My kid, the new FHSA and me

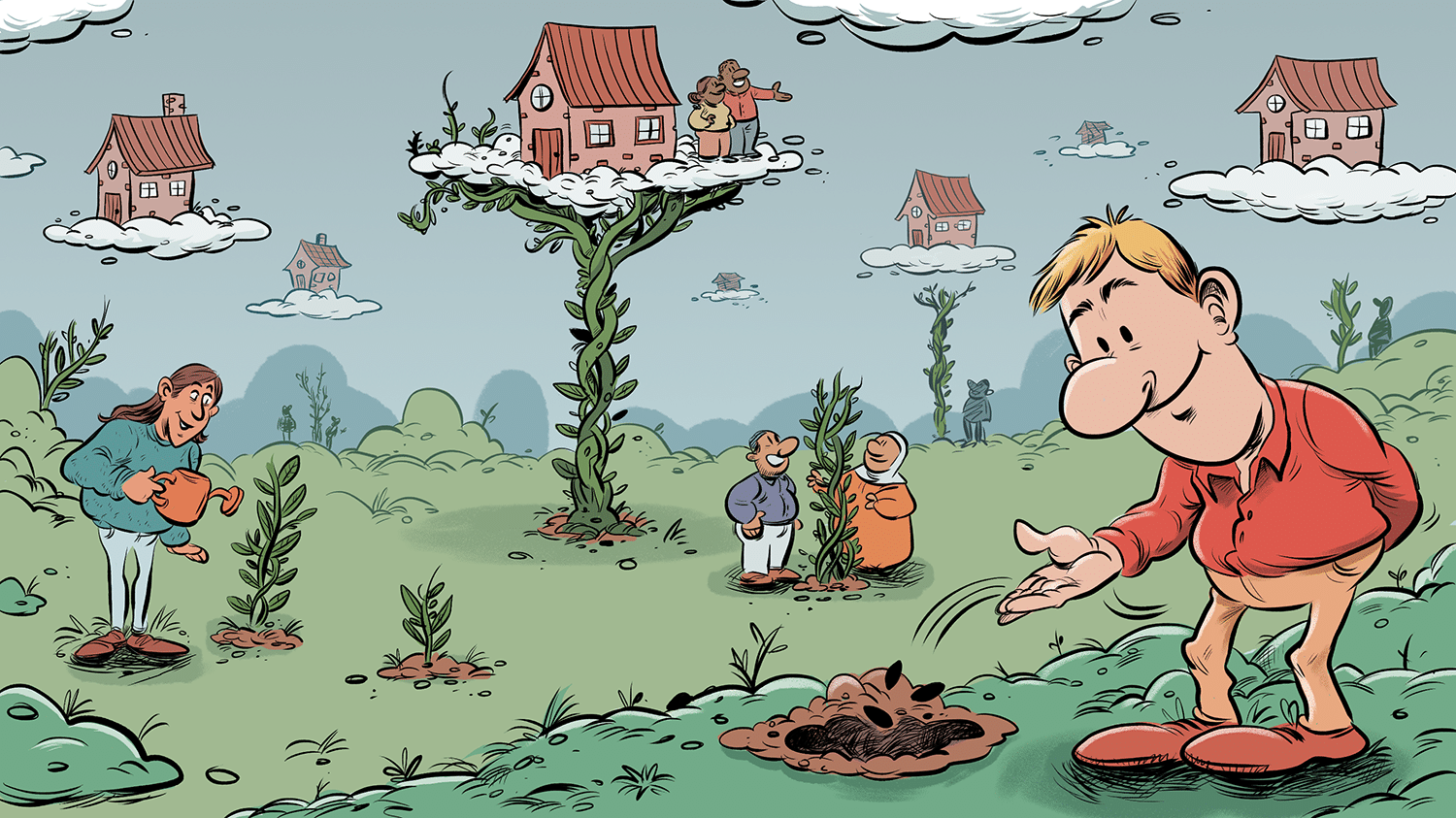

A First Home Savings Account can be a powerful way to save for a first home. But for parents looking to give their adult kids a boost the question arises: How and when should you give them some help to open an account?

Georgia Swan typically suggests that clients consider getting children into registered accounts, like Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs), as soon as they are qualified to contribute as way to start accumulating savings at an early age.

How about the First Home Savings Account (FHSA)? The Tax and Estate Planner with TD Wealth says it may be best to pause and reflect before giving your child some funds to contribute. That’s because it could come down to timing the benefit of a FHSA properly.

“The First Home Savings Account has changed the landscape because it’s an opportunity for parents over time to assist with contributions to an account that will provide tax-free growth to the child,” Swan says. “It also helps parents to not have to suddenly yank a huge lump sum out from their savings to help their kid buy a home at a time when it might not be convenient to do so.”

