How does inflation affect my retirement plans?

From gas prices to grocery bills, rising inflation seems to affect everything. But how might higher inflation impact your retirement plans? Julie Seberras, Senior Manager, Wealth Planning Support with TD Wealth shares some key insights.

At age 64, Brian has enjoyed a long career at a downtown insurance brokerage, but he’s looking forward to retiring next year. His retirement savings include a diversified investment portfolio, that has both registered and non-registered investments, as well as a robust defined benefit pension plan. Brian feels confident in the plan he built with his wealth advisor. However, with higher inflation, he’s begun to wonder: Will it be enough?

Brian is a fictionalized example of something many retirement-aged Canadians are living through. From gas prices to grocery bills, it seems nothing has been spared from the rise of inflation. But what about your retirement? If you’re planning to retire within the next five to 10 years, or are already retired, you may need to check in on your retirement plan.

“There are a number of assumptions that go into any retirement savings plan,” says Julie Seberras, Senior Manager, Wealth Planning Support with TD Wealth, “and inflation is one of them.” As inflation increases, so should your retirement savings, or you risk cutting into your purchasing power. Seberras says the first step is to sit down with your financial advisor to review your plan. If you don’t have a plan, now might be a good time to get one started. After all, even if you have significant savings pegged for retirement, there may be taxes or estate-related considerations you haven’t accounted for.

“Consider your working years as a runway to retirement,” she says. “The closer to retirement you are, the less room you have to make adjustments. That’s why it’s so important to check in with your plan whenever something changes, like inflation.” If adjustments do need to be made, Seberras says you have a number of options, including saving more on an ongoing basis, pushing out your retirement or adjusting your expectations of what retirement will look like.

Let’s dive in and take a closer look at some ways you can adjust for higher inflation.

Do I need to save more?

