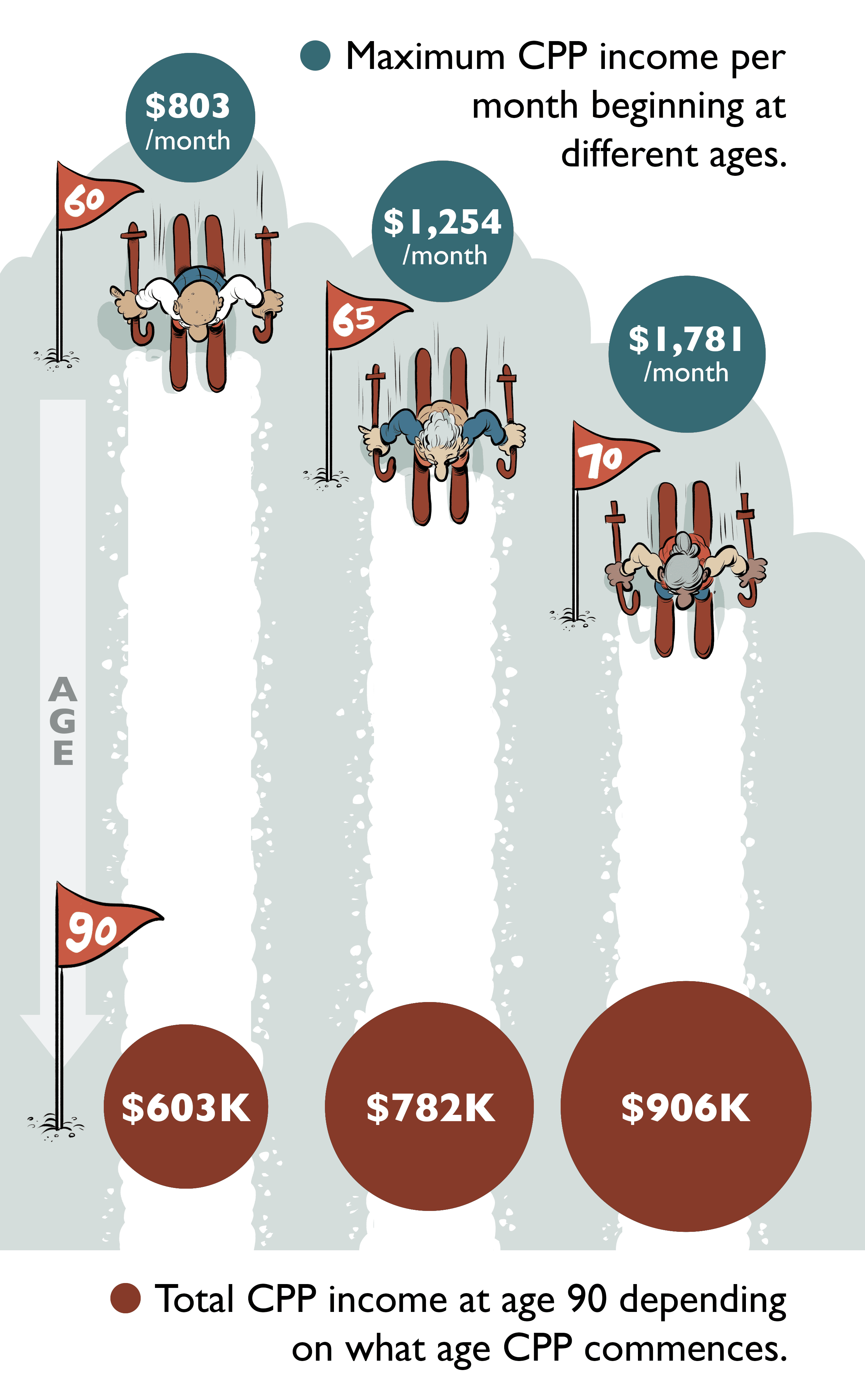

The actual payout for Canada Pension Plan (CPP) depends on how much you have contributed over the years. The standard age to start the pension is 65, but the earliest you can begin receiving CPP is age 60 while the latest you can delay it is age 70. If you take it at the minimum age of 60, your payments are reduced (by 0.6% per month to a maximum of 36%). If you wait until age 70, your payments increase (by 0.7% per month to a maximum of 42%).

What happens when you delay CPP?

If you don’t need the money immediately, waiting just a few years to begin collecting your Canada Pension Plan can mean a higher monthly payment. It can also significantly impact how much you will have collected by the time you turn 90.

Figures represent the maximum allowed CPP income and do not reflect the average benefit received. If CPP is taken at age 60, total income is reduced by 36%. If CPP is take at age 70, total income increases by 42%. For illustrative purposes, CPP is indexed by 2.0%: the actual rate is adjusted annually.5 Figures are rounded. Source: Canada.ca

The longevity gamble is that if you wait to receive maximum payments, the years you have remaining may reduce the total amount you collect: You simply may not live long enough to receive those CPP cheques. Bhagwat says there’s a calculationthat may be helpful: At about age 74, there is no difference between the total amount of funds paid out, whether you began at 60 or 65. Therefore, as long as you live past 74, delaying CPP until 65 makes financial sense.

When deciding to delay taking CPP, you’ll need to make up that income through higher withdrawals from your investment assets — although some people will continue to work into their 60s and beyond and have employment income to draw on. There is an opportunity cost because higher investment withdrawals in early years mean lower investment returns in the future. This is another thing to consider when deciding when to take CPP.

Calculations are nice, however Bhagwat says many people just prefer receiving money right away.

“People say, ‘I want my CPP at age 60 — I don’t care if I’m getting less.’ The perception is that they’ve worked hard all their lives and paid taxes and now they want their money,” he says.

Bhagwat says that no single rule can cover every situation but everyone should at least think about three considerations: The need for funds, your overall health and external factors like tax consequences.

If someone needs CPP to pay bills, taking the funds as soon as possible may be beneficial. And naturally, if a client has health issues, Bhagwat generally recommends taking CPP and Old Age Security as soon as possible. If one’s health is good and there is no immediate need for the money, it may be beneficial to delay and receive a larger payout: If you are fortunate to live past 90, these enhanced payouts may provide additional financial security.

But he says that this decision can’t be made in isolation of other factors. In some cases, withdrawing aggressively from an RRSP first and then taking CPP/OAS as late as possible may make sense if you have a larger estate planning strategy in mind.

Bhagwat emphasizes that no single money decision can be made in isolation of larger plans. A longer life may be a financial complication but it’s also a blessing and he endeavours to help his clients get the most out of it.

“If you clearly understand what you want to do in both the short and long term, making those spending choices can be easier and you’re less likely to regret them.”

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN

- Ninety years of change in life expectancy, Statistics Canada, Nov. 27, 2015, accessed May 17, 2022, www150.statcan.gc.ca/n1/pub/82-624-x/2014001/article/14009-eng.htm. ↩

- Life expectancy at various ages, by population group and sex, Canada, Statistics Canada, Dec. 17, 2015, accessed May 17, 2022, www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1310013401 ↩

- Ibid ↩

- In the midst of high job vacancies and historically low unemployment, Canada faces record retirements from an aging labour force: number of seniors aged 65 and older grows six times faster than children 0-14, Statistics Canada, April 27, 2022, accessed May 17, 2022, www150.statcan.gc.ca/n1/daily-quotidien/220427/dq220427a-eng.htm?HPA=1 ↩

- Canada Pension Plan Amounts and the Consumer Price Index, Government of Canada, Dec. 30, 2021, accessed May 18, 2022, www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/cpp-price.html ↩

![Bounce Back From The Retirement Blues- TD MoneyTalk Life Stories [Feat]](https://www.moneytalkgo.com/wp-content/uploads/2016/06/Bounce-Back-From-The-Retirement-Blues-TD-MoneyTalk-Life-Stories-Feat.jpg)