Getting a tax refund can feel a little like it’s your birthday the first few times you experience it. After a year of watching the Canada Revenue Agency (CRA) extract its share of your income, you may find a cheque in the mail or a friendly e-mail that gives you some of those hard-earned dollars back.

According to Statistics Canada, 1 17.8 million Canadians received a tax refund following the 2021 tax season, with the government returning $37.3 billion. The average refund of $2,093 represents the largest infusion of cash many Canadians will receive this year. In a time of rising interest rates and uncertain inflation, deciding what to do with that money can be daunting, especially if you are just entering the workforce.

Many people get a refund when they contribute to a Registered Retirement Savings Plan (RRSP), since contributions to the account lower your taxable income. Claiming charitable donations and other tax credits and deductions, such as certain medical expenses, could lower your taxable income, too. If you pay your taxes throughout the year, you may find you’ve overpaid after all the deductions and credits are taken into account, which will then prompt a refund.

The question then becomes, what should you do with that lump-sum payment? If you are not sure, then you are not alone. A survey by TD Bank Group 2 found that more than one-third of Canadians aren’t confident in their understanding of income taxes and how the investments they make can affect their tax refund.

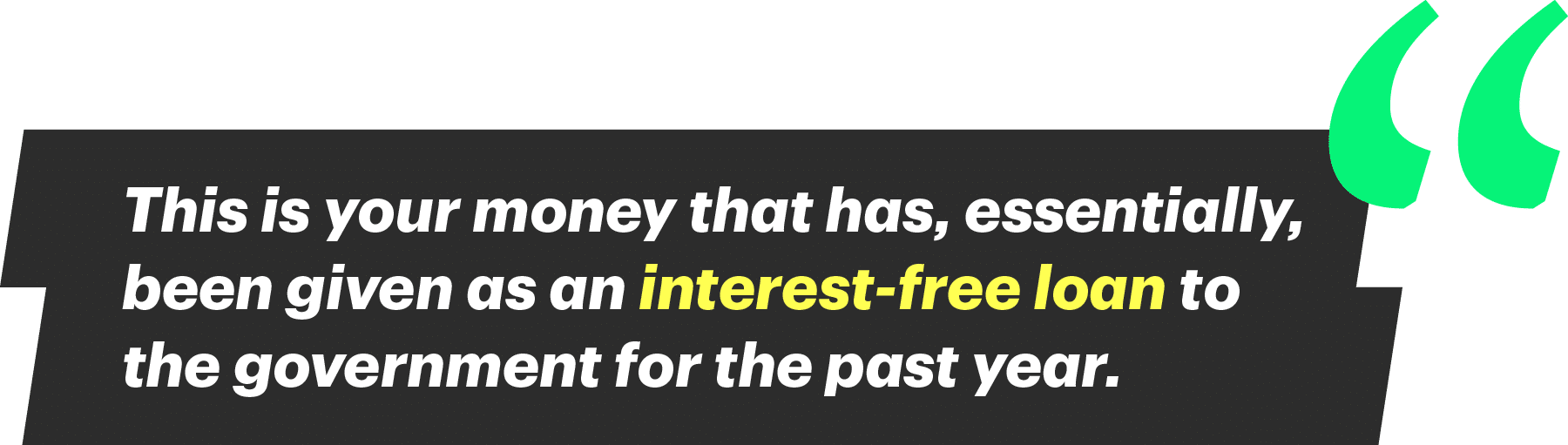

When you do get that auto-deposit, it can be tempting to spend it on a shopping spree, a vacation or a few nights on the town, but Nicole Ewing, Director, Tax and Estate Planning for TD Wealth, cautions people against thinking of those dollars as a windfall. “This is not the government giving you money,” says Ewing. “This is your money that has, essentially, been given as an interest-free loan to the government for the past year. It’s important to resist the urge to think of it as found money.”

She also cautions against spending your refund on things you may not need, but she says you shouldn’t simply leave it in a chequing account either where it won’t earn much interest. Instead, consider using those funds to help you save more for your long-term goals. Here are a few other ideas for what to do with those dollars.

Demolish your debt

One area to look at first is debt, which, if you have a balance on a high-interest rate reward credit card, could be accumulating at a 20% annual rate. Even interest on lines of credit is more expensive these days thanks to rising interest rates. “I definitely have a bias toward paying down that high-interest debt because that’s something that’s very, very difficult to get out from under,” Ewing says. “You’re just losing money if you’re carrying debt.”

There’s another benefit to paying down debt, says Ewing: “Having a nice influx of cash to pay that down not only reduces the amount that you’re paying, but builds momentum and excitement about seeing that amount go down,” she explains.

Invest in yourself

After those high-interest debts have been addressed, it’s time to make your money work for you. Rather than spending your refund, you could reinvest it back into your RRSP. “You get your money, you get your deduction, you’re going to get another refund and you’ll be able to use those funds toward your goals.”

You could also put your refund into a Tax-Free Savings Account (TFSA), a “shockingly underutilized” savings vehicle, says Ewing. Money inside the account also grows tax free, but unlike with an RRSP, you don’t have to pay anything to the CRA upon withdrawal, which makes it useful for shorter-term savings goals. “They’re very, very flexible,” Ewing says. “You can put money in, you can take money out and there’s no penalty and no tax when you withdraw those funds.”

Pay down your home sweet home

With interest rates rising, mortgage costs have climbed to levels not seen in years. If your bill is getting too big, you might consider putting some or all your refund toward your mortgage to lower your outstanding balance. “Paying down that mortgage could be higher on the list this year,” Ewing says. “You might have the opportunity to make an extra payment or increase your monthly payments, depending on what the terms of your mortgage are. In the long run, that can significantly maximize the value of those dollars.”

Knowledge is power

The more you know about your taxes — credits, deductions and investment accounts — the better decisions you can make with your refund. Learn more about tax credits and deductions you won’t want to miss here.

The government of Canada offers a financial tool kit to help tax filers of all ages understand their options, including potential deductions and other benefits that might not be on their radar. And you can take advantage of plenty of tax breaks. The many Canadians who dipped their toes in the gig economy, for example, can deduct certain home expenses when they file. There’s also a work-from-home tax credit and even a “climate action incentive” credit that people in Ontario, Manitoba, Saskatchewan and Alberta can claim to recoup some fuel costs.

Of course, it can still be easy to give in to temptation and spend a little of your refund on retail therapy. While there’s nothing wrong with spending money on a fun purchase, consider first what that $100 might be worth in 30 years if you let it grow tax-free in an RRSP instead. “There’s such an incredible opportunity when we’re young and we have all those years of compounding interest ahead of us,” says Ewing. “Legitimately, every dollar counts.”