Retirement ready at any age

How you view your retirement readiness may depend on your age and personality. We’ve developed a checklist of retirement-ready habits that may help you prepare for the big day — whatever age or life stage you’re at.

When you’ve just started your first job, and the money starts rolling in, it might seem daunting to think about putting money aside — for your big life goals or for a rainy day. It all seems so very far away. But as we grow older, the questions grow too: Am I saving enough?

It’s a question many of us ask because our future lifestyle may depend on what we sock away.

The TD Wealth Behavioural Finance Report, a 2018 study from TD Wealth, reported on how Canadians in general perceive their retirement readiness. 1 The results suggested that few of us feel sure we will be financially ready for retirement when the time comes.

The truth is, many of us may actually be doing a lot of the right things. However it’s understandable that many of us might wonder if we’re on the right track. With that in mind, we’ve put together a series of checklists to share some top behavioural habits that can help create confidence towards retirement readiness. Feel free to check off the ones you’ve completed.

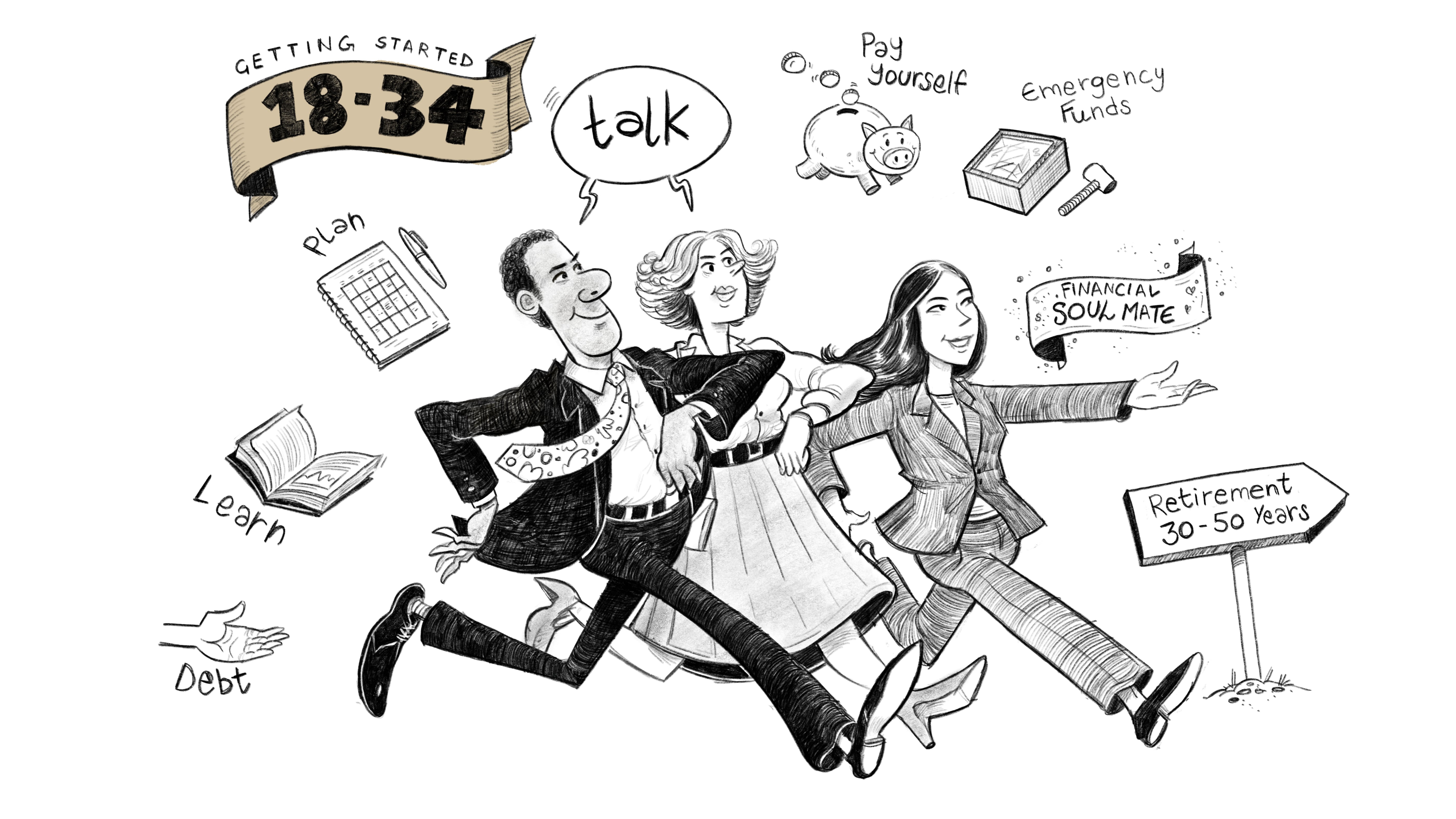

Retirement ready when you’re getting started (18 to 34 years of age)

