Countdown to retirement: 6 questions you can ask yourself

Only have hazy ideas about how you plan to retire? Your retirement dreams may require a little more thought. Here are some concrete ways to help paint a clear picture of your retirement, whether you are on the verge of hanging it up or still a few years away.

If Nicole Ewing, Director, Tax and Estate Planning, TD Wealth could pass only one message on to people facing retirement on the horizon, it’s “be prepared, but stay flexible.”

Ewing says the world continues to change rapidly and the best way to prepare for retirement is to be ready to adapt and make adjustments to your retirement plans as events unfold. Everything from interest rates to travel costs are evolving, Ewing says. If your ideas about retirement aren’t in synch with today’s economic conditions, your plans may have to be re-evaluated to help reach your retirement goals.

“The COVID-19 pandemic has shown us that anything can happen to disrupt our plans and finances. Everyone should heed that experience and not lock into one idea or expectation about what their retirement needs to be,” she says.

People should not assume they’ll have the same investment returns they’ve enjoyed for the past decade, for example. Or that their kids will move out of the family home when they finish school. Or that a two-bedroom condo will still have the same price tag it did from 2002.

Ewing says that some of these changes may put a dint in our golden dreams of life after work. But checking in with a financial planner or advisor can bring a sense of what can be possible under the present economic conditions as well as how your retirement lifestyle might change as circumstances develop.

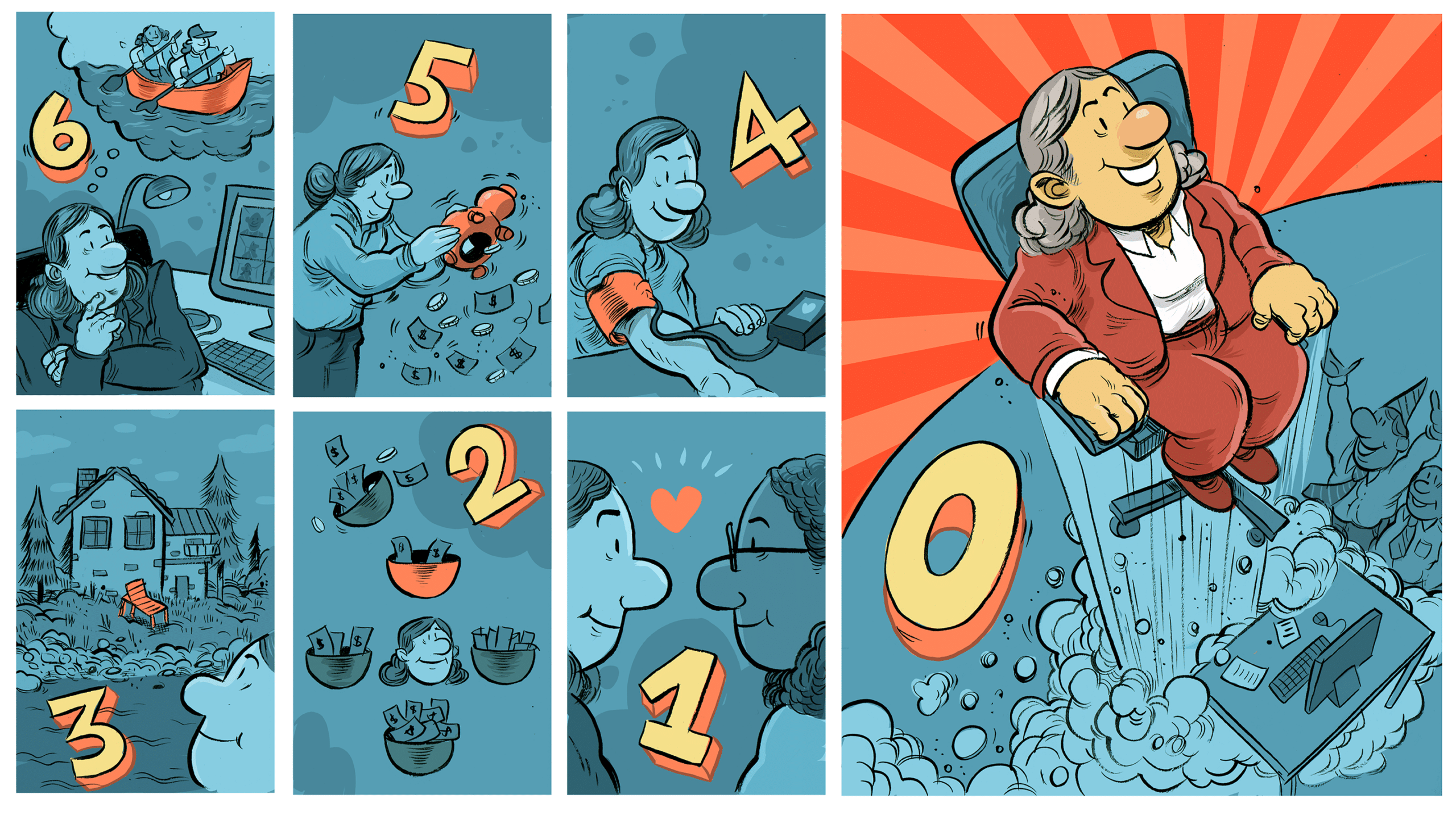

Whether you are retiring next year or the milestone is still a few years away, Ewing wants everyone to ask the following questions of themselves to sharpen their focus on making smart financial decisions.

