10-Second Take:

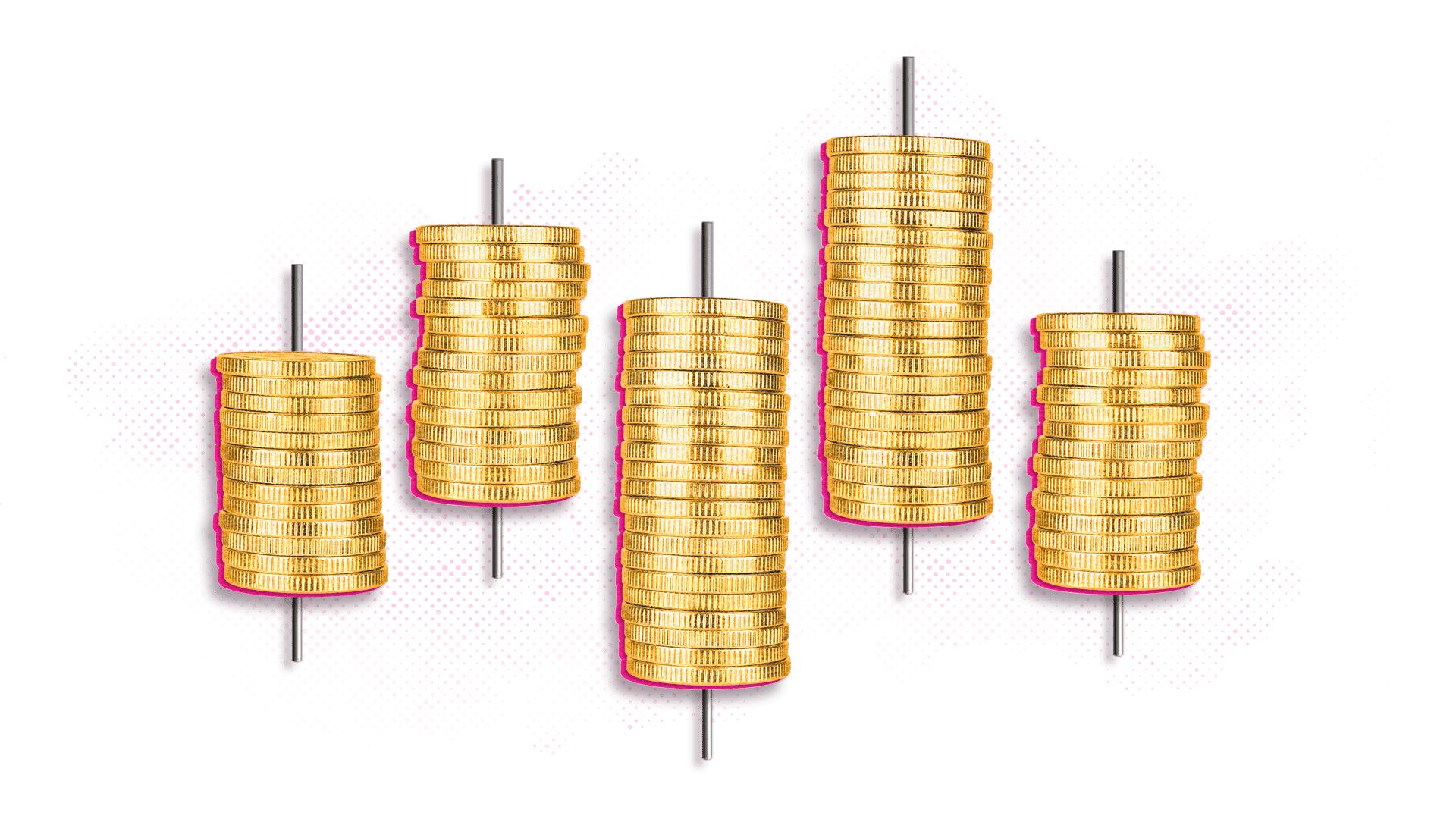

The Volatility Index — or VIX — measures how quickly the price of S&P 500 Index components is changing.

What it means:

The VIX was created in the 1990s as a way to measure the level of anxiety investors are feeling about the market at any given time. By measuring the magnitude of price movements, the VIX acts like a thermostat: When the swings are dramatic and volatility is high, the index rises. How quickly prices change can be a useful way to gauge sentiment among market participants — the VIX is also commonly known as the fear index. The VIX tracks stock index futures using a calculation designed to show anticipated volatility in the U.S. market. While the formula to compute the index is mathematically complex, the VIX itself is easy to understand. Traders typically use this rule of thumb: A number between 13 and 19 can suggest market players are expecting stability, while 20 and above may suggest possible uncertainty and increased market fear.

The VIX isn’t the only sentiment indicator investors can use to help make decisions. Another example is the TD Direct Investing Index which measures independent investors’ buying and selling behaviour for the past month. The TD Direct Investing Index looks at four components tied to the activity of self-directed investors:

- Bought vs. sold: Measures net equity demand — that’s whether investors were buying more or selling more in a specified month.

- Chasing trends: Measures whether investors were buying in a rising or a falling market.

- Bought at extremes: Measures whether investors were buying at the top or bottom of the market (in other words, at a peak or during a dip).

- Flight to safety: Measures how much investors appear to be pulling back to safer, less risky investments.

Using these four measures, the TD Direct Investing Index graphs sentiment on a scale between 100 and -100. A score above zero is bullish and below zero is bearish. A recent score of -56 is considered a “very bearish” outlook.

Ultimately, the goal of sentiment indicators is to measure the feelings of investors by turning behaviour into data that can be collected and charted. Traders often consider VIX levels and other sentiment indicators when determining a trading strategy.