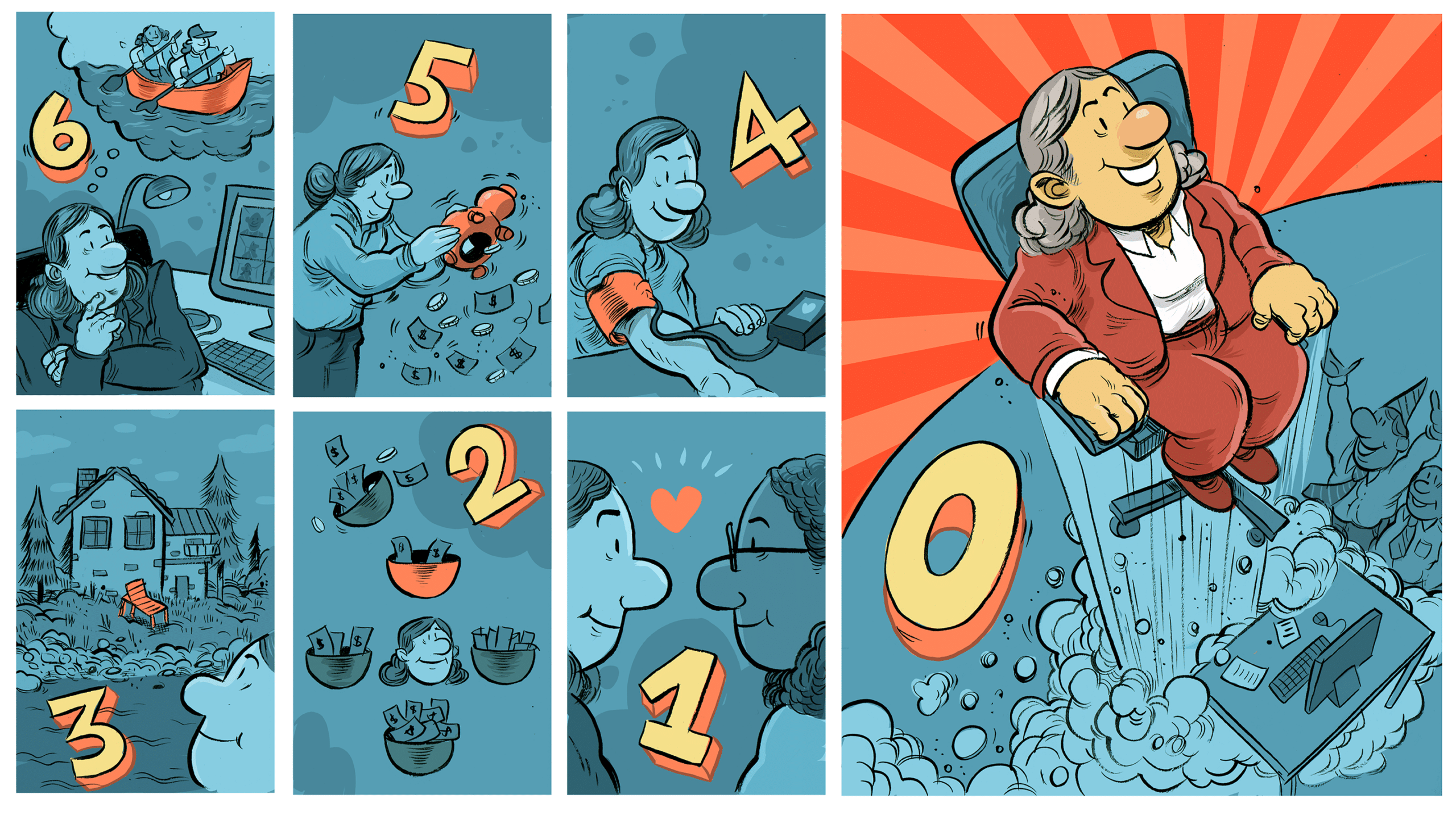

A ready to retire checklist: 6 questions you can ask yourself

Only have hazy ideas about how you plan to retire? Your retirement dreams may not come true without a little more thought. Here are some concrete ways to paint a clear picture of your retirement, whether you are on the verge of hanging it up or still a few years away.

When Betty Dennis, a Senior Financial Advisor with TD Bank, talks about retirement with her long time customers, they have a good reason to listen intently: Dennis herself is retiring in two to three years and she brings a personal outlook when she talks about the need to plan ahead.

She says, “I find that customers who have relied on me for the past 40 years now joke: ‘What do we do when you’re gone?’”

Dennis, who works in New Brunswick, says that while many of us have been saving for retirement for decades, our last working years may demand an assessment of where we are, what we want to do and how we will get there. Often, the reality of impending retirement hits people suddenly and apprehension over what still needs to be done or decided can arise — uncertainty that can be dispelled by a chat with someone like Dennis. She says, “I tell them, ‘This is where we begin setting you up for your future. So, let’s start by thinking about what your retirement is going to look like.”

What retirement will “look like” can be a fuzzy notion that floats in and out of our heads during our working lives, but Dennis says everyone needs concrete strategies around the major pillars of retirement: our goals, the state of our finances and income, housing and our health. We should also consider how it all syncs with our spouse or partner’s plans.

When Dennis is speaking with clients, she often asks them about retirement plans, travel, grandkids, and shows them how they can plan for a time when, like Dennis, they finally wave good-bye to their work mates.

Whether you are retiring next year or the milestone is still a few years away, here are some questions that can help you sharpen your focus and help you make smart financial decisions.

What do I want to do when I’m retired?

To help ensure you’re well prepared for retirement, you should take the time to build retirement goals that are tangible and specific, says Dennis. Whether you want to golf, buy a vacation home or visit grandkids in another city, unfocused ideas can hinder the chance that you’ll fulfill your plans. For example, if you want to travel more, calculating how much your excursions might cost will help you understand how many trips you can take, how long you can travel and even whether you’ll be flying first-class. Once you have an estimate, you can begin to plan how you’ll finance those trips. Perhaps it’ll be through your savings or a pension plan. If you are planning far enough in advance, you should adjust your savings patterns with your goals in mind, she says.

Have I saved enough?

The realization that paycheques will cease suddenly when we retire can pique anyone’s interest in some basic questions: How much will retirement cost? What kind of lifestyle can I afford? Have I saved enough?

Dennis says that getting your financial house in order may help you find clearer answers to those questions. To begin, paying down any credit card debt (and keeping it paid) can help as debt reduces your options in retirement. Next, she says paying off your mortgage before you retire will help ensure your savings go exclusively toward your future lifestyle.

How you invest your retirement savings should also be tuned toward achieving your goals. As you begin to rely more on your savings for income, an emphasis should be placed on preserving those savings through lower-risk investments. At the same time, growth investments may also be needed to keep funds increasing in value. A financial advisor can help you get the right mix of investments depending on your situation and risk profile. One thing to be mindful of is ensuring you have adequate cash or cash-equivalents ready to draw upon when you need them.

Dennis points out that our expectations of aging and retirement are changing. Following retirement, people may continue to work part-time, become consultants or even take the opportunity to start their own business. Retirement doesn’t mean you have to stop saving and earning. If it suits your situation and you have contribution room, you can even choose to delay withdrawals and contribute to your RRSP for a few extra years (up to age 71) or to your TFSA.

Where will I live?

Many of Dennis’ clients don’t want to look after their acres of land on their rural lots after they retire, and traditional wisdom asserts it can be smart to downsize. Rural or urban, you may be able to move to a more affordable home and use the gains on the sale to increase your retirement savings.

That wisdom may still be sound, but several developments have made downsizing more complicated. Rising home prices have made selling sweeter but have also made buying even a smaller home more complicated.

Other factors may also influence your decision and you’ll probably want to think carefully about the timing of such a sale, as well as what you’ll do with the proceeds. A home is a valuable asset, but selling it prematurely and spending the proceeds without regard to the future could risk running out of funds in your senior years, says Dennis. On the other hand, selling and investing the profits could potentially increase retirement savings or offset healthcare costs in your later years. Chatting with a financial advisor can help you understand what’s best for you in both the short- and long-term.

How will I manage my pension income?

“When to take Canada Pension Plan (CPP)… That’s another huge question that everyone asks,” says Dennis. The conundrum is that, while you might be eligible to receive CPP at age 60, waiting until age 70 can bring higher monthly payments. It can be a wise move, but it may not fit everyone’s situation.

Many of us will benefit from our employer’s pension plan as well as CPP. We may also be eligible for Old Age Security (OAS). More income is beneficial of course but each income source comes with its own considerations around the timing of withdrawals.

For example, employee pensions can generally be delayed until the time is appropriate, while withdrawals from OAS and CPP can be delayed until age 70. In all cases, delaying withdrawals can allow funds to accumulate, but there are strict limits for payouts to survivors for CPP or OAS once you pass away. If poor health runs in the family, it may be best to withdraw CPP or OAS earlier, says Dennis.

How healthy will I be?

This may be uncomfortable to think about. Statistics suggest the average 65-year-old Canadian will live for approximately 19 more years — though the actual number will vary widely.1 Unless you know otherwise, plan for a long life says Dennis. The worst thing that can happen is that you leave more money to your children than you planned.

Moreover, how healthy and active we will be in those years will determine how much money we spend. At the beginning of retirement, you may be vigorous enough to complete lifetime goals like travel. Later you may slow down, eventually settling into a more sedentary lifestyle. In a scenario like this, your retirement spending may be front-loaded as you spend more when you are active and then gradually decrease. In your later years, there may come a need to fund significant healthcare expenses, such as in-home nursing. If you don’t have a healthcare plan, you may want to explore other options now, says Dennis.

Have I coordinated with my spouse?

A couple may decide to retire on the same day — or they might make separate plans. In either case, couples should start talking about retirement early and even help each other out by contributing to a spousal RRSP if it’s appropriate. Not only will planning together help you coordinate your finances, but it can also help you set objectives for the years ahead. One spouse may be yearning for retirement while their partner wants to embark on a second career, says Dennis. Both activities need some financial thought behind them.

Coordinating retirement income has its benefits. If one person delays retirement and continues to draw a salary, it could allow the other spouse’s retirement funds to accumulate and remain untouched.

Dennis is in the midst of planning her own retirement right now. She wants to uproot to the Annapolis Valley to be closer to her granddaughter, plus indulge her love of travel and history by visiting Scotland.

She says that while she’s still working, her clients nearing retirement should give her a call if they have any questions. And anyone who is still unsure where to begin with retirement planning can talk to their own financial advisor or walk into a bank branch for a discussion.

Whether your retirement strategy still needs some tinkering or you’ve put off thinking about what exactly will happen when the next phase of life starts, Dennis says it all starts with a chat.

“I find out what they want and then we start putting it together. If you need something, let’s see what we can do.”

DON SUTTON

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN

- Life expectancy at various ages, by population group and sex, Statistics Canada, April 12, 2022, accessed April 12, 2022. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1310013401 ↩