Last year the federal government launched the FHSA, a tax-efficient method of investing funds to put toward a home purchase. Due to the high prices for housing, the FHSA will likely become one of the go-to tools for parents to help kids save towards their first home, says Swan: As of December, more than 300,000 Canadians have opened an FHSA to save for a down payment on their first home. 1 Since a parent can’t open an FHSA on behalf of their child, it means giving a child money which they can then transfer into their FHSA.

While the FHSA has its benefits and can be used in combination with other methods of helping children, Swan emphasizes that parents should consider how they want to help their child. For example, before sharing funds for an FHSA, parents might consider some key questions: whether or not they want the money paid back at some point, whether a gift could delay their own financial goals and, perhaps as importantly, whether it makes more sense to delay an FHSA strategy until home ownership is more squarely in sight for their children. She says the amounts of money passing from the parent to a child for housing are so high — media reports say transfers of $125,000 are now common — no one should hand over small fortunes without due consideration.2

Given the FHSA is still new, people are becoming acquainted with the account features. Like an RRSP, it’s a tax-efficient account since contributions reduce your taxable income and investments grow tax-free. And like a TFSA, there are no tax implications so long as any withdrawal is put toward the purchase of a home. The maximum annual contribution limit is $8,000, the lifetime limit is $40,000 and you can open this account as soon as you turn 18. However it’s also important to know there is a maximum participation period of 15 years for the account. At the end of that time period, if a home has not been purchased, the account must be closed, and the funds moved into an RRSP. For further details on who qualifies and what kind of homes are eligible, click here.

With all of that in mind, Swan says there are a few ideas parents should consider around FHSAs for their adult children.

Timing a contribution

Parents need to be aware that it’s not only about how to contribute but when. For instance, let’s say a parent gives their adult child money for an FHSA as soon as their 18th birthday — the earliest time possible to open an account — and the parents continue to give money to the child for the FHSA annually. An FHSA account must be closed after 15 years, but the adult child, now age 33, might not yet be ready to buy a home. While the money is not lost, the tax-free benefits of the FHSA disappear.

“It might be a better bet if you open this account when the child is age 20 or 21 or later. There may be a better chance that they’ll be ready to buy their own home at 36, 37 or 38,” says Swan. There may even be a sweet spot timewise for helping someone with an FHSA contribution: opening it too early could forestall FHSA benefits while waiting too long means the investments may not have enough time to grow. The answer lies in everyone’s personal situation, says Swan. This is something a financial advisor could help with.

Giving gifts of money

While it may be common to give money to children to help get them started in life, unless things are clearly spelled out, some parents may not have articulated what kind of money transfer took place — even to themselves. Is the money a gift? A loan? A bit of both?

Swan says people are often not good at specifying what a transfer of money to a relative actually entails and it can sometimes bring confusion. One remedy is a document called a Deed of Gift which records the amount of money that was transferred to and received by an adult child. Among the benefits of documenting the transaction with the help of a lawyer is there may be no confusion over what the obligations are for each side: The parents give the money as a gift and the child does not have to pay the money back. A Deed of Gift also helps clarify the transaction if it is called into question by other family members after you pass away. For instance, if a sibling believes this money was in fact a loan, and should be returned to the estate, this document can prove that it was indeed a gift and there was no obligation for it to be paid back.

Once an adult child receives the funds, they can open or continue to contribute to an existing FHSA.

Drawing up a loan agreement

“An FHSA can be an appropriate way to assist a child to save for a house, but that’s only assuming that you have no expectation or desire for the money to come back to you,” Swan says. If a parent is looking to get paid back, they may consider a documented loan, but involving an FHSA could exacerbate matters and should probably be avoided.

That’s because the funds are effectively “locked in” to the FHSA and are intended to be withdrawn only to buy a home. Even after real estate has been purchased using FHSA funds as a component of payment, a loan default could become complicated. Especially if the home is shared with a spouse, there would be legal, financial and practical considerations that could further cause difficulties with any repayment.

Swan says if the parents truly want the funds returned, draw up a document with the help of a lawyer and record the amount loaned, terms of interest, frequency of repayments and the date when the loan should be paid back fully, plus collateral (if any) for the loan. The loan repayments should actually take place and be documented: A court could rule that the transfer of money was a gift if both parties neglect to live up to the provisions of the loan.

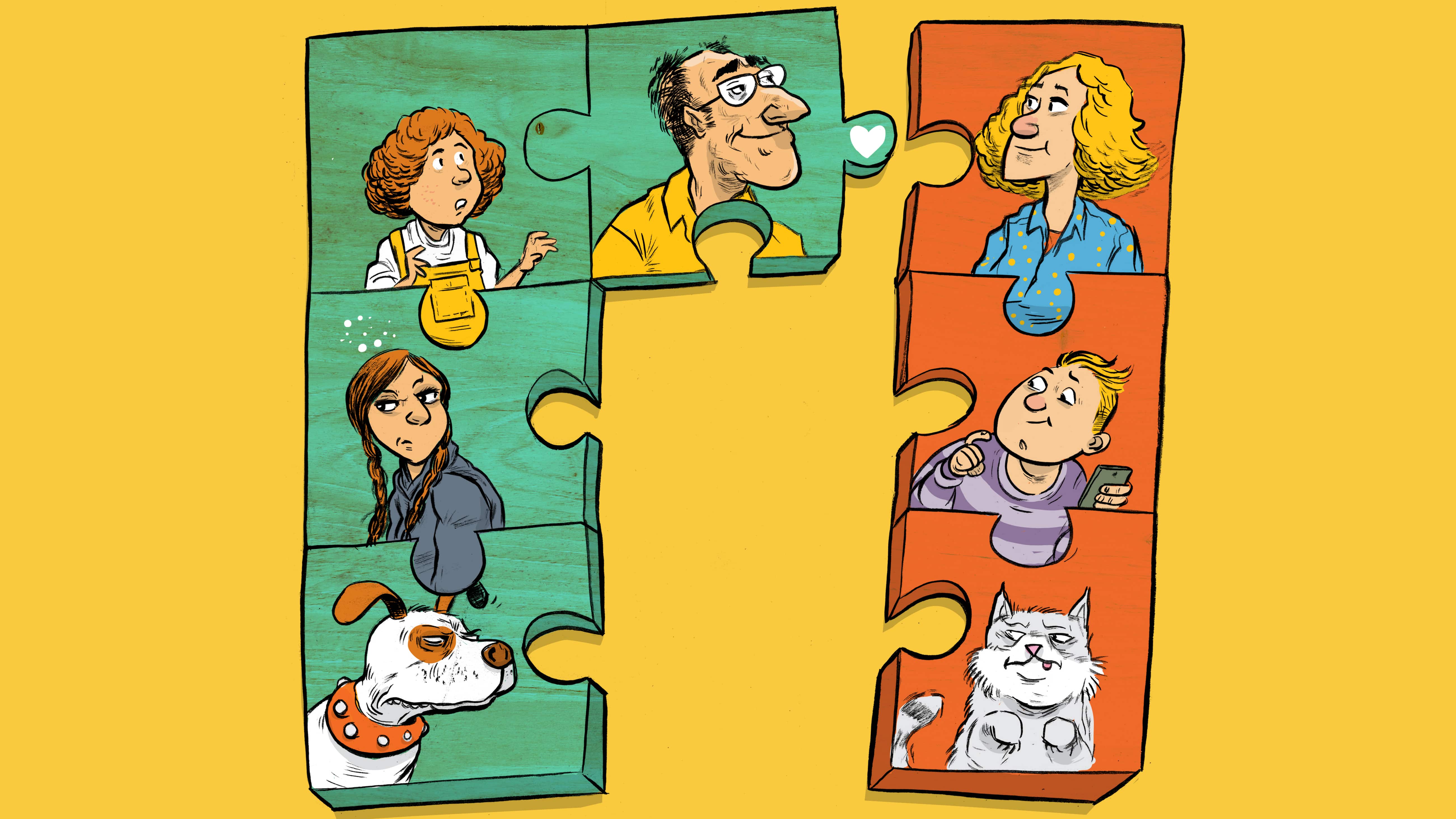

Swan says everyone should speak to a financial planner or advisor before they begin handing over large sums of money because the full implications of a transaction should be discussed. Giving a large sum to help a child get their life underway may feel good in the moment but it should not undercut aid to another child or the parents’ retirement plans.

“The emotional part of dealing with family is huge and family dynamics are even bigger,” Swan says, “I often say to clients, ‘don’t gift to anybody unless you can gift to everybody.'”

DON SUTTON

MONEYTALK

ILLUSTRATION

DANESH MOHIUDDIN

- Saving for your first home? Find out how a First Home Savings Account can help, Government of Canada, December 22, 2023, accessed Feb. 27, 2024, www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2023/saving-first-home-find-out-how-first-home-savings-account-can-help.html ↩

- Rob Carrick, Parents gave their adult kids more than $10-billion to buy houses in the past year, The Globe and Mail, Oct. 24, 2021, accessed Mar. 13, 2024, www.theglobeandmail.com/investing/personal-finance/article-parents-gave-their-adult-kids-more-than-10-billion-to-buy-houses-in ↩