Managing volatility: How automatic contributions can help smooth out market instability

With so much economic uncertainty, are you keeping up with your investment plan? Automatic contributions and dollar-cost averaging could be the answer.

Stuart’s story could be anyone’s: Earlier this year, he set aside $5,000 of his savings to invest. Recent market volatility and other economic bad news, however, has Stuart questioning his original plan. If he invests the full $5,000 at once, what happens to his lump sum investment if the market takes a sudden dive? Considering the ongoing rise in living costs and interest rates, should Stuart keep his funds in the bank instead?

Every day, people recommend investing as an efficient way to grow wealth over time. But what about investing during times of volatility? What should you do if all the news seems to be bad news?

Finding money for your Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA) can be emotionally and financially taxing — particularly when the market is volatile, gas and food prices are rising and there’s armed conflict in the headlines. Volatility, by nature, is unpredictable but having a contribution plan that isn’t upset by the market’s ups and downs can help even out the bumps.

While planning to put your annual tax refund into an RRSP as a lump sum is smart, actually doing it may be difficult. Contributing smaller amounts every paycheque may be a more viable strategy in the long run, particularly in times of increased economic uncertainty. Moreover, incremental contributions also take advantage of dollar-cost averaging and, since they can be made automatically, incremental contributions can help do away with those pesky feelings of indecision.

“I encourage my clients to invest on a regular basis, if they have the cashflow to do so, to take advantage of the different market prices. This way, when they are investing in the market during volatility, they gain control of buying when the market may offer better value,” says Natasha Kovacs, a Senior Financial Planner with TD Wealth.

When deciding what sort of contribution plan you’d like to pursue, here are a few things you may want to consider.

Human nature and investing

A lot of observed investment behaviour can be attributed to our natural human tendencies. Many of us can sometimes be short-sighted and are often slow to act when it’s not convenient. That’s not to say we aren’t capable of great things when inspired, but we may lack the energy to do great things all the time. Moreover, when faced with investment decisions that compete with our day-to-day responsibilities, it’s easy to start thinking of ways to put the decisions off.

Consider how difficult it is for many of us to visit the gym on a regular basis. Even when we know that the result is well worth the effort, it can still take an extraordinary amount of willpower to wake up each morning and get on the treadmill. Investing is like going to the gym: You may not always feel like doing it but acting regularly can help reap long-term benefits.

Automatic contributions

Rather than having to work up the energy to invest over and over, you can have an automatic contribution plan do it for you. Once an automatic contribution or pre-authorized purchase plan is set up, a small amount of money will be transferred automatically from your bank account to an RRSP or TFSA once a month or on payday, for example. In this way, automatic contributions can help alleviate the emotional burden of a manual investment without interrupting your monthly cash flow. You can set up automatic contributions a number of ways, including via your financial institution and often directly via your employer.

Dollar-cost averaging vs. lump sum investing

Lump sum investing is exactly what it sounds like: putting all the money you have allocated to invest into the market at once. However, Kovacs says this isn’t always the best plan for those with long-term financial goals. Not only can it be difficult to find the money for a lump sum investment but making the decision to invest can actually lead to more anxiety. When you have a host of other financial responsibilities (e.g., mortgage and car payments, childcare, groceries), you may be torn over investing your savings all at once. Moreover, you may find yourself constantly worried about that investment if markets lurch from one extreme to the other.

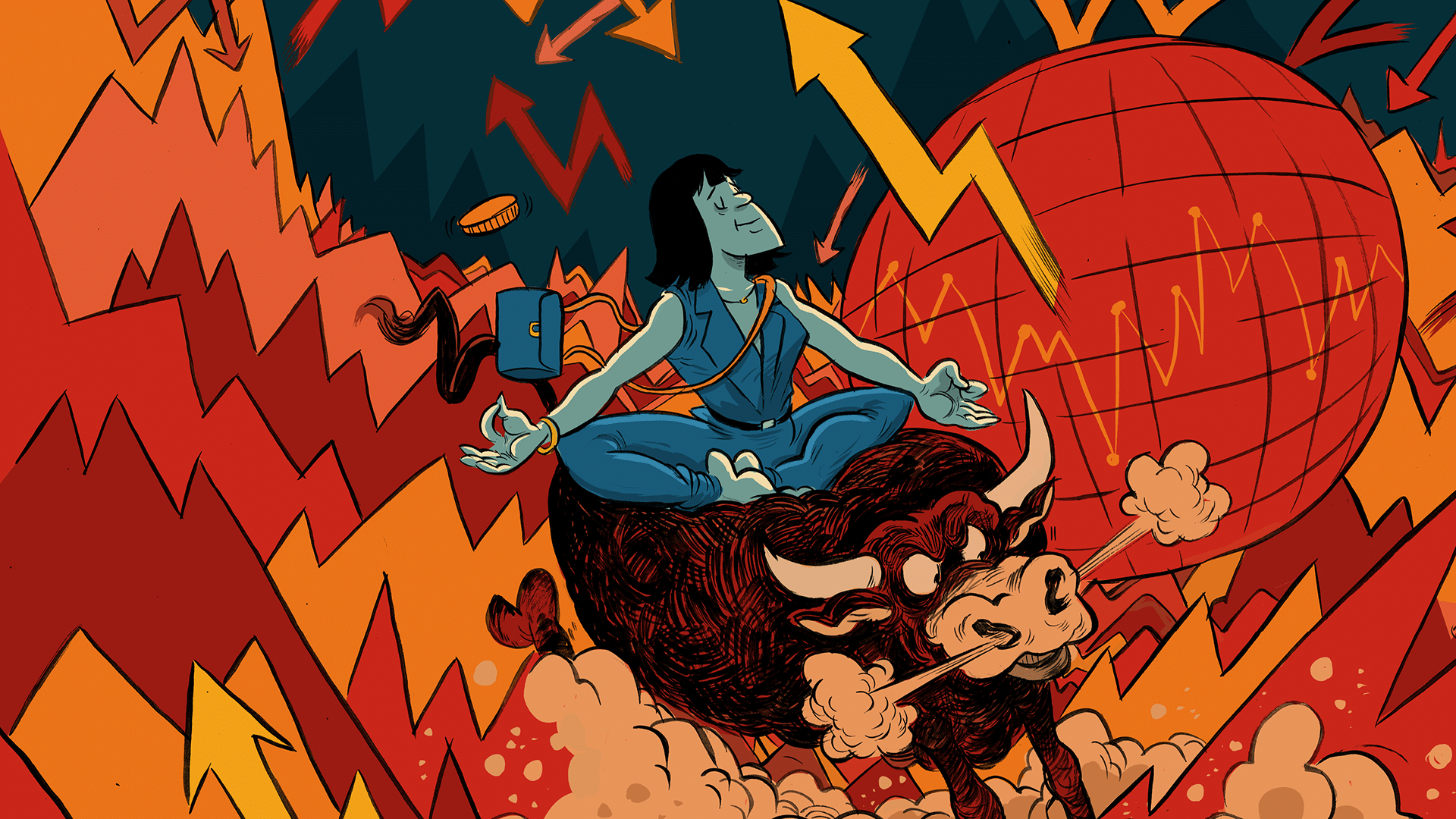

“When there is market volatility, a recommendation is to ease into the volatility by investing on a regular basis vs. a one-time lump sum. Otherwise, the investor sees their investment drop immediately and can allow the emotion to take over vs. focusing on the long-term goal of the money,” Kovacs says.

Dollar-cost averaging, on the other hand, involves making smaller, equal contributions that will be invested regularly over time. No matter what’s happening in the market, the same amount of money is invested. If you invest in mutual funds, your contribution will buy more per dollar on days when the markets are down and fewer per dollar on days when the market is up. However, the risk of volatility is minimized overall because the investment is being spread out. This way, the success of the contribution isn’t vulnerable to a single bad day on the market. Dollar-cost averaging is a particularly beneficial strategy when the market is unpredictable and is often a better choice for people who are hesitant to contribute a lump sum.

“Clients who utilize dollar-cost averaging tend to have a calmer reaction to the market volatility. They have been educated on buying in at lower costs, and as such, they can stay focused on the goal of the money, which is to fund a future goal, rather than on the decline of the market,” says Kovacs.

Staying in the market

No matter what investment path you take, keeping your money invested through thick and thin is generally considered the best plan for those looking to meet their long-term financial goals. While our initial impulse may be to freeze or pull money out of our investments when we encounter uncertainty, it’s helpful to remember that markets naturally ebb and flow. Your success as an investor is generally not contingent on a single wave, but how you ride those waves year over year.

Ultimately, Kovacs says, it’s important to remember the reason “why” you invested your money. “The market will always have points of variability and there will always be headlines to create chaos and uncertainty. Try to take the noise out of the picture and go back to your ‘why,'” she says. “It’s easy to say, ‘don’t look at it’ — it’s harder to do. It can help to revisit your investments, longer term objectives and overall performance. If those continue to align with your reason for investing, stay clear of the noise and stay true to your goal.”

Everyone works hard for their money and deciding what to do with the extra you’re able to set aside can be difficult. If you have any questions on how to make investment contributions easier, it may help to speak to a financial planner.

TAMARA YOUNG

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN