How will you navigate the unexpected?

Financial setbacks can happen to anyone. Do you feel confident you could handle a loss of income or illness? Here are four questions you can ask yourself.

Everyone should have a smoke detector in their home in case of fire. Most of the time you forget it’s there and hopefully it’ll never go off — but most of us have an idea of what we’d do if it did. What if we had the same attitude towards our finances? A continuity plan could give you confidence in knowing your family could cope with a financial or health emergency should the situation arise.

However, many of us aren’t certain we’re ready to weather any emergency: If your job disappeared, what would you and your family live on? How would the mortgage get paid? Would paying essential bills doom your dreams for the future? If the answer is, “I don’t know,” maybe it’s time for a checkup to find out what you could be doing to meet any emergency that should occur.

You may find you’re in better shape than you think but it’s always better to be certain.

Tannis Dawson, a High Net Worth Planner with TD Wealth, says that with the abrupt job losses, the economic downturn and lingering uncertainty, this year has shown us that everyone should have a personal continuity plan. She says that while we all hope to escape any unanticipated events that can send our finances into disarray, we know now that no one can predict the future.

“We work with people to build their wealth, protect what’s important to them, ensure taxes don’t diminish that wealth and help them leave a legacy. Unexpected events can upset any of these plans so everyone should be prepared for the unexpected for the sake of their family,” says Dawson.

Here are four questions you can ask. If any of them make you feel uneasy, you’ll want to talk to an advisor to help get yourself on track.

Are you prepared to withstand a financial setback?

While it’s not nice to think about, financial emergencies do happen. People lose their jobs or become incapacitated and can’t work. Dawson says you can be proactive in case such emergencies do happen. Having access to a low-interest loan, such as a Home Equity Line of Credit (HELOC) can be more sensible than running up high-interest credit card debt. As well, building up an emergency fund equivalent to at least three-month’s pay is something Dawson often recommends. She says that while that can seem daunting, an emergency fund can be built up over time by putting funds aside in a separate account using timed automatic withdrawals.

Would your family be taken care of if you couldn’t work?

Whether it’s an injury that keeps you from working or a more severe illness that could leave you unable to make key decisions, the shock for your family will be hard enough. What they don’t need is any additional chaos if you have left your affairs unattended. Dawson says that having a Power of Attorney can allow a trusted relative or professional to access your accounts and manage your affairs so your family can be looked after.