What do I want to do when I’m retired?

To help ensure you’re well prepared for retirement, you should take the time to build retirement goals that are tangible and specific, says Ewing. By planning out what you want to do year by year and then working that into a larger financial plan, a clear path forward can be built. It’s the difference between just thinking about your “bucket list” and actually checking items off it.

For example, Ewing says that before the pandemic, buying vacation properties in the U.S. was a popular goal for retirees. Today, staying in Canada and retaining healthcare access is a priority for some Snowbirds. With that in mind, plus the rising costs of property ownership, many people are wondering what the Snowbird life might look like in the future — perhaps renting a property for a few years vs. buying is more attractive in the current climate. However someone choses to spend retirement, Ewing says making a plan that costs out the expenses can help determine what kind of lifestyle works best.

Have I saved enough?

The realization that employment income may suddenly cease when we retire can pique anyone’s interest in some basic questions: How much will retirement cost? What kind of lifestyle can I afford? Have I saved enough?

Ewing says that getting your financial house in order may help you find clear answers to those questions. For starters, that may mean paying off debts or consolidating them in a more economical manner, obtaining a line of credit (while you still have an income and can qualify) and building up an emergency fund.

Ewing says drawing up a financial plan can help reconcile your cash flow with your retirement lifestyle. That means determining what percentage of your savings you’ll need to draw down for expenses annually, how much your savings will grow (or need to grow) and how other considerations like taxes, downsizing your home or plans for your estate need to be worked into your retirement plan.

Another idea Ewing likes to pass on is to put limits on when to help out others in your family. Adult children may lean on their parents in retirement — particularly if they or the grandkids need help getting into an expensive housing market. But people have to learn to say, “no,” Ewing says. She adds that parents should have a firm grasp on how much they can gift or lend their kids before they actually do it. After all, retirees have to think 25 years down the road to their very senior years when funds may be needed for healthcare to make their own lives comfortable.

How healthy will I be?

Ewing says people should be proactive about their health and personal care plans and not ignore the fact that we’ll all slow down and need healthcare at some point in our lives. Statistics show that we are living longer than ever and we’ll generally be healthier in our senior years than previous generations.1 But data also suggests that rates of dementia and Alzheimer’s Disease are rising as life expectancy grows.2 Preparation can mean ensuring we have proper benefits packages or other financial options that could take care of medicine, home nursing or therapies in Canada, or coverage if you plan to travel in other jurisdictions. If there are people relying on you financially, you’ll also want to have additional plans in place in case you get sick.

Ewing says how healthy and active we will be in retirement will impact how much money we spend. At the beginning of retirement, you may be vigorous enough to complete lifetime goals like travel. Later you may slow down, eventually settling into a more sedentary lifestyle. In a scenario like this, your retirement spending may be front-loaded as you spend more when you are active and then gradually decrease expenditures. However, she says there’s evidence that shows an outflow of funds that spikes in the last years of our lives due to healthcare costs.3 Ewing says knowing those stats can allow us to get organized.

Where will I live?

Of all the areas where Ewing asks people to be flexible it is housing, because of the high price of real estate and the general economic uncertainty in the air. It used to be normal for retirees to give up their large family homes for smaller accommodations, perhaps in addition to a vacation property. She says many people are now pressing pause when it comes to selling or buying for a variety of reasons. For one, even small properties can be expensive and the gains made from selling a large home and buying a small one may no longer make downsizing worthwhile for some.

Moreover, Ewing says if people are seeing large annual gains in value for the property they own, they may be incentivized to hold on to the property and enjoy the increases. If the property is too large for their current needs, however, they may have to budget for maintenance expenses like gardening or snow shovelling, or even future modifications to make their home senior-friendly.

“But a big concern for those nearing retirement is caring for their aging parents — whether they are going to do it in their own home or a care facility,” Ewing says. She also says that a combination of high housing prices and longevity among seniors means new retirees may become sandwiched between helping adult children who can’t afford to live on their own and caring for their own parents who need a place to live. In cases like that, not selling the family home may seem like a smart idea.

How will I manage taxes on my retirement income?

Many people are fortunate to have several sources of income in retirement and these can include retirement savings, a pension, the Canada Pension Plan (CPP) or the Quebec Pension Plan (QPP), Old Age Security (OAS), and perhaps other non-registered savings such as from an inheritance. Business owners at the end of their careers may continue to draw funds from their business or rely on savings from the sale of that business. Ewing says it may seem like an embarrassment of riches, but some thought should go into managing the withdrawals for these accounts from a tax perspective. For example, it may be more tax-efficient to withdraw from one type of account first, depending on your age and tax bracket. But she says no one strategy fits everyone and drawing down your savings first must be in synch with your larger estate plans and lifestyle choices. In other words, if you want to take a world cruise, small tax concerns may not need to stop you.

For CPP/QPP, if you don’t need the funds immediately and you are healthy, Ewing recommends considering putting off the benefit until you need it. That’s because, if you defer receiving the pension past age 65, the monthly income increases until you reach age 70, the age when you must begin taking your pension. (The amount of the benefit also decreases if you take it earlier than 65.) She also recommends checking what you can expect to get from CPP/QPP before you begin making plans for it. Ewing says women especially, who may have been out of the work force while raising children, may find that they may not receive the maximum amount from their plan.

Have I coordinated with my spouse or partner?

A couple may decide to retire on the same day — or they might make separate plans. A partner or spouse’s financial situation could even differ — perhaps drastically — from their partner’s if they have obligations to family through previous marriages. Ewing notes people can experience health changes at different times, which can be a catalyst for retirement. Whatever the case, two people may arrive at retirement with different mindsets, and they should start talking about it early.

“Partners or spouses who have their own careers may have very different ideas about when to retire and what retirement looks like — especially if there are age gaps. You might not have a shared vision of retirement, but you should have a shared understanding of what each other’s vision is,” says Ewing.

Coordination of retirement can mean discussing how much money will be withdrawn from whose accounts and when, and whether you will share the expenses. It also means discussing other aspects of retirement (lifestyle and plans) and ensuring each plan complements and does not interfere — with the other.

Ewing makes a point about creating a retirement plan separate from your spouse or partner’s plan if the situation warrants it. She says some couples have quite independent lives from each other and that may necessitate an independent strategy. If that’s the case, helping to ensure you are able to live the retirement lifestyle you want may mean putting your own financial plan in place to make it work.

Is my estate planning complete?

Ewing says having an estate plan and getting your Will, Powers of Attorney (POAs) (or mandate in Quebec) and other documents completed is paramount if you haven’t already done so. Even if you have, you may wish to revaluate your documents if you have not updated them for some time. “Flexibility is the theme of the day. As we age, the likelihood of illness or incapacity rises. Therefore, our ability to change these documents diminishes,” she says. Ewing notes that if people become incapacitated through dementia, they may no longer be able to change any legal documents including their Wills and POAs: That means those who are incapacitated — and their families — may be stuck with estate documents that can be decades out of date.

Updating your documents could include adding a new executor for your Will or an attorney for a POA, if your previous choices are aging out of the role. This could also be the time to include new family members in your Will or put in place additional protections for vulnerable beneficiaries.

Ewing says retirement planning is also a good time to ensure there are strategies in place that can offer protection against the financial effects of death so that heirs can benefit from the wealth transfer in a tax efficient manner.

She also reminds people to think about how a new lifestyle in retirement can call for changes in your estate plans. For instance, POAs from Canadian provinces are generally not accepted in the U.S. If you are planning on travelling for an extended period, it may be best to have a POA or the equivalent filed in that jurisdiction. The same goes for assets located in foreign jurisdictions, such as a condo in Florida: A Will dealing with the foreign assets prepared in that foreign jurisdiction may save significant costs and headaches down the road.

Ewing says everyone should build versatility throughout their retirement plan, in everything from finances to health.

“No matter what, having a flexible attitude is an important asset. Retirement is supposed to be about freedom and doing what you want to do. But how to achieve the kind of lifestyle you want in today’s changing climate should be a consideration for anyone nearing retirement,” says Ewing.

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN

- Life expectancy at various ages, by population group and sex, Statistics Canada, April 12, 2022, accessed June 10, www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1310013401 ↩

- Dementia in Canada, including Alzheimer’s disease, Statistics Canada, Sept. 21, 2017, accessed June 10, 2022, https://www.canada.ca/en/public-health/services/publications/diseases-conditions/dementia-highlights-canadian-chronic-disease-surveillance.html ↩

- Out-of-Pocket Spending in the Last Five Years of Life, Amy S. Kelley, Kathleen McGarry, Sean Fahle, Samuel M. Marshall, Qingling Du, Jonathan S. Skinner, J Gen Intern Med. 2013 Feb; 28(2): 304–309. Published online 2012 Sep 5, accessed June 10, www.ncbi.nlm.nih.gov/pmc/articles/PMC3614143/ ↩

![Bounce Back From The Retirement Blues- TD MoneyTalk Life Stories [Feat]](https://www.moneytalkgo.com/wp-content/uploads/2016/06/Bounce-Back-From-The-Retirement-Blues-TD-MoneyTalk-Life-Stories-Feat.jpg)