Does your Power of Attorney include pink nails?

A Power of Attorney allows decisions about your basic care and finances to be made by another person. But what about the things that make life worth living? Here’s how to document your personal lifestyle choices in your POA.

Would you include a weekly manicure in your Powers of Attorney (POA) documentation? Or insist on seeing your local hockey team play?

POAs help ensure we receive the necessities of life in case of incapacitation. These requirements broadly include medical support and the means to pay for it. But it’s become evident that lifestyle items documented in our POAs are as important to our day-to-day happiness — right down to keeping pink nails shining.

According to Tannis Dawson, Vice President, High Net Worth Planner at TD Wealth, POAs are constructed to manage a wide range of situations, though many of us place the emphasis on high-level support. For example, we might employ a POA to care for someone who has a catastrophic medical condition and needs a major redeployment of their money for their ongoing care.

But what Dawson wants everyone to know is that POAs can support our lifestyle choices when medical problems narrow our routines even temporarily. If people are dealing with age-related problems concerning mobility or memory issues, they can still lead active lives with some support. There is now an awareness of how important mental health is to older adults and how vital it is to continue to socialize throughout life — that’s where a well-written POA can help as well.

For instance, in the case of cognitive decline, where someone can no longer do their own banking, there may still be activities they would continue to enjoy: A POA can ensure that a regular visit to the spa stays on the calendar. It can also help ensure birthday gifts to grandkids keep flowing.

If it’s an activity that makes life worth living, then, documenting these needs can be crucial.

“Many clients are providing more details in their POA to ensure their regular massages or eyelash extensions, or whatever is important, are continued if an attorney needs to step in and take care of their affairs,” Dawson says.

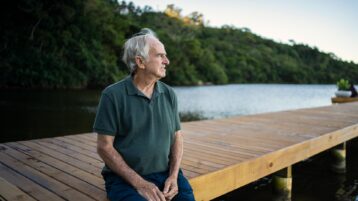

“A Power of Attorney can be as important as a Will,” says Dawson. It’s a document that helps to make your lifestyle wishes clear even if you are temporarily incapacitated. Yet only 40% of Canadians have Powers of Attorney drawn up and fewer still may have thought about exactly how they want to be taken care of when the decisions are out of their hands.1

How do Powers of Attorney documents work?

To identify your priorities when someone else is managing your money and your care, two documents need to be created, one for personal care and one for property. The POA for personal care typically addresses supported care, accommodation preferences, diet and end-of-life considerations. (Note, the POA for personal care is called a representative agreement or directive in some provinces, and that the scope of POAs vary across the country.) The POA for property provides directives for how and where your money and assets should be administered on your behalf.

“A POA can ensure that a regular visit to the spa stays on the calendar.”

And with the recent COVID-19 pandemic in mind, Canadians may have a heightened awareness of how they would like their funds used. The potential shortcomings of long-term care is a concern and people are addressing that in their POAs. “I see people adding what kind of level of nursing homes they would want to live in. They don’t want to be put in the cheapest one and just left,” says Dawson.

There can be complications if lifestyle choices are not included in your POA. Dawson points out that it is not unusual for one child within the family to be appointed the attorney. However, given family dynamics, it’s also normal that family members may not see eye to eye when large sums of money and emotions come together. For example, if their mum is suddenly hospitalized, siblings could disagree on how her money should be managed under the new circumstances. But by providing clear instructions, the parent could pre-emptively support her attorney because the POA speaks for her. There may be less bickering at family gatherings if you have your wishes in writing.

Here are five questions Dawson suggests you ask yourself in preparation for creating your POA.

1. What activities are meaningful to you?

Think about the activities you currently enjoy — it could be a monthly book club meeting or season tickets to the local theatre that you attend with friends. Those outings may require added costs of transportation and possibly an aide to attend with you. Your POA can provide direction to the attorney about which activities contribute to the quality of your life.

2. Are there people who depend on you financially?

Ask yourself these questions: Do you support people? Do you help family? A well-written POA could mean your support does not have to stop once your financial affairs are administered by an attorney.

It is common for grandparents to help with education expenses for grandchildren. That could be regular contributions to a grandchild’s Registered Education Savings Plan (RESP), payment for extracurricular activities like hockey or dance lessons or even private school tuition. Without clear documentation regarding your desire to continue this support, an attorney could suspend the payments.

The same is true for family gifts. If gifts of money are regularly made to children or grandchildren, it is helpful to have your attorney aware that you want this to continue.

3. Pets are family too. Is their care considered?

If there are animals in the household, providing clear direction about how much is reasonable to pay for a pet’s care and who precisely is responsible for the animal can be helpful for the POA.

4. What charities do you support?

“Donations are a big consideration because a Power of Attorney cannot just make donations on the person’s behalf without specific direction,” says Dawson. If you make regular donations every year, identifying that this gifting is to be ongoing can be a useful part of your POA. Dawson also notes that this can be important because it is not unusual for family members to disagree about the merit of one charity over another. Providing clarity on the charities you choose means the payments are more likely to continue.

5. What level of long-term care do you desire?

Making clear where you wish to live if you can no longer live independently is important, but another factor to consider is what happens when there are no relatives around for regular visits, Dawson says. It is not at all unusual for family members to be scattered around the world, so POAs for property are beginning to include guidelines for paid companions to visit on a regular basis. Dawson says these requests needn’t be complicated. Something simple like, “please hire someone a few hours each week to take me outside and sit,” can make a difference to the overall experience of supported living.

A well-written POA matters

Dawson emphasizes that the more details you have in your document, the easier it is for your attorney to know your wishes. In her experience, it is not unusual for family to have many opinions when someone important suddenly gets sick or becomes debilitated: A POA can help your family reduce the ambiguity about what you want this chapter of your life to look like. Speak to a lawyer about creating a POA that reflects the choices you desire.

SUSAN PRINCE

MONEYTALK

ILLUSTRATION

DANESH MOHIUDDIN

- Canadians and their Money: Key Findings from the 2019 Canadian Financial Capability Survey, Financial Consumer Agency of Canada, Government of Canada, modified, Nov. 22, 2023, accessed Dec. 14, 2023, www.canada.ca/en/financial-consumer-agency/programs/research/canadian-financial-capability-survey-2019.html ↩