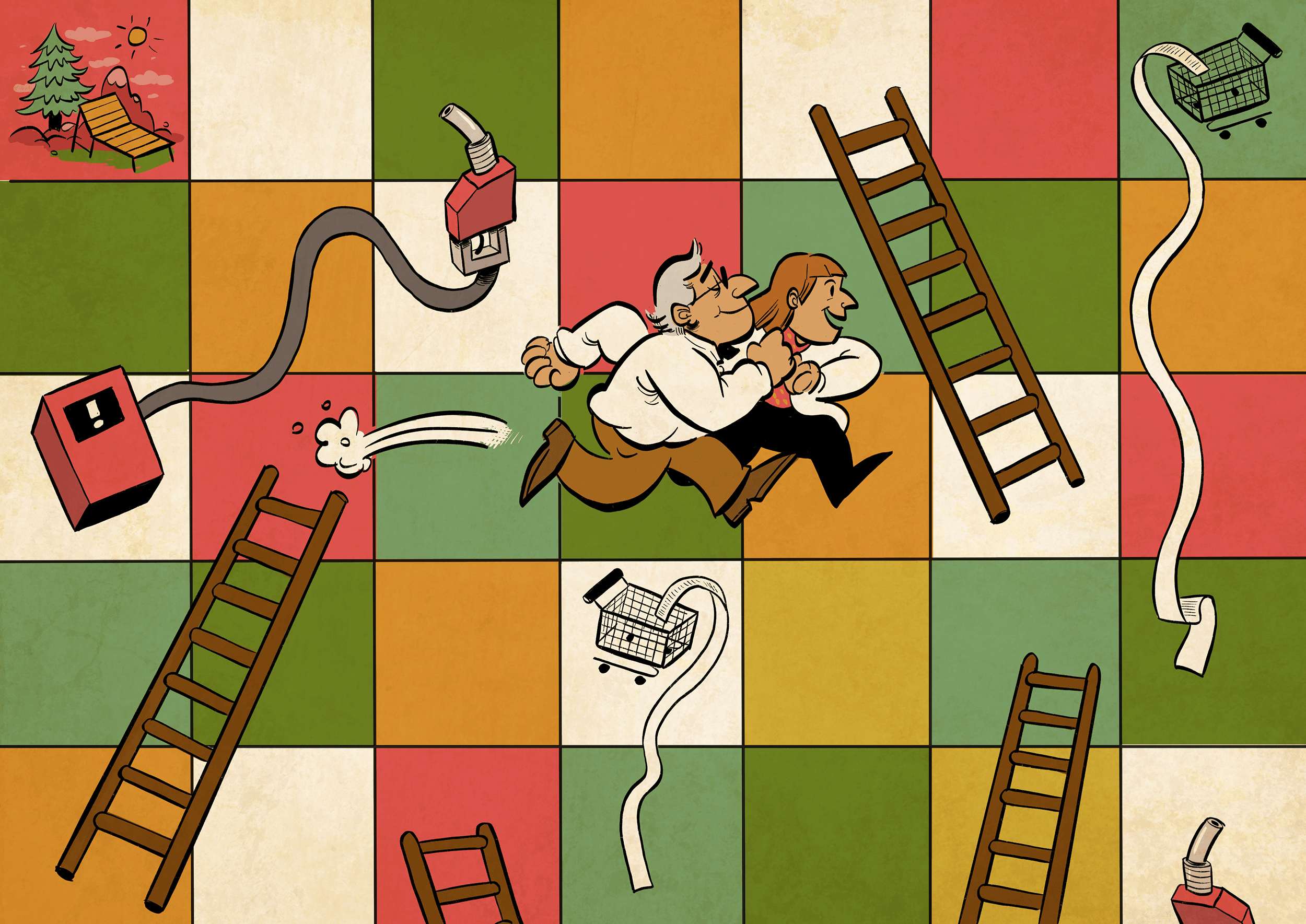

Canadians have endured historic rates of inflation recently. When inflation is rising, it’s difficult for basic saving vehicles like Guaranteed Investment Certificates (GICs) to keep up and maintain the same purchasing power. If your GICs, for example, are only providing a 3–4% rate of return on your investment, the purchasing power of your savings is actually decreasing over time. When your investment rate of return is less than the inflation rate, it’s called a negative real rate of return.

In order to keep up with inflation, Seberras says your rate of return on investments will need to exceed the inflation rate. However, she also cautions that “some investments are impacted by inflation differently than others,” and a review of your portfolio may shed some light on how you’re affected and what can be done.

Among other options, your advisor may recommend increasing your contributions or further diversifying your portfolio.

What about my pension?

Aside from savings you can adjust directly, many Canadians also have pension plans that will be affected by inflation. In some cases, these pensions include what’s called an “indexing benefit” — meaning that your pension will adjust in accordance with inflation. However, Seberras cautions that not all pension plans include this benefit. If yours does not, she says it may be prudent to top up your pension with personal savings to ensure you have an adequate income in retirement.

Are OAS and CPP affected?

Government funded pension plans, like Old Age Security (OAS) and the Canadian Pension Plan (CPP) are reviewed and adjusted annually to ensure they keep pace with inflation. Additionally, as Seberras notes, Canadians 75 and older will begin to receive a 10% increase to their CPP pension payments in 2023.

Will I need to delay my retirement?

Nearly a quarter of Canadians reported delaying retirement when markets took a downturn at the beginning of the pandemic, but today the challenge for those hoping to retire is that we don’t know when inflation will normalize.1 If saving more isn’t an option, you may choose to push back your retirement date, giving you more time to save. That may also give the economy the time it needs to recover. On the other hand, working later may carry implications for your health and family. Naturally, few people are keen to delay retirement and you should speak to your financial advisor (as well as your spouse) before making such a big decision. Depending on your situation, delaying retirement may be unnecessary.

“We’ve all met that person who knows exactly how many days, hours and minutes are left until their retirement,” Seberras says. “If that’s you, you may not be willing to delay. Instead, you may have to make another adjustment. It really depends on the person.”

What other options are there?

If saving more or pushing back your retirement aren’t feasible solutions, Seberras highlights one other possibility: Downsizing your retirement expectations. This one may be the most difficult of the three to swallow. After all, many of us have spent our careers dreaming of the day we’ll be footloose and fancy-free, and what our lifestyle may look like. Downsizing, if necessary, could mean slight adjustments rather than large ones. You may wish to scale back and take a trip abroad every other year instead of annually, for example.

Ultimately, it’s important to remember that economic cycles naturally ebb and flow, and high inflation has historically been temporary. While you may have to defer a few plans, or cut back for a while, if you have a solid retirement plan — this too shall pass.

“Although today we’re talking about inflation, the economy is always changing,” Seberras says. “Sometimes the markets are better, sometimes they’re worse. But there’s always something. That’s why it’s so important to check in with your retirement plan on a regular basis to make sure you’re still on track.”

Speak to your advisor if you have any questions about your retirement plan and what adjustments, if any, you might need to make.

TAMARA YOUNG

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN

- Vermond, Kira, “How the pandemic is leading Canadians to delay retirement,” The Globe and Mail, Janauary 11, 2022, https://www.theglobeandmail.com/investing/globe-advisor/advisor-news/article-how-the-pandemic-is-leading-canadians-to-delay-retirement/. ↩