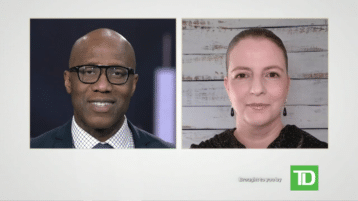

Concerns about an economic slowdown have weighed on industrial demand. Juliana Faircloth, Industrials analyst at TD Asset Management, tells Greg Bonnell that a series of so-called mega projects may soon give the sector a lift.

Print Transcript

Amid concerns of an economic slowdown, there has been a softening in industrial demand. But according to our future guest today, the sector may soon be getting a lift. Planned spending and projects kicking in. Joining us now to discuss, Juliana Faircloth, Industrials Analyst with TD Asset Management. Juliana, great to have you back on the show.

Thanks for having me.

All right. So there are rumblings out there about megaprojects, EV plants, the green transition. How big is all this?

You're right. So there's been a lot of talk about this term megaprojects. What is that? It sounds kind of ominous. Megaprojects are really projects that involve at least $1 billion of capital spending. So massive projects within the economy. There's been estimates flying around out there that there's been $600 billion worth of megaprojects announced in the last two and a half years, so since January 2021. Kind of that post-COVID time period. 600 billion in projects and that's something like three times the normal run rate. So a lot of capital opportunity out there.

I think it's important to think about what's driving that. A few different things. The first is fiscal spending. There's been the IRA. There's been the CHIPS Act, the Infrastructure Investment and Jobs Act. All of that is quite supportive of some of these massive projects. The green transition we talk about all the time, that's going to require significant investment in projects in the grid and our infrastructure to get our economy up to speed in terms of where we need to be on next generation fuels. I think there's a geopolitical angle as well. If we think about the political events that have taken place over the last couple of years, it's pretty supportive of this on shoring theme. We've seen the semiconductor industry move towards investing in North America. Those are massive projects. So all of that collectively is creating an outlook for a pretty good capital spending environment over the medium term.

So some big themes driving this. Obviously, some policy decisions from levels of government. In the here and now, obviously, we're worried about an economic softening. We take a look at PMI's, purchasing managers, indices and indexes, new orders declining. How does that play into the commitment? This is a lot of money, when you're talking to mega you said a billion and up.

Mm hmm. That's a great question and I think that's kind of the crux of the issue that industrial investors have been thinking about. So you're right, We have manufacturing PMI is which are in contraction. The number was reported last week for the month of June. There was a decline month over month. We're at 46 on that index. Anything below 50 suggests contraction. So that's reflected in what we're starting to hear from industrial companies. A lot of companies are talking about their orders slowing down or their orders going negative. But at the same time, we're slowly starting to hear that commentary creep up about megaprojects and about the spending that is coming and slowly moving into these industrial company backlogs. So it's a bit of a fine balance that we're working with between secular growth opportunities and balanced with the cyclical opportunity. And that's been a focus for industrial investors in the last little while.

When I think of those kind of big investments, is this some of the companies in the sector seeing through in the short term? Yes, we have this, but longer term this is where we need to be.

Exactly. So that's kind of the general commentary we've heard from companies all through the last reporting season. I expect that will continue in the reporting season that's coming up in the next couple of weeks that we are seeing a bit of slowing in the near term. But the backlog and interest in some of these industrial products and goods is slowly starting to build up and we'll have to kind of see how that plays out over the near term.

The industrial space is a big one. If we do see this sort of boom in investment and megaprojects, what types of industrial names will benefit the most?

So the short answer is I think there's a lot of opportunity for many industrial companies to benefit. But if we think about breaking down pockets within the sector, capital expenditures and capital spending is generally positive for the capital goods portion of industrials, naturally. If we think about what a megaproject might involve, step one could be hiring an engineering and construction firm that's essentially going to be your designer, your project manager, seeing through a mega-project. Then you might have machinery companies selling construction equipment once shovels hit the ground. If we're thinking about electrifying the entire economy, electrical equipment providers should see a benefit as the electrical content within all of our buildings, our homes, our power infrastructure is all going up. Thinking more about on shoring and some of those mega-projects related to building out more localized manufacturing. That should benefit automation companies, companies that sell equipment to factories. It's quite broad, and I think that's part of the benefit of being a long term investor. We have the opportunity to think through where we see the economics of megaprojects really accumulating and pick the pockets to to play in as an investor.

There's one company I think that you want to highlight in terms of sort of representative of the space, the name Eaton. Tell us about.

Yes. So Eaton, I think is just a good example of what's going on and kind of a straightforward example to think about. So Eaton is a company that sells electrical equipment. They serve many end markets. They serve utilities, data centers, buildings, residential commercial construction. They sell the electrical equipment that builds out that infrastructure. That company has been growing their organic sales ahead of multi industrial peers for the last several quarters. And they have called out recently in their most recent quarter that they see their end market growth being double what it was pre-COVID. So a big jump in the opportunity set that they see moving forward and that again is slowly going to move into their backlog and from their perspective, play out in in strong organic growth over the medium term.

So there are some positive catalysts there for the name. Any risk for a name like Eaton or anyone else in the space right now?

Certainly. I think there's always a risk from execution. A big driver of a lot of these megaprojects is fiscal spending. We know that things can move through government at a slow pace at some times, and sometimes they may not move through at all. So that is a bit of a risk and something to keep on the horizon.

Now, this obviously, if we see this investment boom, these megaprojects will benefit the industrial space. And you laid out nicely sort of like the life cycle of these projects. What about the broader market, would they see benefits?