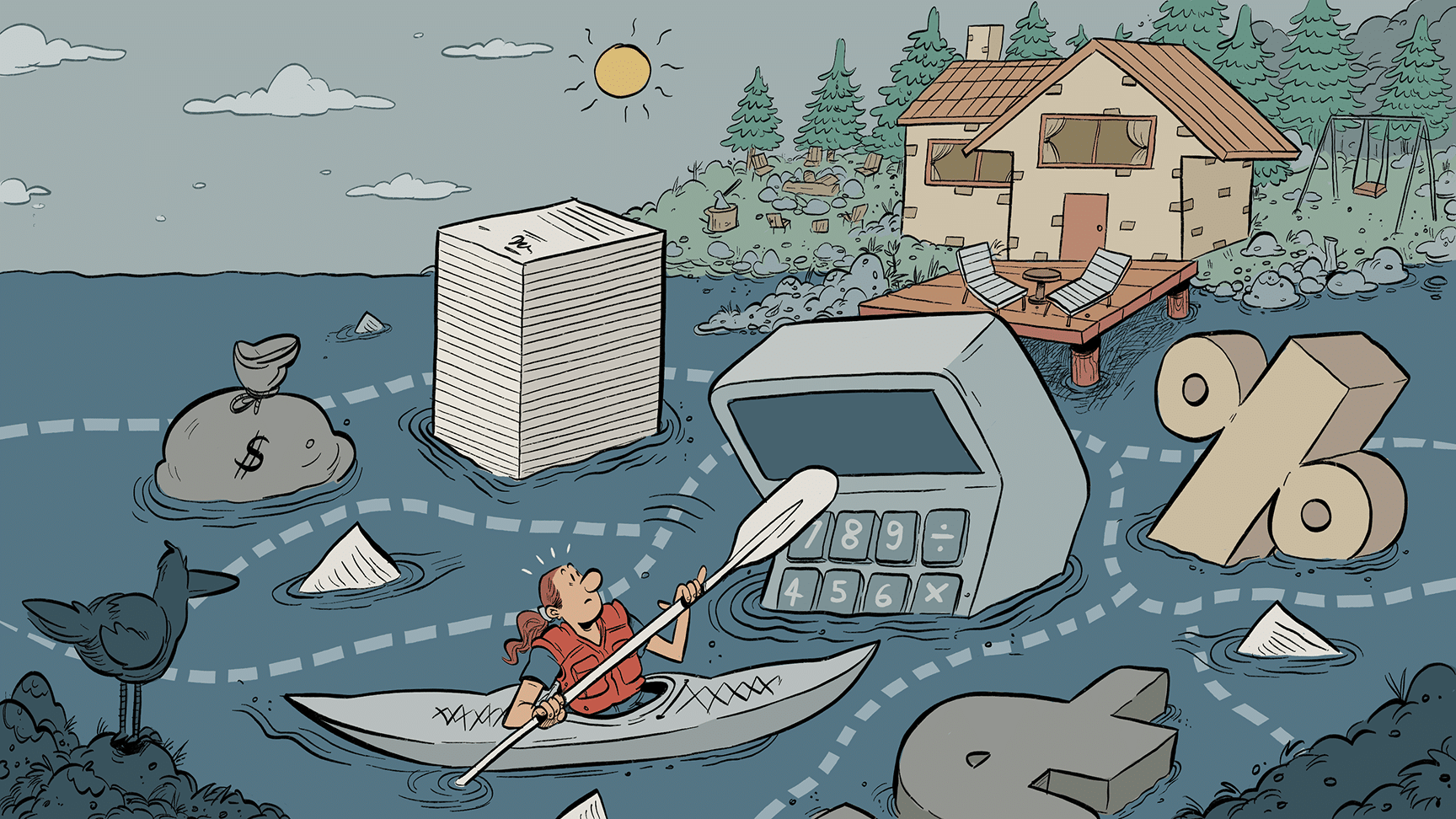

Would you face an unexpected tax bill?

One aspect in a financial emergency that people overlook is taxes, says Dawson. If you are in a financial emergency, you don’t want to trigger a large tax bill if you were to dip into your RRSP without consideration of the consequences: Depending on your situation, up to half of your savings could be lost to taxes. Dawson recommends getting in touch with a tax advisor to see what kind of tax-efficient strategies are available to you. An advisor will be able to keep you up to date with changing government policies and will be able to ensure you have a well-organized tax plan even if your investment plans or family circumstances change.

If you should pass away, would your wishes be fulfilled?

Dawson says catastrophic events don’t wait until your Will and estate plans are updated to happen. Without having a robust estate plan in place, your intentions for your wealth may not be met. This means keeping your Will up to date, ensuring you have a responsible and suitable executor in place and, if you have children who are minors, naming an appropriate guardian for them. Leaving a legacy could also mean ensuring that your loved ones are not faced with a giant tax bill from the Canada Revenue Agency after you’ve gone. Again, Dawson says, it’s best to chat with a tax and estate advisor to gain comfort in knowing what you want to happen when you pass away.

Dawson says that proper planning always must take into consideration unexpected events that can knock a lifetime of planning off the rails. She says saving, investing, dealing with taxes, and proper estate planning are all interconnected. If one aspect goes awry, other areas of your life may be in trouble. Remember that smoke detector? Just as you must renew the batteries once a year, the same goes with reviewing your plan to help ensure it is still on track.

“The best remedy is to always head to people who are experienced and knowledgeable, who can tell what is right for your personal situation,” says Dawson. “They can help construct a plan to help meet any emergency.”

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN