Now more than ever: 7 ways to make charitable giving part of your legacy

Following two difficult years, the need for giving continues to grow, in Canada and across the world. For those who would like to make philanthropy a part of their legacy, here are seven key considerations (and surprising tax benefits) you should be aware of.

Philanthropy looks different on all of us. Many of us donate to charity, some prefer to volunteer, others establish foundations. While our methods may vary, most Canadians have something important in common: We believe in the importance of giving back.

And yet, since 2019, there’s been a marked decline in charitable giving across Canada — a 12% reduction in the number of charitable donors according to CanadaHelps’ 2022 Giving Report.1 At the same time, the need for giving has never been greater. More than 26% of Canadians expect to use or are already accessing charitable services in 2022.2 As the need for philanthropy grows both in Canada and across the world, why are we seeing a decline in the number of people who give?

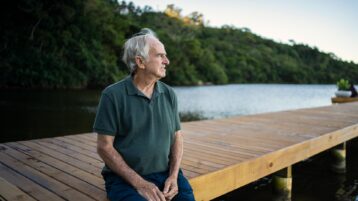

The answer may not be as simple as it seems, according to Jo-Anne Ryan, Executive Director of the Private Giving Foundation and Vice President, Philanthropic Advisory Services with TD Wealth. Ryan believes that giving back is still a fundamental characteristic of Canadian life and is actually increasing in many ways.

“There is a lot of giving in ways that aren’t traditionally measured,” she says.

While Ryan acknowledges that the ongoing effects of the COVID-19 pandemic and recent economic uncertainty continue to impact the ways we give, she says that many Canadians are donating more money than they have in previous years and are finding new ways to make philanthropy a part of their legacies.

“Canadians are very generous. When there is need, we tend to step up and contribute,” she says.

As you consider your own legacy and how charitable giving may continue to play a role in your life, it’s important to remember that no matter how you give or how often, being organized and deliberate is essential to having a lasting impact. Here are seven ways you can make charitable giving part of your family legacy.

Find a cause you’re passionate about

There are 86,000 registered charities in Canada, and endless causes to support.3 Faced with the prospect of selecting just a few, you may feel overwhelmed. “Since you can’t possibly support them all, we encourage our clients to develop a philanthropic plan that reflects their values,” says Ryan. She says the first step is to identify the cause (or causes) you’re most passionate about. A little soul searching may be necessary here, but it’s often an issue that has affected you personally, or someone close to you. If you’re still unsure, Ryan says her team likes to ask: “What do you attribute to your success?” Whether the answer is a scholarship or an opportunity once offered, the next question becomes: “How can you benefit others with that opportunity too?” With so many charities looking for support, Ryan suggests using TD’s step-by-step method to identify the causes you actually want to support financially.

Know your options

Once you’ve identified a cause that’s close to your heart, you may be surprised to learn there are many different ways to make a charitable donation. In addition to simply writing a cheque and getting a tax receipt, other options you might consider include: donating securities from your portfolio; setting up a scholarship or donor-advised fund; establishing a bequest in your will; or designating a charity as the beneficiary of your registered savings plan or Tax-Free Savings Account (TFSA). If you’re uncertain about which option is right for you, Ryan recommends working with your advisor.

Think about the long term

Although many people give sporadically throughout the year, giving on a regular basis can make a lasting impact. Incremental giving can also provide you the opportunity to watch your money make a difference over time with a specific cause you’re passionate about, and incorporate charitable giving more firmly into your lifestyle. For those who are looking to set up a regular donation schedule, charities often allow incremental giving by way of smaller automatic contributions. Alternatively, many companies offer their employees a means to donate to charities through biweekly or monthly deductions from their paycheques. No matter how you choose to organize your charitable giving, making a long-term giving plan could potentially be more convenient and impactful than sporadic giving.

Work with an advisor to give smartly

While Ryan says that tax benefits are not the main reason people choose to give, she recommends working with an advisor to identify opportunities to make your donations tax efficient as part of a long-term philanthropic plan. In addition to donating to charities and receiving a tax credit, there are many other tax-effective ways to give back that may make sense for you. An advisor can help you sort through your options and come up with a plan that reflects your wishes and situation.

However you choose to structure your philanthropic plan, your advisor will help ensure your other financial priorities and later-in-life needs aren’t forgotten in the process. After all, while it may be fulfilling to give back while you’re still alive and can see your dollars have an impact, it may make more sense to leave the lion’s share of your charitable giving through a Will. “We often find that people have more money than they’ll be able to spend in their lifetime,” Ryan says, “but until you go through that planning exercise, you may be a little hesitant about donating. In fact, many people have the capacity to give more after they’ve passed. That’s why charitable giving should be a part of your overall financial and estate plan.”

Teach your family about the importance of giving

Generosity of spirit is a value that can be passed down from generation to generation, but it needs to start at home. When we take the time to teach our children and grandchildren the importance of giving, it helps ensure future generations will carry on the tradition. And while the act of giving may look different on a baby boomer than it does on a millennial, the underlying generosity is the same. To foster this generosity in your kids and grandkids, it can help to include them in conversations about the importance of giving, as well as involve them in the process. That may mean exposing them to the causes you care about early on, or it could mean helping them make their first charitable donation.

Get involved

While money may make the world go ’round, there are other important ways to give back. If you have the time and inclination, volunteering can be a great way to do more for the causes close to your heart. It can also bring you face-to-face with the specific social problem or need of the charity — something that may look somewhat different from how you see it in the media. Volunteering can mean providing basic support — answering phones, collecting donations and helping to organize charity events — or it can mean providing skilled support. For example, if you’re a doctor, lawyer or accountant, you may be able to lend a hand by lending your abilities. Although younger generations in particular are likely to get involved in grassroots volunteerism, there are opportunities for Canadians of every age and profession.

Maximize your impact with donor advised funds

For families or individuals who are looking to give more, the Private Giving Foundation is a donor-advised fund that offers TD clients the option to establish a fund as a simple alternative to establishing a foundation — without all the administrative effort and expense usually required. “We were actually the first Canadian financial institution to launch a donor-advised fund in 2004,” Ryan says. “And since the minimum is only $10,000, it’s easy to get going.” She adds that while the Private Giving Foundation is its own publicly registered charity, TD manages the governance and administration on behalf of its clients, so you don’t have to worry about it.

The last two years have been difficult for many people, both in Canada and across the world. If you’d like to help by making charitable giving a part of your legacy, speak to your wealth advisor about creating your own philanthropic plan.

TAMARA YOUNG

MONEYTALK LIFE

ILLUSTRATION

INNA GERTSBERG

- “The Giving Report 2022: Giving at a crossroads,” Canada Helps, April 5, 2022, https://www.canadahelps.org/en/the-giving-report/. ↩

- Ibid. ↩

- “8 Facts You Might Not Know About Charities,” Canada Helps, accessed Nov. 3, 2022, https://www.canadahelps.org/en/giving-life/connecting-with-charities/8-facts-you-might-not-know-about-charities/ ↩