Retirement seems so far off! Your brain might be telling you it’s wise to save for retirement, but right now it’s so much easier to picture yourself enjoying a trip to Cuba with your friends. If you’re clever about it, you may even manage to do both. Most of us have time on our side to develop a balance of healthy saving and spending habits. But according to the TD Wealth Behavioural Finance Report, younger investors tend to be a little less disciplined and more likely to react to market fluctuations. Here are other things to consider doing now that may help ensure your retirement is on track down the road:

Work with a financial advisor

Start a relationship with a financial advisor who can suggest suitable money strategies and investments based on your profile. Many younger investors can lack structure and discipline in their financial dealings, something an advisor may be able to help with.

Get goal-oriented

Work with a financial advisor to set longer-term goals that are meaningful to you. Looking to buy a home? Build an emergency fund? An advisor may be able to help you buff up on financial concepts and tools that can help you get there.

Pay yourself first

It may help to reframe the savings equation, by making saving come before spending. An automatic payment to a savings account, RRSP or a TFSA can be timed to your payday so you don’t miss the money.

Get committed

Tax refunds, salary increases and bonuses can make great opportunities to get ahead on your savings. You can make a pre-commitment to put away a predetermined portion of any tax refund, bonus or raise into a TFSA or RRSP. It may feel like free money, but it can also be a painless way to boost your long-term savings.

Retirement ready when you’re getting crunched (35 to 54 years of age)

Tell us if this sounds familiar: For once you feel like you’re earning a healthy income, but you are never sure where it all goes! According to the TD Behavioural Finance Report, parents in particular reported a major drop in financial satisfaction at this age, as family expenses mount. With so much going on, it’s little wonder your savings plan might get pushed to the backburner. But all is not lost: You may already have assets such as a house, some RRSP or TFSA savings to finance your retirement years. Here are some other behaviours that successful savers can consider to help stay on track during these years:

Work with an advisor

If you haven’t met with a financial advisor, now may still be a good time to get one. They can help you to develop a reasonable roadmap to help prioritize and target your goals.

Put a picture to your goals

Several behavioural studies have shown that we are better at saving for goals when we attach visible reminders. Want to spend your retirement travelling? You may want to try pinning pictures of your perfect retirement to the fridge. 2

Pay yourself first

Finding money left over after bills are paid can be a challenge. Even small automatic contributions to your retirement savings can help maintain momentum and add up in the long run.

Ask yourself

Do I really need that? Consumer debt is expensive, but many people may find it’s hard to keep yourself within a budget. If it’s reasonable, making a commitment to live within your means can be an important step towards saving.

Retirement ready when you’re getting serious (55 and up years of age)

With retirement on the horizon (along with the thought of enjoying all the epic sunsets you can handle), it’s normal to have questions about your next move. At this point you may wonder if you’re saving enough or even if you have enough to retire early. If you’ve been working with a financial advisor, they may be able to give you an idea of what your retirement could look like and what it may take to get there. Here are four things individuals in this age group can consider doing to see if they are retirement ready:

Review your asset mix

At this time of life, investors may wish to meet with a financial advisor to help review their investment mix. If you are nearing retirement or already in retirement, it may be time to adopt a risk profile that is in line with your lifestyle and income changes.

Plan a tax strategy

As you get closer to a day when you’ll start drawing down your investment savings or receiving a government or employer pension, you may wish to start thinking about the most tax-efficient way to access your savings, and which assets you will draw on first.

Picture your best retirement

Individuals in this group might be getting a clearer vision of their work-free future. Have you thought about whether you’d like to work beyond retirement age, or whether you’re in a position to retire early? These things may play into your income and tax planning. Be careful: Adding new lifestyle expenses may decrease your retirement savings.

Think about downsizing

For some, having a smaller home can help to free up assets that will be needed in retirement. A smaller home can also be easier to care for. A financial professional may be able to help you decide when is an opportune time to make a move.

— Denise O’Connell, MoneyTalk Life

The TD Wealth Behavioural Finance Report was a quantitative study commissioned in 2017. Conducted online, it surveyed more than 1,600 Canadians defined as affluent (more than $100,000 in investable assets) or emerging affluent (25 to 35 years old with more than $100,000 household income), in English and French.

- TD Wealth. “TD Wealth Behavioural Finance Report,” February 2018.

https://www.td.com/ca/en/investing/documents/pdf/wealth/behavioral-finance/Behavioural-Finance-Industry-Report-EN.pdf ↩ - Amar Cheema and Rajesh Bagchi, The Effect of Goal Visualization on Goal Pursuit: Implications for Consumers and Managers, Journal of Marketing, Vol. 75, No. 2 (March 2011), pp. 109-123 (15 pages) https://www.jstor.org/stable/41228586 ↩