Ingrid Macintosh’s career in the investment business has given her a unique vantage point to observe the different ways in which men and women invest. And what she has seen is startling: Despite representing almost half of the workforce, women regularly retire less wealthy than men.

According to the Toronto-based senior executive and mother of four, “Women are out-learning, up-earning and outliving men.” So why aren’t they out-investing them?

As Vice President, Wealth, at TD Asset Management and Executive Sponsor of TD’s Women and Wealth Initiative, Macintosh is committed to helping women take charge of their finances. She believes women fall behind early, and usually due to one or more of these three money myths: too little time, too little knowledge or too little money.

We recently spoke to Macintosh, who shared the things she believes women should be doing to build their financial confidence.

Make time for your finances

“When you think about your career journey as a woman, it’s very often the early years of your career where you start to potentially have some disposable income that could be used for investing,” says Macintosh. But she adds there can be so much else going on in women’s lives during this time: new relationships, new opportunities, maybe a marriage, building a family. It’s too easy to defer getting started investing for another year. “People spend more time planning a holiday than they’ll spend on their financial plan or putting money away,” she says.

If you’re distracted from starting that financial journey early on, you’ve done more than defer for a year, says Macintosh, you’ve foregone the growth of that money and the compounding it can achieve over time. “Simply getting started can be incredibly powerful,” she says

Examine your saving and spending choices

“When I think about financial literacy, I think of literally building a muscle,” says Macintosh, who believes it helps to understand the consequences of financial decisions, both active and passive. “Here’s an example: If I buy boots for $300, I’m going to feel fabulous on Saturday, and then they’re going into my closet and I may regret buying them. If instead I saved that $300, 20 years from now, that might be $1,000 in my investment account. What is the impact of regularly investing even a small amount and having it compound month-over-month, time-over-time? But also, what is the impact of not saving every month?” Macintosh says the key to financial literacy is understanding that small financial decisions can make a huge difference over time.

Stop being weird about money

“I wish women would talk about money the way they talk to their friends about relationships and sex,” Macintosh says. An example? A recent conversation about money with an old friend was a watershed moment for her. Despite years working in financial services, Macintosh admits that discussing finances so openly and transparently outside of work was something new. It can be hard to talk about financial obstacles, she says, but very often your friends are experiencing the same thing, have been through something similar or are ready to learn along with you. “Now I feel like I can go to her all the time to talk about how I’m thinking about my lifestyle choices around money.”

Commit to figuring this out

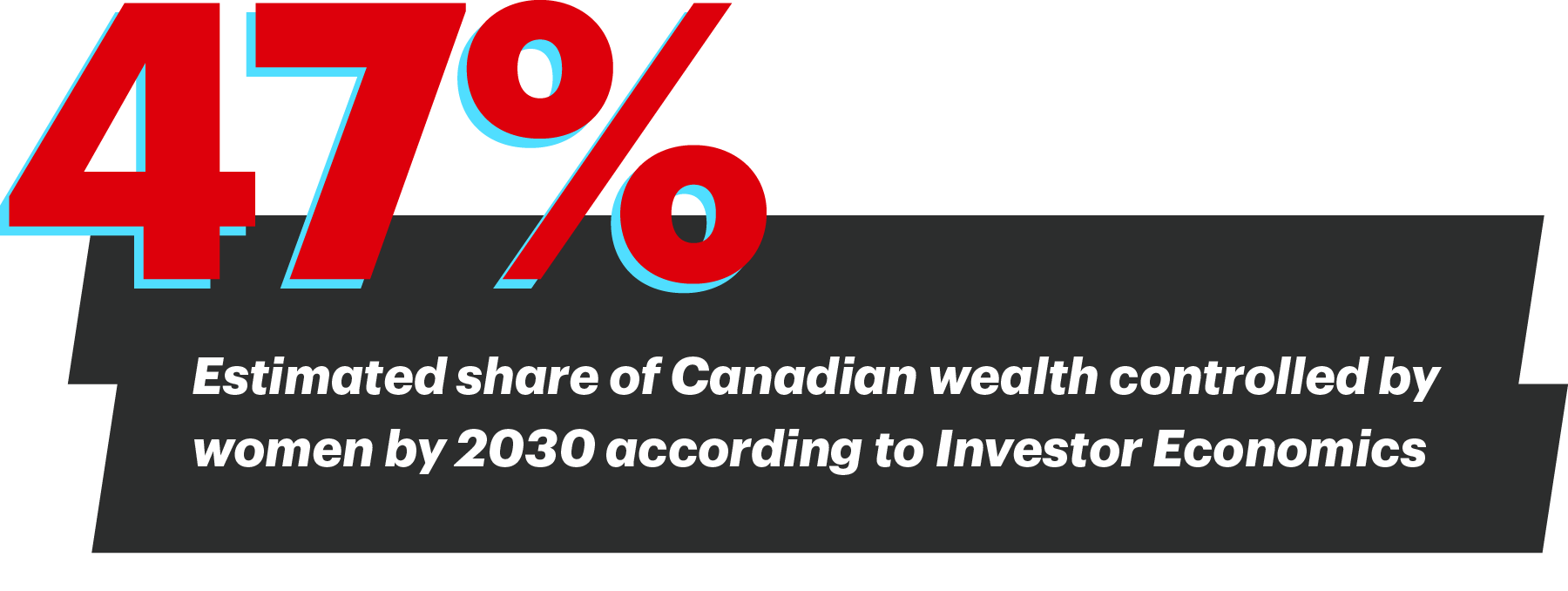

Canadian women are now out-learning men, says Macintosh. Thirty years ago, only 15% of women had a degree. Today, 56% of undergraduate degrees are earned by women. 1 But there’s an even bigger reason Macintosh believes women should feel empowered to become “good” with money: “At some point, you are going to be the financial decision maker in your relationship.” She has the stats to back that up. By 2030, the share of Canadian financial wealth controlled by women is anticipated to increase to 47% from 39% at the end of 2020, through a combination of higher earnings and inheritances.2 “So even if you haven’t had to before, figure it out. You’re going to be accountable. Build your confidence now because if you don’t have it, you’re not going to be in a good position,” Macintosh says. “That’s my rallying cry to women.”

You can read more from our interview with Ingrid Macintosh at TD.com.

If you are new to investing, TD Direct Investing has resources to help you build confidence and manage your investments. Visit TD Direct Investing’s New to Investing Resource hub to learn how you can invest for yourself, not by yourself.

- Statistics Canada, “Proportion of male and female postsecondary graduates,” https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3710013502. Accessed February 2023 ↩

- Investor Economics, “Household Balance Sheet Report 2021,” https://www.investoreconomics.com/reports/2021-household-balance-sheet-report/. Accessed February 2023 ↩