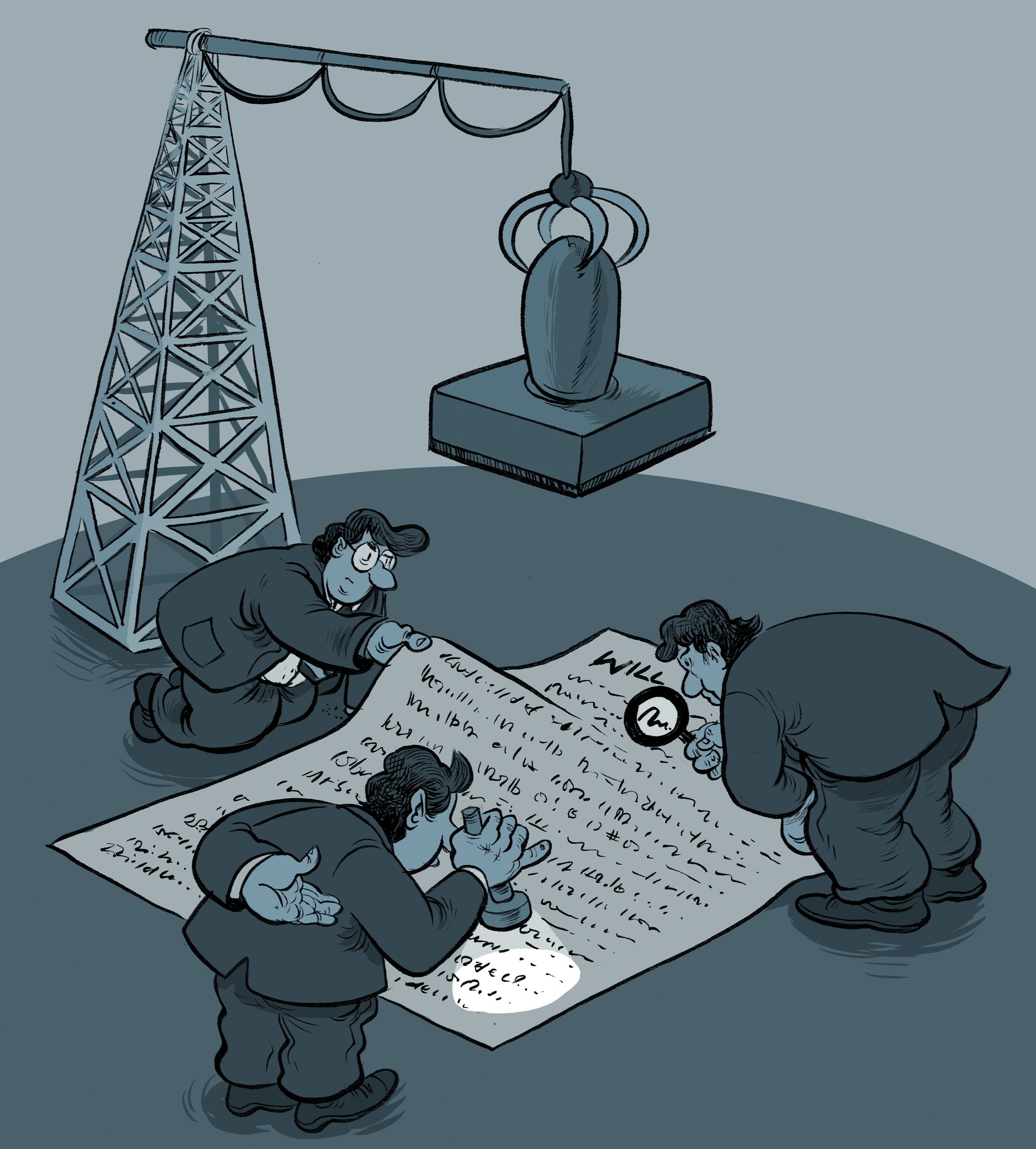

The MoneyTalk guide to probate: what it is and what you need to know

It’s a key part of managing a person’s estate but Canadians may be confused about how it works and how to mitigate the fees involved. Here’s what you need to know about probate.

Probate can be an enigma for Canadians writing their Wills. Yes, rules differ by province and what gets probated can depend on your individual circumstances. Further, probate doesn’t happen with every estate or Will. But what many of us naturally want to know is, “How can I avoid probate?”

Probate doesn’t need to be complicated. If you divide the process into what the law requires, how it affects you and the fees involved, it becomes easier to understand.

Treva Newton, a Tax and Estate Planner with TD Wealth in Victoria, B.C., says Canadians stand to gain from a greater understanding of how probate works, especially if their assets or family situations are complicated. But everyone — those writing Wills, future executors and an estate’s eventual beneficiaries — should be familiar with what probate entails.

“It’s a challenging process. Each type of asset is governed by different rules. You need to be careful how you plan,” she says.

But while all situations are different, Newton says there are some general rules and information about probate that everyone should know before they draw up a Will or embark on an estate strategy. We’ve broken the concepts down to what probate is, what the fees are and how you may be able to reduce these costs. If you have questions about probate, you may find some of the answers here.

What is probate?

The basic definition of probate is the court’s determination of whether a Will is truly the final testament of an individual, whether that Will is indeed valid, and whether the executor named in the Will has the right to manage the estate.

All executor duties and transfers of assets must follow this determination. Few things in the Will can be processed without it. But to make this clearer, let’s revisit the process in chronological order:

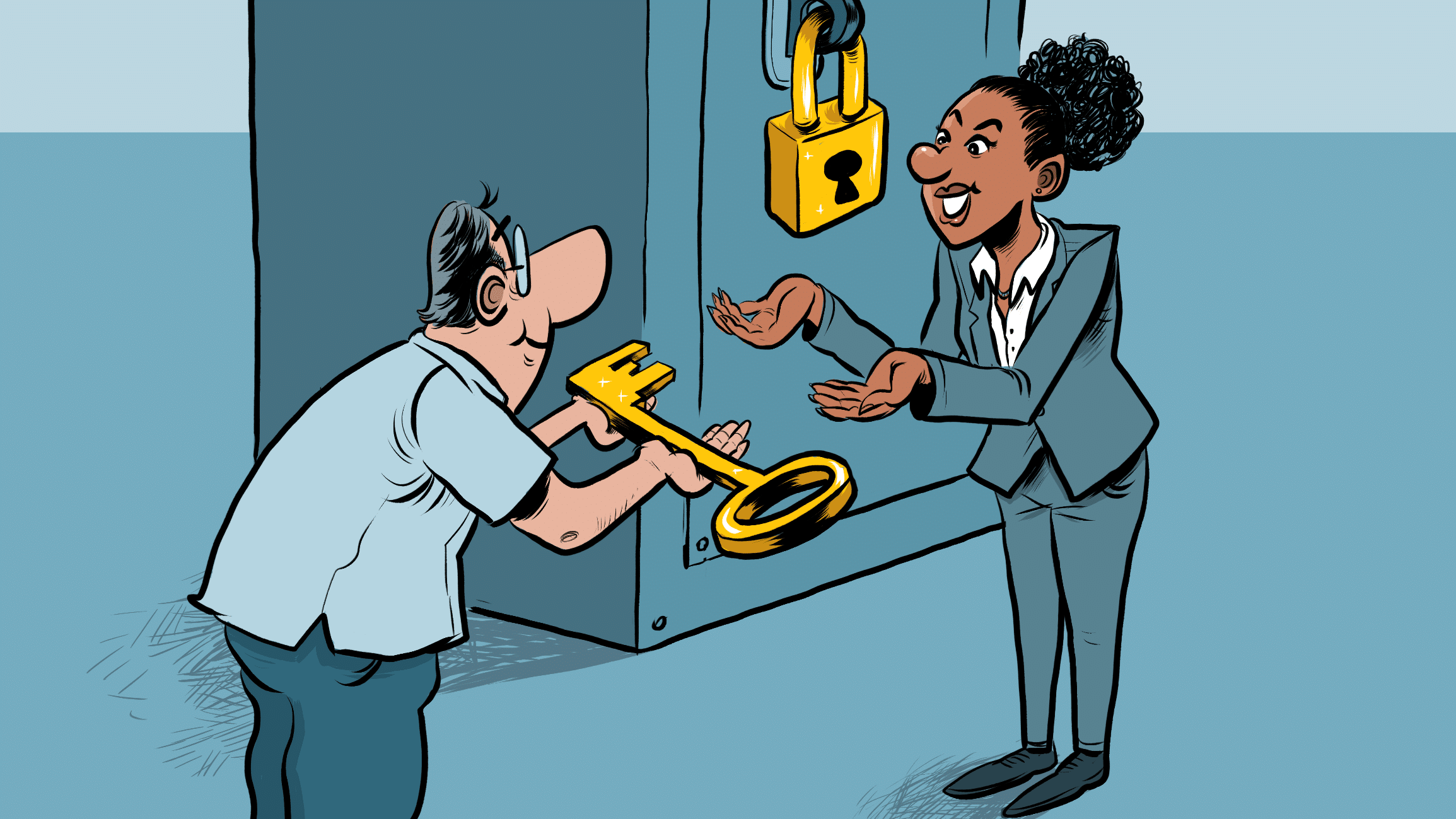

Someone passes away, a Will emerges and an executor is named in that will. However, before the executor can take control of assets in the estate, like a bank account, a financial institution must ensure that the Will is valid and the executor has a legal right to do so. The legal process of verifying the Will and the executor is what’s known as probate. A financial institution will request probate and the executor will apply to provincial court to set the probate process in motion. Once the Will is deemed valid — probated — by a provincial court, the executor can gain access and begin their duties.

Usually, banks or insurance companies are the organizations that request probate but it depends on what assets the deceased possessed.

What happens when my Will is probated?

When a Will is probated, a court will certify the executor can legally manage the estate and whatever bank accounts, property and other assets are in the deceased’s name. Before this can happen, the executor must prove to the court that the Will is the latest valid Will. Depending on the jurisdiction, this may be done through a Wills search of provincial registries. The executor must also submit a valuation of the estate. Once the Will is probated — literally stamped with a certification of probate — an executor can access bank accounts and other assets.

What are the costs for probate?

Probate could be viewed as an inconvenience if not for the charges attached. Probate taxes or fees vary greatly from province to province and each jurisdiction may use slightly different terminology. For instance, Ontario’s “estate administration tax” has the highest cost among the provinces ($14,500 on an estate of $1 million). Manitoba and Quebec, by comparison, have no fees attached to their probate process. Note, court costs for applying for probate are a separate, lesser expense.

What assets do and do not go through probate?

Which assets will go through probate can vary. Generally speaking, registered accounts such as Registered Retirement Savings Plans (RRSPs), Registered Retirement Income Funds (RRIFs) and Tax-free Savings Accounts (TFSAs) that have a named beneficiary are not considered part of the estate and won’t be probated. These accounts will go directly to beneficiaries. In some provinces, shares of private companies may also escape probate as long as they are the only asset of an estate.

Real estate always goes through probate, with the exception of when it is transferred to a surviving spouse through the right of survivorship. After these generalities, what goes through probate depends on your individual situation.

Does my estate have to go through probate?

Not necessarily says Newton. “You must have assets in your own individual name in order for the assets to go through your Will. If all of your accounts are jointly held with your partner or spouse, then you usually don’t have to go through probate because there are no individual assets actually going through your Will,” she says.

Newton says these jointly-held assets typically include bank accounts or property like the family home: When the first spouse dies, the assets “roll-over” to the surviving spouse. When the second spouse passes away and their assets are inherited by their children, for example, probate is likely required.

How long does the probate process take?

Probating a Will may take as little as a few weeks or as long as six months. The probate process is tied to separate but related estate management procedures. Essentially, if an estate must be probated, a value must be placed on the estate: This is an additional task for the executor who must employ professional assessors to estimate the value of the deceased’s assets. This may be straightforward or more complicated depending on how extensive and diverse the deceased assets may be. Once the estate has been valued, the probate fees or taxes can be paid and the executor can proceed with other estate duties.

How can I avoid probate?

There are several ways an individual may prepare their estate in order to minimize the requirements of probate. Newton emphasizes that you can work with a financial professional to help create a personalized plan, but here are some things that plan may include:

- Put assets in a trust: Putting funds and property into an Alter Ego trust (in the case of an individual) or a joint partner trust (in the case of a couple) is a popular method of reducing probate costs for wealthy Canadians. “If you put assets into a trust before you die, the assets won’t go through your Will and won’t be subject to probate fees,” says Newton, but she notes there are also costs and fees involved in setting up and managing a trust.

- Identify beneficiaries for registered accounts: While the funds inside RRSPs and RRIFs can circumvent the probate process, that can only happen when there are beneficiaries named in the account. If there are none, the funds will revert back to the estate and will be subject to probate. Everyone should check annually that the beneficiaries named in their registered accounts are up to date.

- Consider jointly held ownership: If one spouse passes away and all their assets (accounts and property) are held jointly, then everything passes to the surviving spouse and there may be no reason for a bank to ask for probate. However, if each half of the couple has separate bank accounts and holds property in their own names, or there are other beneficiaries from the Will, a financial institution may ask for probate. Newton says that every couple is different and that there may be good reasons to hold assets individually: People can benefit from talking with their lawyer or a financial advisor about this.

- Gift away assets: “Canada has no gift tax. If you don’t own the asset at your death, it’s not going to go through your Will. A lot of people will give away money and other assets during their lifetime if they feel they won’t require them,” says Newton. She says that people should move carefully around gifting: If we give away too much money to family, we may find ourselves short of funds if we have unexpected healthcare costs.

How can you prepare for the probate process?

Newton says people should work with estate lawyers and accountants in order to ensure that their probate process goes smoothly: “People can also work with a trust company. The estate and probate process is what they do. With even a simple estate taking two years to complete, working with a trust company can save you a significant amount of time and stress.”

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN