Cottage-buying strategies you need to know

Many of us dream of owning a vacation property one day. But even before finding a real estate agent, perhaps it may be wise to call your financial advisor.

Like many Canadians, Jeff Halpern dreamed of owning a vacation property long before he was able to afford one. The Business Succession Advisor at TD Wealth says, “Growing up in difficult financial circumstances, I saw people who had cottages, and they just looked so happy. I’ve always felt that the cottage is such a beautiful place to bring the family together every summer, and so I aspired to be a cottage owner from a young age.”

Many years later, while working in Singapore, Halpern took a two-week vacation and travelled back to Canada to fulfill his goal. As he tells it, he spent much of that trip driving up and down Lake Simcoe until he finally found a for sale sign and a willing seller. He called an agent and put in an offer that very day. “It was the end of August, and we had to close the purchase when I was back in Singapore. My family has been using it ever since.”

If you’ve been keeping an eye on real estate headlines, you’re probably aware of the roller coaster ride prices have been on for a few years now. And yet, for many, the all-Canadian dream of one day owning a family vacation property remains. The decision to purchase one, however, is big and shouldn’t be taken lightly — even if you can already picture your kids building sandcastles on the beach. To better understand what prospective buyers should be aware of before they take the plunge, we spoke to Nicole Ewing, Director, Tax and Estate Planning, TD Wealth. Here are the considerations she shared.

Why cottage-buying involves a financial strategy first

A lot has changed since Jeff bought his cottage in 1999. For one, prices are much higher now. As a result, Ewing says that “it’s increasingly important to think about a purchase like this within the context of your overall financial plan.” To begin, prospective buyers should work with their financial advisor to discuss not only where the money for a down payment will come from, but also how a mortgage (or second mortgage) might affect your cashflow going forward. From a planning perspective, Ewing also suggests buyers consider the purpose of their property, beyond summers in the sun: “A lot of people purchase a cottage with the idea that they’re going to retire there. That may play into the calculation of how you’re going to afford it. Is there a certain point, for example, where you’re selling your current home to finance a permanent move to the cottage?”

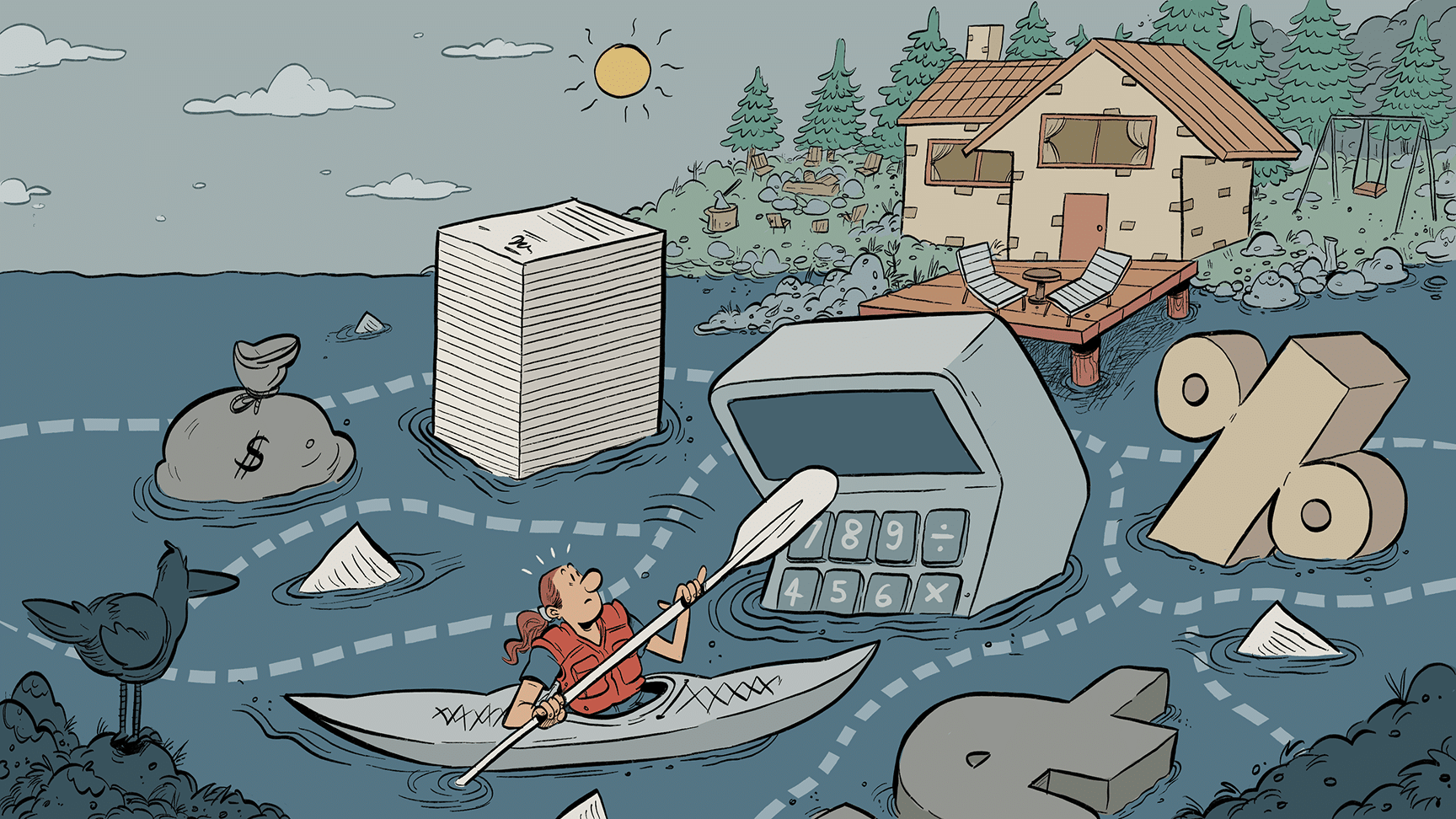

Run your numbers (twice)

Currently house prices have resumed their upward trend and interest rates are much higher than five years ago. If you’re planning to borrow money from a financial institution, Ewing says it’s a good idea to run your numbers with the help of an advisor to see how it impacts your overall financial plan before you commit to a purchase. Things to consider include: the interest rate you may pay today, how that interest rate could change in the future and (perhaps most importantly) how your financial situation may evolve. For example, if you’re only five–10 years away from retirement, have you considered how you’ll afford your mortgage payments after you retire? Many standard mortgage amortization periods are 20–25 years. Unlike your first home, which you may have purchased in your 30s, you may be paying for your vacation property using a more limited income stream.

Ewing says, “You don’t want to leave yourself completely vulnerable. If it were me, I’d be asking my advisor to run some scenarios to help me figure out what I’d need to sustain this purchase, and what my backup plan might be.” Additional costs to consider include: maintenance costs, home improvement costs, property tax, utilities and recreational costs (e.g., will you have a boat?).

Ewing also suggests checking in with your lender well in advance in case there are credit or borrowing limitations you may not be aware of, particularly if you’re already retired.

Be cautious with co-ownership

If you intend to make your vacation property an heirloom for your extended family, you may have considered co-ownership with a sibling or relative. In the case of co-ownership, Ewing says it’s wise to look before you leap. “A variety of complications can arise with co-ownership arrangements, but the most important takeaway is to always have a co-ownership agreement in place. It’s so essential. You don’t want to end up suing a relative.”

Within any co-ownership agreement, Ewing suggests addressing a number of diverse and even mundane issues, such as: how you’ll divvy up both the initial and ongoing costs, who will have decision-making rights, who will have access and when, how you’ll structure ownership and what will happen from an estate planning perspective if one of you dies. For instance, have you considered who will be responsible for putting the boat away at the end of the summer? And who gets final say about whether or not you’ll host that neighbourhood dock party? These arrangements can become quite complex, so it’s best to be very thorough in your planning before you begin the house hunt.

“Ultimately, family dynamics can add to the risk,” says Ewing. “If you fall out with a friend, it’s less big of a deal than if you fall out with a family member. Best to proceed with caution.”

Remember, a cottage is a different kind of asset

While your cottage may be a home away from home, it is actually a different kind of asset from the point of view of changing values, maintenance costs and other considerations.

“What if the area floods?” says Ewing. “Or sometimes, you may buy in what’s considered to be a very desirable area, and then the highway changes, and suddenly the stores and amenities that you used to rely on are gone.”

To help ensure you approach the purchase on safe footing, you may want to work with a real estate agent who is familiar with the area and cottages in general. After all, there are a number of nuances to rural properties that you may not be aware of. For example, are you ok with sharing a well for water with your neighbour, and paying them for the privilege as the case may be? Would you be comfortable maintaining a private road, or one that is used by others through an easement? These sorts of cottage-specific considerations are important for any prospective buyer hoping to avoid future headaches.

Once you’ve purchased a cottage, your family will likely develop strong emotional attachments to the place and that could have an impact on how much you’re willing to spend on renovations, as well as how you’ll want to pass it on eventually. For all these reasons, you may wish to work closely with an advisor or planner to ensure you have an experienced second opinion as you buy, maintain and pass the property on.

Consider the taxes

Before you purchase any piece of new property, it can be important to consider how it will impact other areas of your financial life. The most obvious impact will, of course, be the property taxes you pay. But consider too how this property will be passed on and the capital gains tax that may follow.

After death, taxes can become complicated if you don’t have a solid plan in place. If your cottage is not your principal residence when you die, for example, your estate will be required to pay a capital gains tax — a potentially significant burden if you’ve owned the cottage for decades.

Ewing says many people believe that putting a cottage in a trust is one of the better ways to manage this. But she adds that you should consider the costs associated with trusts. Moreover, the strategy does not do away with the tax issue entirely — it just pushes it further into the future.

People may think another method to manage capital gains tax is to give your adult children co-ownership while you are still alive. However, Ewing points out that it actually does not solve the tax issue and may create problems since our children have as much say in what happens to the property as you do.

Over two decades after he purchased his cottage, Jeff Halpern has no regrets. “My kids grew up with the cottage, they always loved it, and now our six grandkids are growing up with it. Between the water sports, learning to swim and going fishing, it’s just a very nice way for families to unite and make memories,” he says.

Like Halpern, your daydreams may be filled with visions of cozy nights by the fire and breakfast on the dock with your family. Before making an offer on that charming property, however, it’s important to take some time to consider your decision and the impact it may have on your finances. While that’s not to say these considerations should ultimately dissuade you, a thoughtful approach is often the safest as you proceed with any large purchase. As always, it can be helpful to speak to your financial advisor or planner if you have any questions.

TAMARA YOUNG

MONEYTALK LIFE

ILLUSTRATION

DANESH MOHIUDDIN