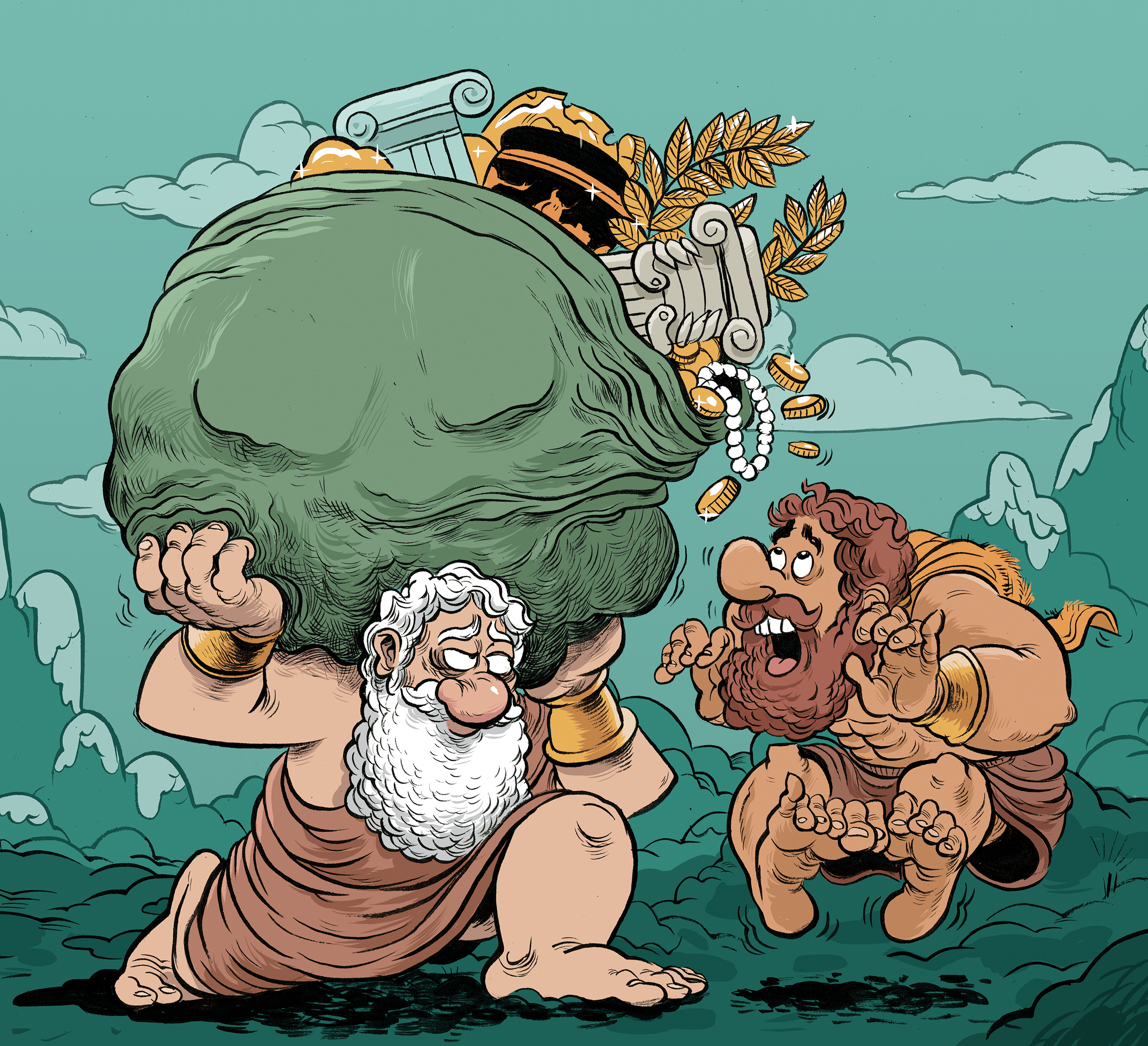

Canadian Inheritance Tax: Myths and facts

Beneficiaries in Canada don’t pay an inheritance tax like they do in the U.S. But learning how estates are taxed in this country can help you build an estate plan that can save money and ensure more of your assets go to your heirs.

Georgia Swan gets asked this question a couple times a month: “Will I have to pay tax on my inheritance from a family member?”

As a Tax and Estate Planner with TD Wealth, she realizes the confusion comes from the fact that the U.S. does have an inheritance tax. The answer? No, Canada doesn’t have an inheritance tax. Case closed.