I would say that in a big investment and capacity like we are expecting perhaps to see over the medium term should generally be positive for the broader market. If we're investing in capacity in North America, that should be positive for economic growth, positive for GDP and ultimately positive for corporate earnings. At the same time, capital expenditures are an expenditure that has a direct impact on free cash flow generation for companies. So as always, we'll stay focused on identifying quality companies that have a track record of strong capital allocation to try and pick and choose where management teams are going to be able to deploy capital and generate the best return for investors and the broader market.

Thanks for having me.

All right. So there are rumblings out there about megaprojects, EV plants, the green transition. How big is all this?

You're right. So there's been a lot of talk about this term megaprojects. What is that? It sounds kind of ominous. Megaprojects are really projects that involve at least $1 billion of capital spending. So massive projects within the economy. There's been estimates flying around out there that there's been $600 billion worth of megaprojects announced in the last two and a half years, so since January 2021. Kind of that post-COVID time period. 600 billion in projects and that's something like three times the normal run rate. So a lot of capital opportunity out there.

I think it's important to think about what's driving that. A few different things. The first is fiscal spending. There's been the IRA. There's been the CHIPS Act, the Infrastructure Investment and Jobs Act. All of that is quite supportive of some of these massive projects. The green transition we talk about all the time, that's going to require significant investment in projects in the grid and our infrastructure to get our economy up to speed in terms of where we need to be on next generation fuels. I think there's a geopolitical angle as well. If we think about the political events that have taken place over the last couple of years, it's pretty supportive of this on shoring theme. We've seen the semiconductor industry move towards investing in North America. Those are massive projects. So all of that collectively is creating an outlook for a pretty good capital spending environment over the medium term.

So some big themes driving this. Obviously, some policy decisions from levels of government. In the here and now, obviously, we're worried about an economic softening. We take a look at PMI's, purchasing managers, indices and indexes, new orders declining. How does that play into the commitment? This is a lot of money, when you're talking to mega you said a billion and up.

Mm hmm. That's a great question and I think that's kind of the crux of the issue that industrial investors have been thinking about. So you're right, We have manufacturing PMI is which are in contraction. The number was reported last week for the month of June. There was a decline month over month. We're at 46 on that index. Anything below 50 suggests contraction. So that's reflected in what we're starting to hear from industrial companies. A lot of companies are talking about their orders slowing down or their orders going negative. But at the same time, we're slowly starting to hear that commentary creep up about megaprojects and about the spending that is coming and slowly moving into these industrial company backlogs. So it's a bit of a fine balance that we're working with between secular growth opportunities and balanced with the cyclical opportunity. And that's been a focus for industrial investors in the last little while.

When I think of those kind of big investments, is this some of the companies in the sector seeing through in the short term? Yes, we have this, but longer term this is where we need to be.

Exactly. So that's kind of the general commentary we've heard from companies all through the last reporting season. I expect that will continue in the reporting season that's coming up in the next couple of weeks that we are seeing a bit of slowing in the near term. But the backlog and interest in some of these industrial products and goods is slowly starting to build up and we'll have to kind of see how that plays out over the near term.

The industrial space is a big one. If we do see this sort of boom in investment and megaprojects, what types of industrial names will benefit the most?

So the short answer is I think there's a lot of opportunity for many industrial companies to benefit. But if we think about breaking down pockets within the sector, capital expenditures and capital spending is generally positive for the capital goods portion of industrials, naturally. If we think about what a megaproject might involve, step one could be hiring an engineering and construction firm that's essentially going to be your designer, your project manager, seeing through a mega-project. Then you might have machinery companies selling construction equipment once shovels hit the ground. If we're thinking about electrifying the entire economy, electrical equipment providers should see a benefit as the electrical content within all of our buildings, our homes, our power infrastructure is all going up. Thinking more about on shoring and some of those mega-projects related to building out more localized manufacturing. That should benefit automation companies, companies that sell equipment to factories. It's quite broad, and I think that's part of the benefit of being a long term investor. We have the opportunity to think through where we see the economics of megaprojects really accumulating and pick the pockets to to play in as an investor.

There's one company I think that you want to highlight in terms of sort of representative of the space, the name Eaton. Tell us about.

Yes. So Eaton, I think is just a good example of what's going on and kind of a straightforward example to think about. So Eaton is a company that sells electrical equipment. They serve many end markets. They serve utilities, data centers, buildings, residential commercial construction. They sell the electrical equipment that builds out that infrastructure. That company has been growing their organic sales ahead of multi industrial peers for the last several quarters. And they have called out recently in their most recent quarter that they see their end market growth being double what it was pre-COVID. So a big jump in the opportunity set that they see moving forward and that again is slowly going to move into their backlog and from their perspective, play out in in strong organic growth over the medium term.

So there are some positive catalysts there for the name. Any risk for a name like Eaton or anyone else in the space right now?

Certainly. I think there's always a risk from execution. A big driver of a lot of these megaprojects is fiscal spending. We know that things can move through government at a slow pace at some times, and sometimes they may not move through at all. So that is a bit of a risk and something to keep on the horizon.

Now, this obviously, if we see this investment boom, these megaprojects will benefit the industrial space. And you laid out nicely sort of like the life cycle of these projects. What about the broader market, would they see benefits?

I would say that in a big investment and capacity like we are expecting perhaps to see over the medium term should generally be positive for the broader market. If we're investing in capacity in North America, that should be positive for economic growth, positive for GDP and ultimately positive for corporate earnings. At the same time, capital expenditures are an expenditure that has a direct impact on free cash flow generation for companies. So as always, we'll stay focused on identifying quality companies that have a track record of strong capital allocation to try and pick and choose where management teams are going to be able to deploy capital and generate the best return for investors and the broader market.