“But that doesn’t mean that the deceased person’s estate is not taxed. If the estate does not pay the tax on the assets, then there are limited circumstances where the Canada Revenue Agency (CRA) may pursue the beneficiary of those assets for the tax owed,” says Swan.

Swan says that the estate itself — underlying assets like property and investments — is subject to several tax laws. As well, the person managing that estate, the executor (or estate trustee), is responsible for seeing that the taxes are paid on these assets. This means that taxes need to be paid before these assets reach the hands of the beneficiaries or heirs and everyone involved should be prepared for this process. Lack of preparation could mean financial complications and money unnecessarily lost.

In worst-case scenarios, the CRA may look to a beneficiary to recover funds from taxes owed by the deceased’s estate. For example, if an aunt died owing back taxes, but passed on a home to you in her Will, the CRA may need that home sold to account for those taxes.

Moreover, if the executor improperly distributed the assets without being mindful of the tax owing, the executor may also face personal liability.

Swan says people who are writing Wills and planning estates, as well as those who may be inheriting those estates, should pay attention to this tax process. Here are some things they should be mindful of.

How an estate is taxed in Canada

The tax responsibilities for a straightforward estate could be organized into two areas: What the estate may owe tax-wise to the CRA, and what probate fees or taxes need to be paid so that the estate can be “released” by the provincial courts.

One of the first steps to settle the taxes on an estate is for the executor to file a minimum of two separate tax returns: one for the previous year, if not already filed, and the so-called “terminal return.” The terminal return is required for the portion of the current year up to the deceased’s date of death. It is on this return that the accrued capital gains on any assets, the value of any Registered Retirement Savings Plans (RRSPs) or Registered Retirement Income Funds (RRIFs), and any income earned in that final year, are reported. Swan says it is crucial to understand what the tax consequences may be because it will determine what tax liability must be paid after someone’s death. The estate administration process, and certainly the distribution of any assets to the beneficiary, might not move forward without it.

How capital gains on property work

In Canada, when someone passes away, the Income Tax Act states that the individual is considered to have sold all of their assets at the time of death — called a deemed disposition. Capital gains tax is applied to assets and property whose value has increased. Among other assets, this applies to investments in non-registered accounts and to second properties such as vacation homes or income properties.

Swan says there are exceptions. First, the principal residence exemption allows any capital gains which have accrued to an individual’s principal residence (usually the family home but it could also apply to a cottage or another vacation home under certain circumstances) to be sheltered by the exemption. There are strict rules, however, for the application of the principal residence exemption, so Swan suggests tax advice should be sought in this matter.

How registered accounts are treated

When you contribute to an RRSP you generally get a tax benefit up front. At death, any funds in an RRSP or RRIF become fully taxable on the deceased’s final tax return, unless the RRSP or RRIF is passed to a surviving spouse. If you have designated a beneficiary (other than a spouse), the beneficiary will get the remaining value of that registered account after the taxes are paid by the estate. For this reason, the executor must make sure that there are enough assets within the estate to pay that bill.

Tax-Free Savings Accounts (TFSAs) by comparison are not taxed at the time of death. If they have a designated beneficiary, a TFSA will generally pass to that beneficiary without tax consequences to the estate.

How probate fees are applied to the estate

Depending on individual circumstances, the deceased’s Will may be submitted for probate. Under this process, a court will be asked to confirm the Will of the deceased and affirm that the executor appointed has the authority to administer the estate. At this time, a probate fee or “estate administration tax” may be applied to the estate.

In some provinces this may be a flat fee, but in other provinces, such as Ontario, they are calculated based on the value of the assets that pass through the Will: The larger your estate, the larger the probate fee could be. Assets included in the probate calculation will generally include the principal residence (unless it is jointly owned, such as with a married couple), other real estate such as cottages or rental properties, and any unregistered accounts. Registered accounts (RRSPs, RRIFs, TFSAs, etc.) will also be included in the probate calculation unless a beneficiary has been properly designated.

How to get professional help with estate related taxation

Swan says that every family and financial situation is different, and few people have straightforward estates. Receiving an inheritance from a family member may be bittersweet, but dealing with a complex tax bill may not be the type of legacy anyone wants. She recommends people reach out to an estate lawyer and tax professional to ensure that you structure an estate plan that can avoid tax problems for your heirs and allow your intentions with your wealth to be met.

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN